Capital asset pricing model

Post on: 21 Сентябрь, 2015 No Comment

CHAPTER ONE: Introduction

Introduction

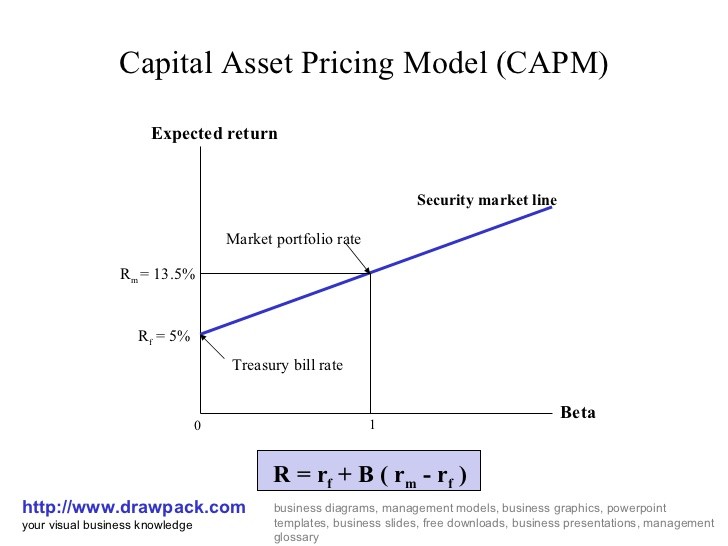

The Capital Asset pricing model, almost always known as CAPM. It is a set of prediction of the risk and return in modern financial economic. It is an economic model for valuing stocks, securities, derivatives and/assets with their respective risk and return.CAPM is based on idea that investors demand additional expected return (called the risk premium) if they are asked to accept additional risk. The model gives us clear-cut prediction of the relationship between the risk and the expected return of an asset. This relationship serves two vital functions. First, it set a benchmark rate of return for a investment and Second, model helps the investor to make an educated prediction about the expected return on asset.

CAMP starts with a requirement of investor point of view, investor likes the overall portfolio reward (expected return) and dislike overall portfolio risk (standard deviation of return). So as a result investors will invest in those stocks that have low risk and high rate of expected return. Although, those stocks which have lower risk will ask for a higher price.

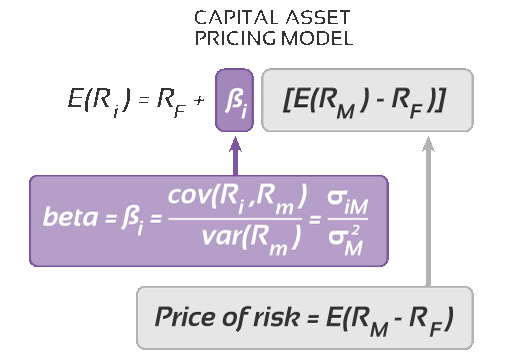

Capital Asset Pricing Model (CAPM) is based on two factor portfolio analysis developed by Markowitz (1952). It is the typical risk and return model used by most annalists for their decision making. The fundamental concept of CAPM is that, investors are compensated for only that portion of risk which is not diversifiable. This non-diversifiable potion is called beta, to which expected returns are linked.1

The Sharp-Lintner-Black CAPM states that the expected return on an asset is proportional to its systematic risk measured by the beta. By Appling some assumptions, the CAPM is a linear function of a risk free rate, beta and the expected risk premium.

This is required for public and private funds evaluation and their decisions. The CAPM has been widely used for knowing the performance of managed funds and calculating the cost of capital. Implementation of the CAPM on emerging markets seems problematical. This is due to immaturity in these markets this included insider trading, prohibiting foreign capital, and high transaction costs, as well as data problems such as irregular trading. These assumptions are not as hard as they seem. The model has been tested in many emerging markets in the world including those in Asia, Latin America South East, Europe, and also the developed markets of the US, the UK and Australia. 1

There is small empirical support on the risk and return relationship and asset pricing tests in Pakistan. From the last five years the trading activity in the Karachi stock market had a mix trend. There was an increasing trend from 2004 to April,2008 and than market started declining its index point till December,2008 and after that the increasing trend till now October 2009.But an average its much batter than some other markets. Remittance of Pakistani workers’ in the banking sectors, global ban on unofficial banking channels. This extra liquidity in the banks was spread as portfolio investment in stock market and the fall in interest rates are also made equity investment good looking. Increased in foreign exchange also added in this regard. 1

Overview of Karachi Stock Exchange

The Karachi Stock Exchange came into existence on 18th September 1947. It was later transformed and listed as a company limited by guarantee on 10th March 1949. At beginning 90 members were registered. However, six of them were acting as brokers and only five companies were listed with a Rs. 37 million paid up capital. The KSE is the main center of activity where 75-80% of current trading takes place.

KSE 100 index was started in November 1991 with a base of 1000 points.

In 2002, when the Karachi stock market was doing best in the world, the US Dow Jones and the European markets’ indexes were at their lowest level in seven years. This was relatively more diversified market and opened for international investors in 1991, therefore this appeared to provide great potential for international diversification. The low correlation provides a hedge against the shock transfers from the developed markets and other emerging markets. The Karachi Stock Exchange’s unique international portfolio implications and attractive capital gains make the study of risk return relationship an interesting task. It will be important for international investors to know the nature of risk return relationship and other factors explaining these high rates of returns in this growing market.

Near past years the Karachi stock market trading activity has increased significantly. The market was acknowledged the best performing stock market in the year 2002 in terms of the percentage raise in the market index.100 index of Karachi Stock Exchange has increased by 112.2 % during 2002. It was rose from 1145 on 1 September 1992 to 11342 on 28 April; it was an increase of approximately 990 %, which amounts to an annual gain of approximately 64%.

But from 2008 it start declining dramatically and it has lost the index from 15,274 to 5,865 indexes. But again in 2009 it showed a increasing trend and till 29 october it has gain KSE 100 index 9,169.00 points.

Over the past few years Securities and Exchange Commission of Pakistan has been taking measures to restore confidence of the investor — both foreign and domestic in the capital market of Pakistan. The SECP ensures that the market functions in a smooth and transparent manner and is also vigilantly observing the market. Its regulatory mechanisms aims to minimize elements of systematic risk and other possible defaults on the one hand and promotes institutional strengthening building of various segments of the capital market on the other. The SECP has been actively pursuing a reform agenda since 2001 for the capital market.

Choice of Subject

As I mentioned above, CAPM is truly a popular in the western financial world, so I believe there is a need to test the validity of CAPM under Pakistani Economic condition, since KSE is the key player in the Pakistani economy. By investigating the validity of the CAPM, I think the results are of interest for financial manager in Pakistan who is thinking about using (or already used) the CAPM partly in their decision.

Purpose of Study

This study is regarding the price of financial asset and would evaluate the Predictive applicability & efficiency of CAPM model with reference to Karachi Stock Exchange.

The main objectives are:

- Whether the higher/lower risk will yield higher/lower expected rate of return.

- Whether the expected rate of return is linearly related with the stock beta, i.e. its systematic risk.

- Whether the non-systematic risk affect the portfolios’ return,(CAPM predicts that only the systematic risk has the explanation power on the rate of return)

Scope of the study

This study emphasis on detail discussion on CAPM model and will use returns data Of 21 companies for period of 5 years From (Oct 2004 to Oct 2009) predictive Power of Capital Asset Pricing Model (CAPM).