Can You Beat the Market With Dividend Paying Stocks Andrew Hallam

Post on: 22 Апрель, 2015 No Comment

As most of my regular readers know, my investments are comprised of index funds. I don’t own individuals stocks.

But I used to.

And many people think I’m crazy because, over an eleven year period, my individual stocks outperformed a diversified portfolio of indexesbefore I sold them, and opted for an indexed strategy. When I sold those stocks, I was emotionally gutted (because those stocks were my babies) but I think it was the right thing to do. You can read my original post about it, here: Why Am I Selling $700,000 Worth of Individual Stocks?

Most active investors don’t track their stock market performances, dollar for dollar, compared to a diversified portfolio of indexes. Sure, some might have done it for a couple of years, but I have yet to see a financial blogger who claims to have beaten a portfolio of rebalanced, diversified indexes over a decade or more. So it surprises me when I read about investors, online, who suggest that it can be done fairly easilywith the safety of dividend paying stocks.

I’m the opposite. My stock picks beat the market handily over more than a decade. And I tracked the dollar for dollar comparison, both with my personal account, and with the account of the investment club I run.

But I don’t have illusions of grandeur, and here’s why:

True, I researched my stocks thoroughly, but there are plenty of times when I was simply.lucky.

Let me explain:

Last week, I found my handwritten notes on a business that I was interested in buying, in 2001.

It had paid uninterrupted dividends for more than 100 years: read more

It was diversified, run by extremely well respected people, and it had increased its earnings per share by more than 150% in the previous decade.

It had increased its dividend payout nearly every yearvirtually foreverand by more than 14 percent annually over the previous decade.

It had net profit margins of 21 percent, annual net income that was three times greater than its long term debt, and a book value per share that had doubled in the previous ten years.

It had fewer outstanding shares than it had the previous decade

Profit margins had improved every year for more than fifteen years.

My challenge to you:

Try finding a business with better metrics than this one, and you will likely exhaust yourselves looking. Don’t even mention the Canadian banks. They don’t come close to the stable, growing profitability metrics of this blue chip business. Not even close.

And what about price?

When I looked at this business, it was selling at $37.15 per share.

And I calculated the following—in 2001:

If the business could grow its EPS (earnings per share) by 11 percent annually for the next decade (a lower than historical growth rate) that would give me a projected EPS of $4 per share, in 2011, from $1.41 per share in 2001.

If the stock sold at its decade average price to earnings ratio, then it would give me a projected, future stock price (in 2011) of $104.80 per share.

What were professional analysts saying in 2001?

Valueline analysts projected that the share price would grow by 13 percent to 19 percent annually over the next five years. Respected analyst, Edward Plank, said this, in December, 2001: “Given their current price, their high safety and stability ranks make them a worthwhile long-term holding on a risk-adjusted basis. That’s primarily because consistent earnings growth is practically assured”

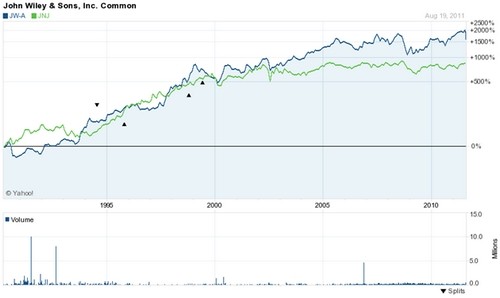

This is what I expected, compared to what actually occurred: