Candlestick charting_1

Post on: 16 Март, 2015 No Comment

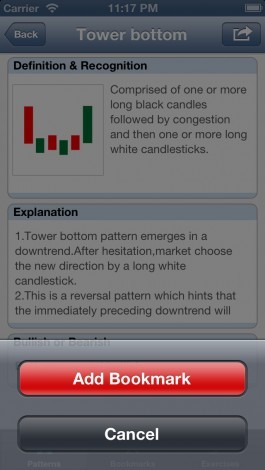

Candlestick charting can give you invaluable insight into price action at a glance. While the basic candlestick charting can tell you what the market is thinking, they often generate false signals because they are so common. Here we introduce you to more advanced candlestick charting, with a higher degree of reliability, as well as explore how they can be combined with gaps to produce profitable trading strategies.

The recognition of the pattern is subjective and programs that are used for charting have to rely on predefined rules to match the pattern. There are 42 recognised patterns that can be split into simple and complex patterns.

Basic candlestick patterns

In the chart below of EBAY, you see the long black body or long black line. The long black line represents a bearish period in the marketplace. During the trading session, the price of the stock was up and down in a wide range and it opened near the high and closed near the low of the day.

By representing a bullish period, the long white body, or long white line-(in the EBAY chart below, the white is actually gray because of the white background) is the exact opposite of the long black line. Prices were all over the map during the day, but the stock opened near the low of the day and closed near the high.

Spinning tops are very small bodies and can be either black or white. This pattern shows a very tight trading range between the open and the close, and it is considered somewhat neutral.

Doji lines illustrate periods in which the opening and closing prices for the period are very close or exactly the same. You will also notice that, when you start to look deep into basic candlestick patterns, the length of the shadows can vary.

Using gaps

When gaps are combined with candlestick patterns and volume, they can produce extremely reliable signals. Here is a simple process that you can use to combine these powerful tools:

- Screen for breakouts using your software or website of choice.

- Make sure that the breakouts are high volume and significant (in terms of length).

- Watch for reversal candlestick charting (such as the ones mentioned above) after the gap has occurred. This will typically happen within the next few bars, especially if the bars are showing indecision after a long trend.

- Take a position when such a reversal occurs.

Attempting to play reversals can be risky in any situation because you are trading against the prevailing trend. Do make sure that you keep tight stops and only enter positions when trades meet the exact criteria.