Can Managed Futures Regain Their Mojo

Post on: 4 Апрель, 2015 No Comment

Can Managed Futures Regain Their Mojo?

August 5, 2013 Jeff Schlegel

The financial market crash of 2008 brings back good memories for some investorslike, those who shorted the market and those who invested heavily in managed futures. In a year when just about every investment category on the planet went splat, managed futures as a collective group stood tall with a gain of more than 15% (as measured by the Altegris 40 index).

After the crash, investors swooned for managed futures and their potential for non-correlation to stocks and bonds. To meet demand for an asset category formerly reserved for institutions and very wealthy investors who could afford to pay hefty minimums, a growing number of managed futures-oriented 40 Act mutual funds hit the scene aimed at retail investors, offering much lower investment minimums and providing daily liquidity. Financial advisors and individuals piled in, and a new fund category quickly mushroomed.

According to Morningstar Inc. the first open-end managed futures funds began trading in 2007. By June 2013, the category comprised 51 funds and more than $9 billion in assets. There are also two managed futures-related exchange-traded funds, with roughly $163 million in assets.

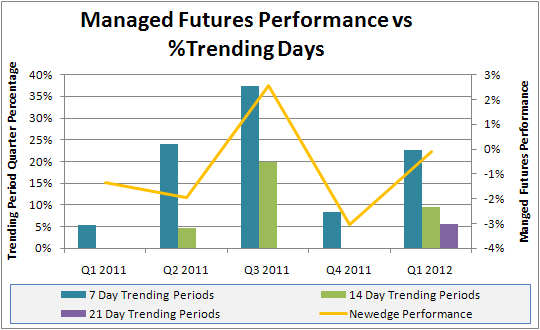

But because of an unhappy combination of poor performance and high fees, the party has pooped out for 40 Act managed futures funds. The latest installment of the annual Morningstar/Barrons survey of alternative investments usage by financial advisors and institutions found that advisors shied away from managed futures in 2012. This category had been their top pick in the two prior years. As the survey points out, performance may have been a factor as managed futures ETFs and mutual funds lost 15.6% and 7.4%, respectively, in 2012, similar to their losses in 2011.

Additionally, the survey notes that both advisors and institutions said they dont like the undisclosed performance fees managed futures funds frequently charge. (Those fees are disclosed, but are often buried in the fine print.)

The fact is they havent been able to deliver on performance, says Nadia Papagiannis, Morningstars director of alternative funds research. We dont know if its structural or a cyclical change in the market environment that makes it hard for this strategy.

Thats an important point to ponder for investors interested in the managed futures space.

Trend Is Your Friend

Managed futures are programs run by commodity trading advisors (CTAs) who are registered with the Commodity Futures Trading Commission. They manage client assets in proprietary programs that trade an array of futures contracts in more than 150 global markets ranging from currencies and commodities to stock indexes and interest rates, and they can take both long and short positions.

Proponents of managed futures say these programs provide diversification by investing in a broad range of assets that offer non-correlation to traditional long-only stocks and bonds. Non-correlation doesnt mean negative correlation, but it does imply the ability to avoid steep drawdowns such as the 37% nosedive in the S&P 500 in 2008.

In theory, managed futures are supposed to help lower portfolio risk by being more nimble in either bull or bear markets than traditional asset classes. But its not a one-size-fits-all approach.

Theres a big misconception about what managed futures are, says Brian Cunningham, president and chief investment officer at 361 Capital in Denver, which runs the 361 Managed Futures Strategy Fund. Financial advisors and investors want to lump them together as an asset class. Theyre not really an asset class; theyre a collection of strategies.