Capital Asset Pricing Model with Missing Data MATLAB Simulink Example

Post on: 21 Сентябрь, 2015 No Comment

Capital Asset Pricing Model with Missing Data

This example illustrates implementation of the Capital Asset Pricing Model (CAPM) in the presence of missing data.

The Capital Asset Pricing Model

The Capital Asset Pricing Model (CAPM) is a venerable but often-maligned tool to characterize comovements between asset and market prices. Although many issues arise in its implementation and interpretation, one problem that practitioners face is to estimate the coefficients of the CAPM with incomplete stock price data.

Given a host of assumptions that can be found in the references (see Sharpe [3], Lintner [2], Jarrow [1], and Sharpe, et. al. [4]), the CAPM concludes that asset returns have a linear relationship with market returns. Specifically, given the return of all stocks that constitute a market denoted as M and the return of a riskless asset denoted as C. the CAPM states that the return of each asset R(i) in the market has the expectational form

for assets i = 1. n. where b(i) is a parameter that specifies the degree of comovement between a given asset and the underlying market. In words, the expected return of each asset is equal to the return on a riskless asset plus a risk-adjusted expected market return net of riskless asset returns. The collection of parameters b(1). b(n) are called asset betas.

Note that the beta of an asset has the form

which is the ratio of the covariance between asset and market returns divided by the variance of market returns. If an asset has a beta equal to 1, the asset is said to move with the market; if an asset has a beta greater 1, the asset is said to be more volatile than the market; and if an asset has a beta less than 1, the asset is said to be less volatile than the market.

Estimation of the CAPM

The standard form of the CAPM model for estimation is a linear model with additional parameters for each asset to characterize residual errors. For each of n assets with m samples of observed asset returns R(k, i). market returns M(k). and riskless asset returns C(k). the estimation model has the form

for samples k = 1. m and assets i = 1. n. where a(i) is a parameter that specifies the non-systematic return of an asset, b(i) is the asset beta, and V(k,i) is the residual error for each asset with associated random variable V(i) .

The collection of parameters a(1). a(n) are called asset alphas. The strict form of the CAPM specifies that alphas must be zero and that deviations from zero are the result of temporary disequilibria. In practice, however, assets may have non-zero alphas, where much of active investment management is devoted to the search for assets with exploitable non-zero alphas.

To allow for the possibility of non-zero alphas, the estimation model generally seeks to estimate alphas and to perform tests to determine if the alphas are statistically equal to zero.

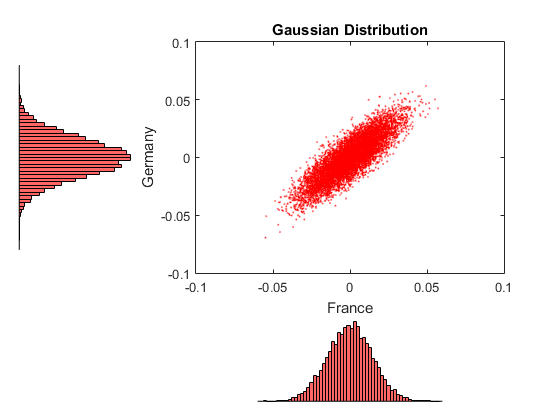

The residual errors V(i) are assumed to have moments

and

for assets i,j = 1. n. where the parameters S(1,1). S(n,n) are called residual or non-systematic variances/covariances.

The square root of the residual variance of each asset, i.e. sqrt(S(i,i)) for i = 1. n. is said to be the residual or non-systematic risk of the asset since it characterizes the residual variation in asset prices that cannot be explained by variations in market prices.

Estimation with Missing Data

Although betas can be estimated for companies with sufficiently long histories of asset returns, it is extremely difficult to estimate betas for recent IPOs. However, if a collection of sufficiently-observable companies exists that can be expected to have some degree of correlation with the new company’s stock price movements, e.g. companies within the same industry as the new company, then it is possible to obtain imputed estimates for new company betas with the missing-data regression routines in the Financial Toolbox.

Separate Estimation of Some Technology Stock Betas

To illustrate how to use the missing-data regression routines, we will estimate betas for twelve technology stocks, where one stock (GOOG) is an IPO.

First, load dates, total returns, and ticker symbols for the twelve stocks from the MAT-file CAPMuniverse.