Calculate intrinsic value (DCF)

Post on: 11 Май, 2015 No Comment

By Nick Kraakman

| 29 December 2012

You have found a good business with a high The amount of net income returned as a percentage of shareholders equity. It is a measure of how profitable a company is able to deploy its equity.

Return on equity = Net income / Shareholders’ equity

>return on equity. low debt levels, healthy profit margins and a steadily increasing book value? Great, then it is now time to calculate the company's An estimate of the ‘true’ value of a company, assuming that the market price does not always reflects this value correctly. This is the cornerstone of the value investing strategy.

>intrinsic value to determine whether the stock price is low enough to invest!

The following quote provides a definition of the term intrinsic value.

[Intrinsic value is] the discounted value of the cash that can be taken out of a business during its remaining life.

The most successful investor of all time. Buffett was a student of Benjamin Graham, and has earned a place in the top 3 richest people on earth by applying sound value investing principles.

>Warren Buffett in Berkshire Hathaway Owner Manual

So the intrinsic value is the net present value ( The net present value (NPV) is the current value of an amount of money in the future, as if it existed today. A dollar today is worth more than a dollar in the future, since that dollar could be earning an interest rate when invested today. We calculate the present value of a future dollar by discounting it.

Net present value = Future value / (1 + Discount rate) ^ Number of years from today

>NPV ) of the sum of all future free cash flows ( Free cash flow (FCF) is the cash that can be freely taken out of the company after it has paid for maintenance of its property, plant and equipment. Many investors believe that this figure is a more reliable figure for profitability than net income, because it is less prone to tampering by management.

Free cash flow = Cash from operating activities — Capital expenditures

>FCF ) the company will generate during its existence. This intrinsic value reflects how much the business underlying the stock is actually worth if you would sell off the whole business and all of its An asset is something a company owns which generates money. Examples of current assets are cash, inventory, and accounts receivable. Examples of fixed assets are equipment, buildings, and real-estate.

>assets. Value investors make money by buying good businesses at a price way below the intrinsic value.

The idea behind this is that in the short term the market often produces irrational prices, but in the long term the market will on average price the stocks correctly. So if you buy when the price is irrationally low and sell when the price approaches the intrinsic value (the correct price), you will earn market beating returns while taking less risk! You can read more about the difference between price and value by clicking here.

Discounted Cash Flow method

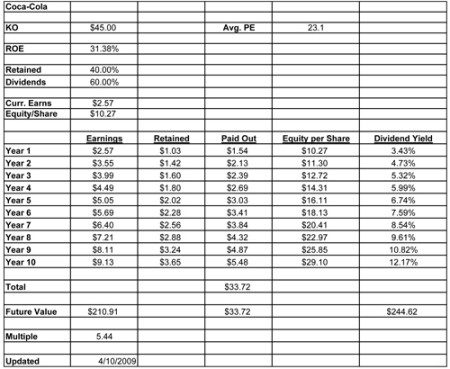

To calculate the intrinsic value of a stock using the discounted cash flow method, you will have to do the following:

- Take the free cash flow of year X and multiply it with the expected growth rate

- Then calculate the NPV of these cash flows by dividing it by the An imaginary interest rate, most often equal to the long-term historical return of the stock market, which is used to calculate how much a dollar amount in the future is worth in today’s money. This is the minimum return you would have to earn to justify stock picking over investing in an index fund.

>discount rate

>shares outstanding to arrive at the intrinsic value per share

Is the current stock price much lower than the intrinsic value per share you calculated? Then you might consider investing. However, take into account that the intrinsic value you calculated is merely an estimate and that small changes in inputs can lead to significant changes in the estimate. So do not take the calculated value as true, but merely as a rough indication.

* For this calculation we assume that the company and all its assets will be sold in year 10 at a free cash flow multiple of between 12 and 15. This is because it is impossible to predict the future, especially more than 10 years ahead.

Free Discounted Cash Flow calculator

To make life a bit easier for you we created an automated discounted cash flow spreadsheet which you can use to quickly calculate the intrinsic value of US listed companies. And the best thing is that all you have to do is fill in the ticker symbol and the spreadsheet will do the rest! The spreadsheet is powered by Google Documents. Simply click the button below and then click File > Make a copy.. to start using the spreadsheet from your own Google documents account.

If you want more advanced functionalities, you might consider our PREMIUM value investing spreadsheet.