Buying Before the ExDividend Date and Selling After

Post on: 28 Июнь, 2015 No Comment

Cashing in on dividends is great, but its better to have a longer timeline.

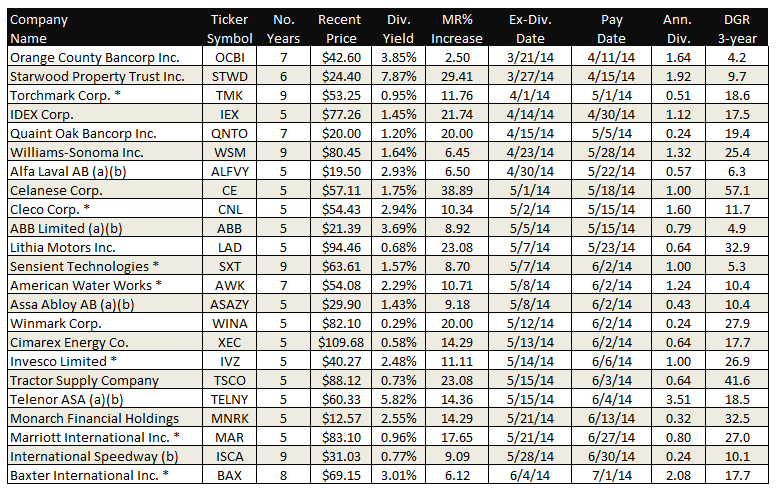

The ex-dividend date is an important date to keep in mind when purchasing a stock, but there are some who like to buy a stock before the ex-dividend date, and sell the stock after to “scoop the dividend.” Doing this is possible but difficult and some claim to make a profit.

Im sure a profit can be made, but it will take a lot of effort and I don’t advise this mainly because I have a buy and hold philosophy; but there are other reasons why this is probably not a good idea either:

- After a stock issues a dividend, the price of the stock generally goes down.

- You have to risk a large sum of money to make the dividend gains enough to cover any price volatility and trade commissions.

- When you scoop the dividend you then have a tax liability which you have to pay and account for (short-term capital gains ).

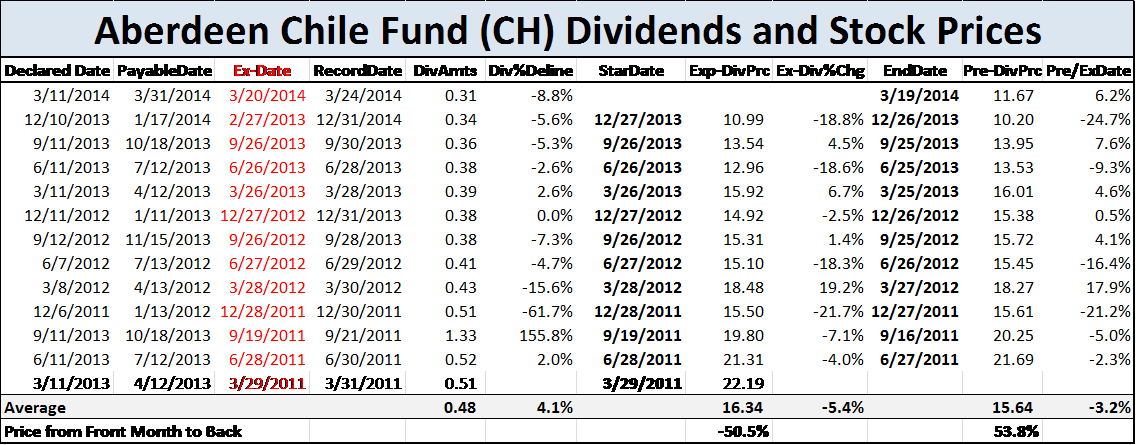

- You run the risk of buying the stock high (security prices go up right before an ex-dividend date) and selling low (the price tends to go down after a dividend is issued). This is a basic accounting truth, but I provide an explanation here .

Why not buy before the ex-dividend date?

With those things in mind, there are quite a few things this dividend will have to cover: brokerage commissions, capital gains taxes, the loss on the price drop, and the time you’ve used chasing the dividend. After those are accounted for, you must hope there is enough money left to make the effort worth it!

It sounds like a lot of work to me, which is why I don’t do it. Can profit be made here? Profit can probably be made, but not enough to attract me.

The Internet Said Dividend Scooping was Good!

You may see a lot of talk online about buying before the ex-dividend date and selling after, and you may see people making a lot of wild claims, but most of those are just wild claims.

People are always searching for the quick buck, but resorting to dividend investing reminiscent of day trading is a quick way to be working extra hard for peanuts. Stick to regular investing, and wait it out, because any other way is just a classic retelling of “the Tortoise and the Hare.”

Buy dividend stocks for the consistent dividend, and day-trade the stocks worth day-trading.