Calculating Yield and Understanding Yield Curve

Post on: 16 Март, 2015 No Comment

Chapter 3: Calculating Yield and Understanding Yield Curve

The yield of a bond is the return that the bondholder gets on his investment. There are many ways to look at the investors returns, which is why there are several definitions of yield. A good understanding of what yield is and how to calculate it will tell you what you will earn from a bond.

Nominal yield is nothing but the coupon rate of the bond. It is the actual interest that the bond issuer pays periodically to investors. In percentage terms, nominal yield is also referred to as coupon rate. The coupon is always calculated on the basis of the par value of the bond. A bond with a nominal yield or coupon rate of 10%, payable semi annually and a par value of $1,000 will pay $50 to the bond holder after every six months.

Required yield or the required rate of a return from a bond is the rate that investors expect the bond to pay so that they feel their investment is worthwhile. It must be noted that the required yield is neither determined by the bonds coupon, nor its market price. It is the rate that you would expect to earn if you were to invest your money elsewhere instead of that bond. Typically, required yield is the return paid by other similar bonds in the market, having the same risk profile and maturity. It can also be seen as the opportunity cost of investing in that bond.

As bonds are traded in the secondary market, you will not always be able to purchase the bond on its par value. You might have to pay a premium on the bond or you may get the bond on a discount. In case of nominal yield, you just calculate the return assuming that the bond has been purchased at par value. But in reality, the price you paid will be something else, and your return should be calculated on the actual investment that you made on the bond. The simplest way to calculate current yield is using the following formula:

Current Yield = (I / P) x 100

Here:

I is the annual interest that the bond pays to investors. If the bond pays $50 after every 6 months, the annual interest will be $100.

P is the market price of the bond or the actual investment that youll have to make to purchase the bond

Although this formula quickly gives you an idea of the return that youll earn on the bond, there is one major problem with this method. When you buy the bond on premium or discount, you will have to consider the capital gain or loss that youll make when the bond matures.

If you paid a premium for the bond, you will lose some money when the bond matures, as the par value repayment will not fully compensate for the price you paid for the bond. The exact opposite will happen when you bought the bond for a discount. This means we need to adjust our current yield formula to take capital gains into account.

Current Yield = (I / P) x 100 + (100- NP) / T

Here:

NP is the normalized price of the bond. It is calculated by dividing the actual market price of the bond by its par value and then multiplying it with 100. For example, a bond with a par value of $5,000 and selling for $5,500 (10% premium), has a normalized price of ($5,500/$5,000) x 100 = 110. A bond selling at a discount will have a normalized price of less than 100.

T is the number of years left till the maturity of the bond.

Lets calculate the current yield of a bond that has a par value of $5,000, market price of $5,500, 3 years left to maturity and a coupon rate of 10%.

I = 0.1 * $5,000 = $500

P = $5,500

NP = 110

T = 3

Plugging these values into the current yield formula:

Current Yield = ($500 / $5,500) x 100 + (100 110) / 3 = 5.75%

You can see how the yield of the bond is significantly lower than the coupon rate being offered on it, just because you are having to pay a premium on it. Such a scenario is not unrealistic and it can happen when the interest rates in the economy fall. You should also keep in mind that when you are calculating yield between two coupon payments, you have to take accrued interest in account. To do this, you simply have to use the dirty price of the bond, instead of the listed flat price.

So far we have calculated yield by using the actual interest payments made by the bond, but current yield can also be calculated for a zero coupon bond. The formula for calculating current yield of a zero coupon bond is as follows:

Current Yield for a Zero Coupon Bond = <[Par Value / P]^(1/T) 1> x 100

For a zero coupon bond with a par value of $5,000, market price of $4,000 and 3 years left to maturity:

Yield to maturity (YTM) is the most important and more relevant yield of a bond. You would have noticed that so far in the yield calculations we have not considered the fact that future payments of interest and repayment of par value need to be discounted to get their true present value.

The yield that you get after factoring in time value of money in the yield calculation is referred to as the yield to maturity. When you know the price of the bond, yield to maturity is the rate of return that will make the sum of present value of all future cash flows equal to the price of the bond. This concept can be represented as the following formula:

P = [I / (1+YTM)] + [I / (1+YTM)^2] + … + [I / (1+YTM)^n] + [Par Value / (1+YTM)^n]

Here:

P is the market price of the bond

n is the number of periods to maturity

YTM is the yield to maturity of the bond

As we saw earlier when calculating bond prices, this can also be written as:

Price = I x [1- [1 / (1+YTM)^n ] ] / YTM + [Par Value / (1+YTM)^n]

You can see that it will be very difficult to calculate YTM through this formula using a simple calculator. A technique that can be useful here is guessing and checking. You can start by assuming that YTM could be 4%, 5%, 6% or 7%. Now you can calculate the price of the bond on the basis of these 4 assumptions.

If for 5%, the calculated bond price is lesser than the market price, while for 6%, the calculated bond price is higher than the market price, we know that YTM lies between 5% and 6%. You can further refine your guess by calculating the price for 5.3%, 5.4%, 5.5% and 5.6%. There is a chance that you will have to increase or lower your guess depending on the result of the calculation.

This whole process can be quite tedious, especially if you are a regular investor in the bond market. It will make much more sense to use special programs that can quickly run this calculation for you and give you a good enough approximation of the true YTM.

Once you know the yield to maturity of a bond, you can easily compare this investment opportunity to any other investments. This is the final return that you will earn on your investment and is directly comparable to annualized returns from stocks, deposits, or even real estate investment.

The YTM formula can be adjusted according to different kinds of bonds. For a zero coupon bond, you have to completely remove the first term from the formula, as there are no periodic interest payments. For a puttable bond, you have to calculate the yield to put. To do this, you have to replace the par value of the bond with its put value in the formula and replace the number of periods to maturity with the number of periods to put.

Similarly, for a callable bond, you have to replace the par value of the bond with its call value in the formula and replace the number of periods to maturity with the number of periods to call. When there are multiple dates on which the bond can be called, you can calculate the Yield to call for all these dates.

When the same bond is both puttable and callable, you can calculate its yield to maturity, yield to call and yield to put. The worst yields of these three is referred to as the yield to worst. If you are a risk averse investor, this is the yield you should consider before making the investment. Of course, theres an even worse case that you have to think about- the possibility of the issuer defaulting on its payments.

You should also remember that the yield of a bond has an inverse relationship with its price. This is because the higher the price of the bond is, the higher your investment will be. If the yield remains the same, it will result in a lower return on investment. Similarly, if you get a bond on a heavy discount, the yield on the bond will be higher as you would be earning the same return, but on a lower investment.

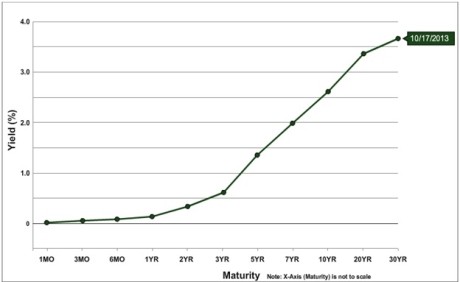

The yield curve or the term structure of interest rates is a very important economic concept that can help you assess bond market investments and also get an idea of what the market feels about future interest rates. The yield curve is the graph between the yields to maturity of different bonds and their respective time to maturity.

Treasury bonds are typically used to construct the yield curve as they provide the best benchmark for bonds with similar maturity. The shape of the yield curve can change and these changes indicate some underlying economic changes that can have an impact on your bond investments.

There are three fundamental aspects of the yield curve:

- Yields of bonds with different maturity terms usually change in the same direction This is because a bond with a longer term can be seen as equivalent to multiple bonds of a shorter term. For example, instead of investing in a bond with a term of 2 years, you can instead invest in a bond with a 1 year maturity and when this bond matures, you can invest in a another 1 year bond. Therefore if the yield of a long term bond increases, the yields of these short term alternative bonds should also increase, as otherwise investors will stop buying these bonds.

- Short term bonds have more volatile yields as compared to long term bonds Short term bonds tend to have more volatile yields as their prices have to be constantly adjusted to the short term changes in the economy. However, over a longer term, a lot of these economic changes are smoothened out, and this expectation is built-in in the yields of long term bonds.

- Long term bonds usually have a higher yield than short term bonds There is always a risk associated with a bond investment. The interest rates could go up, meaning you would have better alternative opportunities to that bond, or the issuer could default. Both of these risks are compounded over a longer term. When you hold a bond for a longer period, there is a greater chance of interest rates changing or the issuer defaulting. To compensate for this higher risk, issuers of long term bonds have to pay a higher yield to investors.

There are three major types of yield curves that are observed in different economic scenarios.

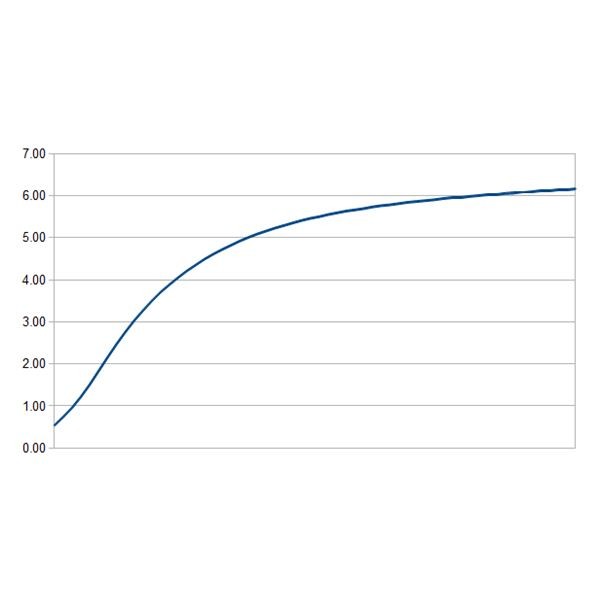

In a normal yield curve, investors associate a higher risk with long term bonds, which results in higher yields for them. The market sentiment is normal, with expectation of some growth and no major risks on the horizon. A normal yield curve has an increasing pattern, i.e. the graph climbs up as it moves towards the right (higher terms). As the curves moves towards right, it gets flatter, which means that the difference in yields per unit change in maturity goes down.

In other words, the difference in yields between a 1 year and 2 year bond will usually be greater than the difference in yield between a 10 year and a 11 year bond. Longer term bonds are seen as having a higher risk, and investors demand a higher yield in return of taking that risk.

A flat yield curve, where yields for bonds with short term and long term maturities are very similar, is seen when the market is uncertain about which way the economy will go. When investors are not sure whether interest rates will move up or go down, the yields for bonds with different terms tend to converge.

This phase never stays for a long time, as the market soon decides on the outlook of the economy, and this is reflected in the yield curve. When the yield curve is flat, you should buy bonds that offer the minimum risk, as you would have no advantage in terms of yield when you buy high risk bonds.

Inverted Yield Curve

The inverted yield curve, where yields for bonds with short term maturities are lower than those of long term bonds, is seen in very rare situations. Such a yield curve indicates that the market believes interest rates will soon go down. An inverted yield curve is a downward sloping curve.

It may seem unintuitive that investors would actually buy long term bonds, which present a higher risk, even though they are being given a lower yield. This happens when investors believe that the economy is shaky and that this is the right time to lock your money in long term investments, as yields will go further down in the near future. Inverted yield curve is a rare scenario and it does not last long, as after some time, the outlook about the economy generally improves and people again have normal expectations about interest rates and risk.

In addition to these three major types of yield curves, there can be other shapes of the curve as well. For example, a steep yield curve is one where the gap between long term treasury bonds and short term treasury bills increases. This is seen as a sign that the economy is about to get into a rapid expansion mode. Another kind of yield curve is the humped yield curve, where the yields of medium term bonds are higher than both short term and long term bonds.

Credit spread is the difference in yield of a corporate bond as compared to a treasury bond. Also referred to as quality spread, it represents the premium that the corporate bond issuer has to pay to investors to encourage them to prefer the bond over risk free treasury securities.

The reason behind this extra premium in yield is that companies have a significantly higher chance of default as compared to the US government defaulting on its repayment obligations. This spread can be graphically understood as a gap between the yield curve of the corporate bond and the yield curve of government bonds.

Credit spreads can change significantly as the economic conditions change. When the economy is doing well, investors are more confident and there is a lesser chance of companies going bankrupt. In such a situation, credit spreads tend to shrink as the two yield curves come closer. On the other hand, when the economy is not doing well, investors become risk averse and prefer risk free government securities over corporate bonds. In such a situation, credit spreads widen, as companies have to offer a higher yield to lure investors to their bond issues.

Although the yield curve gives a very good picture of the current state of interest rates and what the market thinks of how they will change in future, it does not take into account the fact that different treasury bonds offer different coupon rates.

Making this adjustment is very important as it will not make much sense if you are comparing a corporate bond with a 10% coupon rate with a treasury bond that just offers a 3% coupon rate. The spot rate curve is determined after making these important adjustments to the yield curve. To plot the spot rate curve, the yields of zero coupon treasury bills are charted against their respective terms.

A good understanding of how to calculate different yields and how to read the yield curve is very important to making smart bond investments. These concepts give you a much better idea of the returns that you can earn from your investment and the risk of the economic situation changing in the near future. With these techniques at your disposal, you can also carry out a much better comparison between different bond products.