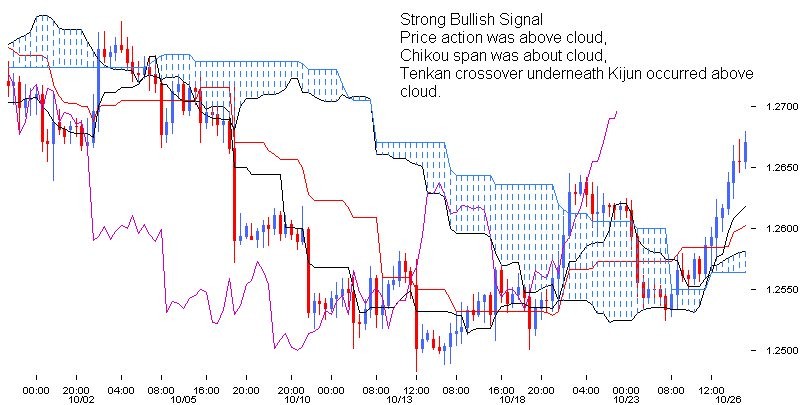

Bullish signal

Post on: 17 Апрель, 2015 No Comment

Seventh Inning Stretch, or Delay of Game?

April 12, 2009

All the hoopla I am hearing about this recent bear market rally a.k.a. our recent bottoming is becoming a bit disconcerting, although it was clearly expected as I noted in Good News Novelties in January. The media loves one thing, to sell headlines whether by paper or by click-throughs. It is a sure bet that pessimism is a hot commodity in a sea of optimism, and now that the tide is out, optimism is the new best seller over pessimism.

Social order, of the less-than-scientific-kind, favors Newtons First Law of Motion which would indicate that the current optimistic wave will continue through inertia until one-hell-of-a jetty of bad news is able to break it (i.e. Q1 earnings and Q2 revisions ). That said, the recent trickles of continued bad news have been ineffective during this rally.

Just before this rally began, on March 5th I posted a number of links indicating some of the best technicians thought youd be crazy to be short in early March see Signs of a Bounce . Well now we have met that bounce, and some investors (or stock jockeys) are cheering that the worst is behind us. The bears still favor fear mongering, leaving most of us scratching our heads to see which side to lean towards. The only fair assumption is that we are somewhere between the first and the last inning. My guess is that this is not the Seventh Inning Stretch on the way to recovery but rather a delay of game on our deflationary decent.

Some of my favorite and more prescient financial bloggers and authors are offering new warning signs. Some of the better clippings are noted below. Id expect the current wave of optimism to come crashing down when and only when it would take a financial imbecile to realize that the bottom has not yet arrived, usually after its too late. At that point retail investors are sure to have repeated their age old mistakes of buying high and selling low.

For all the hemming and hawing about how much money professional traders make year after year, its sad and funny to admit that contrarian herd psychology is a fail-safe trading strategy. If there is one thing that bothers me most is the thought that every day the vix goes lower, the potential for its reversal grows larger.

Bear Market Rally? by Barry Ritholtz Is this the real thing, or just another Bear Market rally? So far, we’ve had 4 runs of about 20% each. Here are 3 things to keep in mind:

The Economy’s ‘Green Shoots,’ Real or Imagined by the New York Times Editors Ben Bernanke, the Federal Reserve chairman, said on CBS’s “60 Minutes” that he is seeing “green shoots” showing up in the economic landscape , “as some confidence begins to come back.” What are the bright spots in the economy? Is there reason to believe that Mr. Bernanke’s view is not wishful thinking?

The Incredibly Shrinking Market Liquidity, Or The Upcoming Black Swan Of Black Swans by Tyler Durden Anyone who is doing anything sensible right now is either losing money or is out of the market entirely. These are the words of a quant trader, who is seeing something scary in the capital markets. Scary enough to merit a warning that we could be on the verge of another October 87, August 2007, or January 2008.

How Far Can You Trust This Rally? by Kopin Tan To buy the equity market at these levels, says BarclaysCapital strategist Barry Knapp, implies a degree of confidence in a sharp recovery that doesnt seem to jibe with the available evidence.

Is That Recovery We See? by John Mauldin I think, given the track record of the analysts who project a 74% rise in earnings for financial stocks in the 4 th quarter of this year, that we should remain a tad skeptical.

The Imminent Disinformation Schism by Tyler Durden The real split will be of naive, easily-manipulated, small-time mom and pop investors, who only care about looking at their daily yahoo finance screens and 401(k) statements, seeing more black than red, and only focusing on what happened in the immediate past, and the forward looking taxpayers, who see the upcoming budget deficit fiasco, the social security ponzischeme, the Medicare/Medicaid debacle, the ridiculous underfunding in public and corporate pension funds, the rising city and state taxes, the shuttering factories, the rising unemployment, the plummeting American production base, the seasonally upward-adjusted economic data coupled with consistently downward revised prior economic releases, the increasing savings rate and the multi trillion discrepancy in consumer purchasing power.

S&P 500 50-Day Moving Average Spread by Bespoke Investment Group The S&P 500 is currently trading 8.56% above its 50-day moving average, which is its most overbought reading since May 2001. As shown in the historical 50-day moving average spread chart of the S&P 500 below, these levels are rarely reached, and when they are, pullbacks or sideways trading usually ensues. However, oversold levels hit multi-year extremes and kept getting more and more oversold at the end of 2008. While its likely that the market will take a breather, anything can happen in this market.

Posted by greenewable

Signs of a Bounce

March 5, 2009

There is a growing body of folks calling for a bounce. None of todays technicals indicated that yesterdays pop will last. However I am pasting below a number of links and charts of people who have been reversing bearish courses or who are offering other views that a bear rally is in store. My initial impression is that they were early to call the bear market, and theyll likely be early calling the reversal.

From Bespoke Investment Group on Sentiment:

This weeks survey of investor sentiment by the American Association of Individual Investors (AAII) showed that investors are now at their most bearish levels in the history of the survey. As shown, 70.27% of respondents to the weekly survey (which didnt include todays 4% decline) are currently in the bearish camp.

Also from Bespoke on Oversold Conditions:

Moves below the green shading are considered oversold, and since we dont have to ever worry about moves above the red shading, why even mention that they are considered overbought (sarcasm emphasized)?

From Doug Kass at thestreet.com on Fundamentals, Sentiment and Valuation:

Kass: Bottoms Up, Mr. Market

My contention, as discussed on last nights show, is that the serious problems have been more than fully discounted in the worlds equity markets. Moreover, while many have grown increasingly impatient with the new Administrations piecemeal strategy toward addressing the banking industrys toxic assets, a cohesive deal, under the leadership of Lawrence Summers, will soon be forthcoming and will be effective.

The investment pyramid consists of the three angles of fundamentals, sentiment and valuation. I made this market bottom call based on my expectation of an early 2010 stabilization in the economy (making the 27-month recession the second-longest in history) coupled with an extreme sentiment and valuation swing. (As Dennis Gartman is fond of saying, sentiment and valuation have moved from the top left of the chart to the bottom right of the chart in an historic fashion.)

I am fully cognizant of the magnitude of our economic and credit challenges and that the future is not what it used to be. Indeed, my expectation of The Great Decession, which is somewhere between a garden variety recession and The Great Depression, remains intact and is my baseline expectation. [More ]

From Robert Prechter of Elliot Wave International on Valuation and Technicals:

Prechter Advises Closing Short Positions on Stocks

Feb. 24 (Bloomberg) Elliott Wave International Inc.’s Robert Prechter. who advised shorting U.S. stocks three months before the bear market began, said investors should end that bet after the Standard & Poor’s 500 Index tumbled to a 12-year low.

He warned of a “sharp and scary” rebound for anyone still wagering on a retreat, according to this month’s “Elliott Wave Theorist.” Short selling is the sale of borrowed stock in the hope of profiting by buying the securities later at a lower price and returning them to the shareholder.

“This is an environment of escalating financial chaos,” wrote Prechter, famous for cautioning that stocks would crash two weeks before the Black Monday retreat in 1987. “Our main job is to keep the money we have. If we exit now, we will do that.” [More ]

From Bill Fleckenstein of the Prudent Bear Fund on Valuations:

Cheapest Stocks Since 1990 Reduce U.S. Short Selling (Update3)

While Seabreeze Partners Management Inc.’s Douglas Kass and David Tice at Federated Investors Inc. say there’s still money to be made betting that food and computer makers will fall, even Marc Faber, who publishes the “Gloom, Boom & Doom Report,” abandoned his so-called short positions. Bill Fleckenstein. who warned of the housing bubble in 2005, closed his 13-year-old bear market fund and bought shares of Microsoft Corp.

“It’d be easier for me to find five stocks I think are going to go up than five stocks I think are going to go down,” said Fleckenstein, who is based in Seattle. “Being short right now just feels like the wrong strategy.”

From Steve Leuthold, of the Grizzly Short Fund on Valuations:

Leuthold Says Stocks Will Surge, Depression Avoided

(Update4) March 4 (Bloomberg) Steve Leuthold, whose Grizzly Short Fund returned 74 percent last year betting against U.S. stocks, said now is the time to buy equities because investors are too fearful about the economy.

These comparisons people make with the Great Depression are totally out of touch with reality, and pretty stupid, he told Bloomberg Television in an interview today. Weve been in much worse, much more panicked and more scary situations in the U.S.

The economy isnt as bad as it was in 1974, when stocks began rebounding, said Leuthold, who oversees $3.2 billion at Leuthold Weeden Capital Management in Minneapolis. He predicted the Standard & Poors 500 Index will surge to at least 1,000 in 2009, representing a gain of 44 percent from yesterdays 12-year low of 696.33. [More]

Sources :

Bespoke Investment Group, March 5, 2009

Bespoke Investment Group, March 4, 2009