Can you buy gold in your IRA

Post on: 5 Май, 2015 No Comment

DanMoisand

Dan’s Latest Posts

Editor’s note: Dan Moisand answers reader questions on all things retirement every Friday. If you have a question for Dan, please email him at RetireQA@marketwatch.com.

This week we have a nice variety of topics to discuss. Interest in owning gold has increased along with the price of the metal in recent years, but can you buy gold in an IRA? Should you? What happens to your ability to use IRAs when you already have a 401(k)? What is the maximum one can put in a retirement plan? Should a retiree keep a mortgage? Do you have to take cash or can you pay out a Required Minimum Distribution in shares? Can you gift IRA money to family?

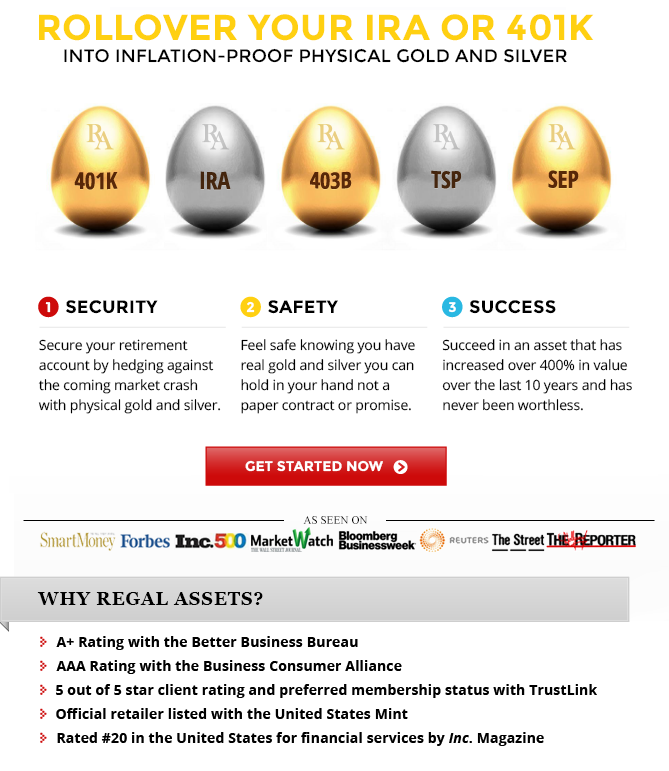

Q. Is it much of a problem to buy gold in your IRA? Several gold companies are recommending doing just that. Any comments. -DS

A. It can be a big pain in the neck. You have to pay a trustee to set up the account, take possession of the gold, store and secure it, and send reports. The companies willing to do this charge substantially more than typical IRA trustees charge for handling plain-vanilla stocks, bonds, and mutual funds. You will find pretty hefty commissions to buy and sell actual bullion or coins. By the way, the bullion or coins must be .995 fine. Most coins do not qualify. South African Krugerands, for instance, are deemed collectibles and are not permitted to be held in IRAs. An easier way to go is an exchange traded fund (ETF) that tracks the price of gold. Any brokerage firm can buy and sell these as they would any stock.

Now whether you should own gold is another issue entirely. Proponents tout it as the currency of the ages, protection against a falling (collapsing, they would say) dollar, and an inflation hedge. Naysayers say all gold does is shine and cost you money to own. One of my favorite quotes on the topic comes from a guy named Warren Buffett: “We spend huge amounts of money digging it up from underground. Then we spend huge amounts of money storing it back underground and pay men with guns to protect it. People looking down from Mars would be baffled.“

Q. I am married filing a joint return. I am working and contribute to a 401(k) program with my employer; however, I do not contribute the maximum allowable amount to the 401k plan. I also have an IRA account. My wife is not working and has an IRA account. Can I contribute to both my wife’s and my IRA accounts without contributing the maximum to my 401k account? My annual adjusted income is below $90,000. -WS

A. Yes. Whether you max out your 401(k) contributions or not has no bearing on what you can put into an IRA or whether those contributions are deductible. That is determined by age and income. In 2013 if you are younger than 50, you can stash $5,500 each into an IRA. You can set aside an additional catc- up contribution of $1,000 for anyone that will be age 50 or more on 12/31/2013. You can split these amounts between traditional and Roth IRAs in any proportion you want.

You have until April 15 of this year to make contributions for 2012. The limits for last year were $5,000 for regular contributions and $1,000 for catch-up contributions to any combination of traditional or Roth IRAs

If your Modified Adjusted Gross Income (MAGI) is less than $95,000 in 2013 ($92,000 in 2012), you can deduct the entire contribution to both your IRAs. Because of your participation in the 401(k), the deduction for you phases out as your MAGI reaches $115,000 ($112,000 in 2012). At that point, you can not deduct your contribution—but your non-working spouse still can. Contributions to her IRA remain fully deductible until you hit $178,000 in income, fully phased out at $188,000 for 2013. In 2012 the range was $173,000-$183,000.

Q. What is the most that a person could invest in retirement? How many plans could they legally invest in? I’m aware of the $23,000 [limit] for a 403(b) and $6,500 for a Roth IRA. What else? Is there a cap for one person? I have never seen this question answered. Thanks -DA

A. Everyone with earned income can contribute to IRAs. How much and whether such a contribution is tax-deductible depends upon income and filing status. The most that can be contributed to a traditional IRA for 2013 is $6,500 for someone that earns at least $6,500 and over age 50 ($5,500 if under 50). That same worker, if eligible due to income, could direct some or all of their IRA contribution to a Roth IRA.

Eligibility for other plans is dependent upon your employer. If they offer a 403(b), 401(k), or certain 457 plans and you are over 50, the cap on your contributions is the $23,000 you mentioned ($17,500 if under 50). Other plans like so-called SIMPLE 401(k)s and SIMPLE IRAs have lower limits. The overall maximum that can be contributed by employee and employer across all plans in 2013 is $51,000. The IRS offers a decent summary in which you can see it is not always as simple as I describe here.

Q. My wife and I are both around 65 and probably going to retire in the next year or two. We have approximately $350-$400K in equity in our current home which we will be selling in the next year or so in order to downsize into a much more manageably sized home. My question is whether we should buy our new home outright or whether it would be better to take out one of the current low-interest rate mortgages and use the cash for other things.—GC

A. Rates are low and if you can itemize deductions, your after tax cost of borrowing is even lower than the stated interest rate. However, the interest is still a cost. From a net worth perspective, you come out better off by keeping a mortgage if you earn more after taxes on your cash. Safer investments are also low-yielding these days, so you have to bear risks. If your income sources at retirement are steady and secure, you may be more willing to bear that risk. People get very emotional about this topic. Some say you are crazy to have any debt and others will call you crazy to not take a mortgage given today’s low rates.

Q. Hi Dan, I will have to start taking Required Minimum Distributions (RMD) from my IRA soon. I have an IRA brokerage account. I live off the dividends from the stocks in my IRA. If I sell stock to satisfy my RMD I will lose the dividends. Can I take the RMD distribution with in- kind stock shares and have them sent to my regular brokerage account so I can continue to receive the dividends? -C A

A. CA, yes you can. Be careful, though, about waiting until the last minute if you will try to remove just the RMD amount. You will have to instruct the brokerage to transfer a specific number of shares. If the price per share drops, you may not remove enough.

If you have the cash to do so, you could buy the stock in the brokerage account first, then sell the shares in the IRA, and pay out the cash. Alternatively, you could sell the shares in the IRA, distribute the cash, and buy the stock back in the brokerage account. The IRS wants to tax the value distributed and really doesn’t care what method you use. As long as you own the stock on the record date, you will be entitled to the dividend.

One note of caution, CA. If you are dependent on the dividend from that stock so absolutely, I am concerned about how well diversified your holdings are.

Q. Is it possible to give to your children from your IRA account without paying taxes? -GC

A. Nope. When money comes out of an IRA, Uncle Sam wants his cut.

Dan Moisand’s comments are for informational purposes only and are not a substitute for personalized advice. Consult your adviser about what is best for you.