Can You Outperform the Market It s Expensive to Find Out

Post on: 6 Июнь, 2015 No Comment

I am something of a heretic in the investment world, and many people believe that I am wrong. I think that, for most people, it is a complete waste of time to try to outperform the market. I even write books to that effect.

Many people say, Yeah, maybe thats true for some people. But I am special.

Maybe you are, but it costs money to find out if thats really true, and the odds are excellent that you are not.

In the years when you are figuring out whether you are the next Warren Buffett, you will almost certainly pay more in fees and commissions than those investors who own straightforward index funds, and in performance terms, you will start behind by at least that amount. Of course, even if your performance is good, it is possible that it is down to simple luck, just like you could theoretically be a great investor with an amazing edge and simply be losing money due to a streak of bad luck. Its really hard to tell which is which. You can be sure, however, that those investors with good performance will think it is skill and not luck and tell everyone about their success while the losers keep quiet or disappear (leading to a selection bias where investors appear more successful than they are) — just like 1 out of 1,024 coin flippers will come up heads 10 times in a row.

Of course, you may actually not be very good at this and end up picking average or random stocks, leaving you with the cost drag and a sub-optimal portfolio as the main downside. On average, individual investors trying to beat the markets do not systematically pick underperforming stocks — on average, they pick stocks that perform like the overall market. They likely have a sub-optimal portfolio that is not well diversified, but in my view, the main underperformance comes from the costs incurred.

The most obvious cost when you trade a stock is the commission to trade. While that has been lowered dramatically with online trading platforms, it is far from the only cost. A few others to consider:

- Bid–offer spread

- Price impact

- Transaction tax

- Turnover

- Information/research cost

- Capital gains tax

- Transfer charge

- Custody charge

- Advisory charge

- Your time

Depending on your circumstances and the size of your portfolio, you may find that it costs more than 1% each time you trade the portfolio (the low, fixed online charge per trade is only a small commission percentage if you trade large amounts).

This is certainly less than it used to be decades ago, but for someone who is frequently trading their portfolio, it will be a major impediment to performance. In addition, capital gains taxation tends to be far higher for frequent traders, and the “hidden fees,” such as custody or direct or indirect costs of the research and information gathering, come on top.

The more this adds up to, the greater the edge someone will have to have just to keep up with the market.

I recently saw a particularly cringe-worthy advertisement in which a broker compared trading on its platform with being a fighter pilot, complete with Tom Cruise style Ray-Ban sunglasses and an adoring blonde. I remember thinking, “I would love to sell something to whoever falls for that. The platform makes more money the more frequently you trade, and they obviously think you trade more if you think it’ll make you be like Tom Cruise.

Maybe You Just Have to Pick Your Moment?

Warren Buffett is quoted as saying that “just because markets are efficient most of the time does not mean that they are efficient all of the time. Quoting Buffett about investing is like quoting Tiger Woods about golf. He is a world-famous investor with a long history of being right, so we are all bound to feel a little deferential.

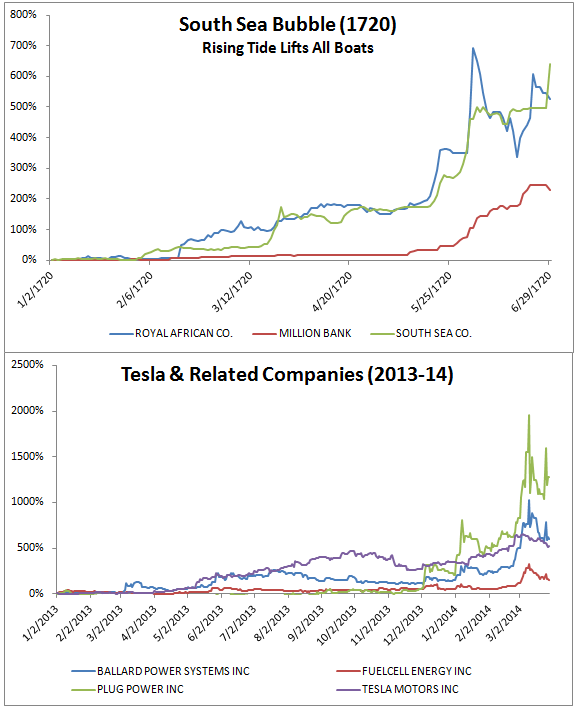

Buffett might be right, of course. Markets might be perfectly efficient some or even most of the time and horribly inefficient at other times. But how should we mere mortal investors know which is when? Can you predict when these moments of inefficiency occur or recognize them when you see them? Clearly, we can’t all see the inefficiencies at the same time or else the market impact of many investors trying to do the same thing would rectify any inefficiency in an instant. But can you as an individual investor spot a period of inefficiency?

I think that it is incredibly hard to have an edge in the market even occasionally, but that some people truly have it, even most of the time.

But you have to be honest with yourself. If you have a long history of picking moments where you spotted a great opportunity, moved in to take advantage of it, and then exited with a profit, then you may indeed occasionally have an edge.

You should use this edge to get rich.

If you liked this post, dont forget to subscribe to Inside Investing via Email or RSS.