Can the Stock Market Rally Continue

Post on: 22 Апрель, 2015 No Comment

iStock

Can the markets keep advancing? This was the big issue on my emails over the long weekend. The Wall Street Journal noted this morning that many were becoming comfortable with the 2013 advance (6.5 percent in 2013) and are allocating more money to stocks.

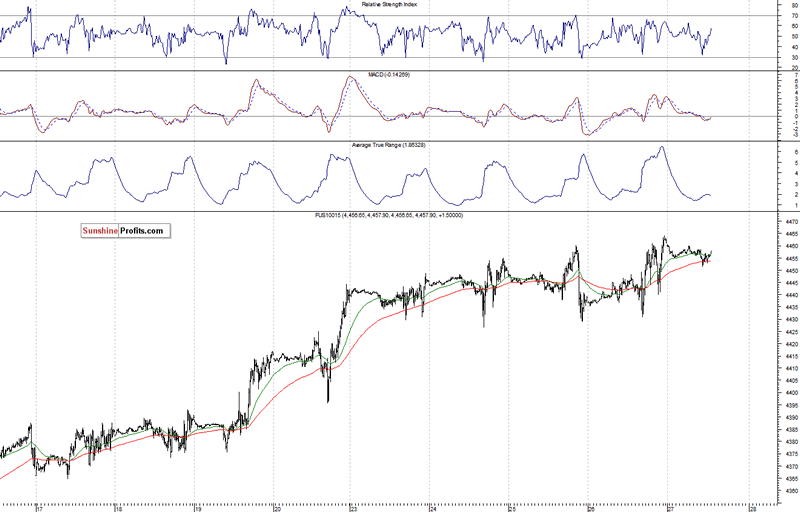

With a forward price-to-earnings ratio of around 14, the markets are not overbought on a valuation basis, but they may be on a technical basis. The S&P 500 is now 3.3 percent above its 50-day moving average of 1,471. Sam Stovall at S&P Capital IQ notes that the S&P 500 typically trades around 0.5 percent above its 50-day moving average, and during market tops has traded as high as 4.9 percent above that level.

Bottom line: We are trading at the high end of the range for the moving average, indicating that the almost straight-up run from Jan. 1 is a bit stretched.

Another issue is the low volatility, with the CBOE Volatility Index (VIX) at 14.4, is not far from multi-decade lows. I have said many times the VIX is not a great long-term indicator — the VIX is a one-month horizon indicator. Most are focused on longer-term horizons. Credit Suisse, for example, has a Fear Barometer that looks at a three-month horizon that looks at trading in puts and calls that far out. Normally the number is about 25, now it is at 32 — slightly elevated.

1) HMOs are down this morning on an unfavorable government proposal for Medicare Advantage rates in 2014. Humana down about 10 percent.

2) Wal-Mart Stores. Spending relief coming? Lots of notes out over the weekend about how badly Wal-Mart has been hit by the higher payroll taxes and the delay in sending out tax refunds. Credit Suisse noted consumers have received $15 billion less in refunds compared to last year. The good news: Refunds, they say, are picking up and should normalize by early March.

Wal-Mart will report earnings this Thursday. Guidance for 2013 is key, of course, with consensus expecting roughly 9 percent earnings per share (EPS) growth. Estimates of fourth-quarter EPS of $1.57 have not come down since Friday.

One thing’s for sure: Though tough to quantify, the higher payroll tax is definitely having an impact. Last week, Burger King said the strong results had moderated due to the higher payroll taxes and Target cited new pressures on its customers, including the payroll tax increase.

3) Shanghai Index down 1.6 percent, biggest drop in a month, on concerns China may introduce more measures to dampen property prices.

4) The Japanese finance minister, Taro Aso, has said he has no intention of buying foreign bonds through a fund with the Bank of Japan. this of course does not mean that the BOJ will stop buying U.S. bonds altogether (they are the second-largest foreign holder of U.S. bonds, after China).

It does highlight a major problem: Who is going to buy U.S. bonds once the Federal Reserve starts selling their huge supply? This was a big issue at the IndexUniverse ETF conference last week: With China showing no indication of increasing their appetite for U.S. bonds, and the Fed eventually becoming a seller, where is the natural buyer? The U.S. retail investor is already loaded up. The typical answer? Institutions. Let’s hope the pension funds respond.