Capital Gain FAQs

Post on: 6 Май, 2015 No Comment

Current as of January 1, 2015

Answers to some basic questions about capital gains and losses.

Q: My stocks went up but I didnt sell yet. How much gain should I report?

A: None! As a general rule you dont report capital gain or loss until you sell. There are exceptions, such as when you receive capital gain distributions from a mutual fund.

Q: Does a capital gain increase my income?

A: Capital gain is a separate category of income with special rules. Yet its treated as part of your overall income for many purposes, such as limits on IRA contributions or deductions, or determining how much of your Social Security benefit is taxable.

Q: Does a capital loss reduce my income?

A: As a general rule, you can deduct capital loss up to the full amount of your capital gain plus $3,000. If your capital loss exceeds your capital gain by more than $3,000, the unused loss is carried forward to the next year.

Q: I have gain in a special category thats taxed at 28%, but Im in the 15% bracket. Why do I have to pay 28% on this gain?

A: You dont. If you have a 28% capital gain, you pay your regular rate or 28%, whichever is lower. The same is true for a 25% gain.

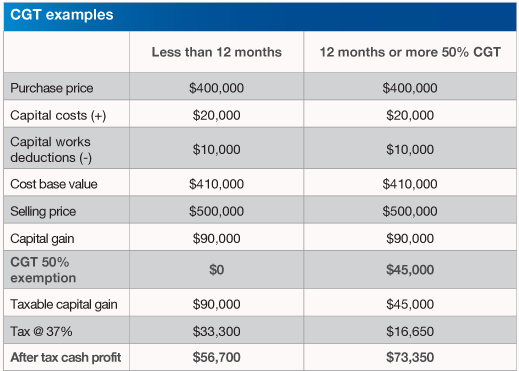

Q: Im concerned that a long-term capital gain will push my other income into a higher tax bracket. Doesnt this mean the real cost of a capital gain is higher than it appears?

A: No, the tax rates apply first to ordinary income and short-term capital gain without taking long-term gain into account. Then the tax on long-term gain is calculated and added to the first figure.

Q: My mutual fund reported that I sold shares even though I didnt take any money out! Why?

A: If you move money from one fund to another within the same family of funds, youre selling one fund and buying the other. If the value of the first fund went up before you made the move, you have to report a gain and pay tax on it. Consider the tax consequences before moving money to a different fund, even within the same family of funds!

Q: I had capital gains in my IRA. How much tax is owed, and who has to pay it?

A: Capital gains and other investment income are not taxed while they remain in the IRA. Taxable withdrawals from an IRA are taxed as ordinary income, so you wont get the benefit of lower capital gain tax rates when you withdraw this income.

Q: I have some stocks that went up, and Im ready to sell. I want to transfer them to my son and have him sell them because hes in a lower tax bracket. Does this work?

A: If your son is a minor or still in college when he sells the stock, the gain may be taxed at your rate instead of his because of the kiddie tax. Otherwise, if its a legitimate gift (no expectation of getting anything back) this idea may work — but dont forget about potential gift tax consequences.

Q: I have a stock that went down, and Im not ready to sell because I think its going back up. Can I sell it for the loss and then buy it back right away?

A: You wont be able to deduct the loss if you buy back right away, because of the wash sale rule. You need to wait at least 31 days before buying the same stock again if you want to claim a loss.

Sign up for our FREE NEWSLETTER