Bullish Options strategies

Post on: 6 Август, 2015 No Comment

Why Owning Options Beats Owning Stock

Monday, February 6th, 2012

Two weeks ago, Apple announced blow-out earnings that pleased just about everyone who follows the stock. Since that time, AAPL has soared by 9.2%. Owners of the stock are celebrating.

Meanwhile, the actual options portfolio we carry out at Terry’s Tips increased in value by 42.5% over this same time period. Options outperformed the stock by more than 4 times.

Today I will share with you the actual option positions we hold in this portfolio, and show the potential gains (or losses) that lie ahead. This is an important report that I hope you will read carefully

Why Owning Options Beats Owning Stock

In April, 2010, we set up a $5000 portfolio to demonstrate that a well-designed options portfolio could substantially outperform the outright purchase of stock. We selected AAPL as the underlying, a company we thought had a good future.

We never imagined that future would be quite as spectacular as it has been so far. The stock has skyrocketed by 72% since then. Meanwhile, our options portfolio has gone up by 263%. Our subscribers who mirrored our portfolio from the very beginning have gained over 3.5 times as much as they would have if they had merely purchased shares of AAPL.

We withdrew $3000 of the original $5000 so new subscribers could mirror the portfolio with a smaller investment. The original investment, now $2000, as grown to its present value of $12,141 in 21 months. Not bad by any standards, if we do say so ourselves.

How did we do it? Quite simply, we bought call options with a few months of remaining life and sold call options with only one month of remaining life against these positions. The shorter-term calls we sold to someone else decay at a faster rate than the longer-term calls that we own. This gives us a major advantage over anyone who has just gone out and bought shares of stock.

In options terminology, we created a portfolio that maximized net delta (the equivalent number of shares of stock we own) as long as there was positive theta (which means that the portfolio would make a small gain every day that the stock remained absolutely flat).

Here are the actual positions of this report from our weekly report sent to paying subscribers:

If you spent $12,141 (the portfolio value) to buy stock, you could purchase 26 shares. The net delta of this portfolio (117) means that we own the equivalent of 117 shares, or over 4 times as many as the stock owners control. Meanwhile, theta ($32) means that we are collecting a sort of dividend of $32 every day that the stock remains flat. We don’t actually get a check for that amount, but that is how much the portfolio should gain from the different decay rates of the long and short options in the portfolio.

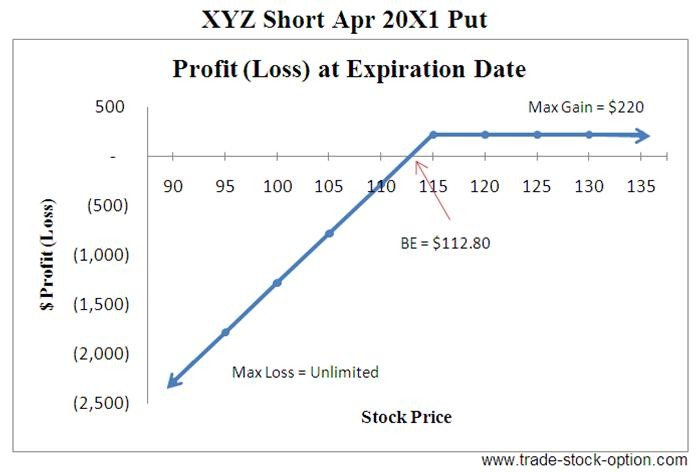

Here is the risk profile graph which shows the gains (or losses) that this portfolio should experience when the current short options (Feb-12) expire on February 17, 2012 at the various possible stock prices. (Note: If the stock moves sharply from its present level, we would make adjustments to the portfolio that would shift the curve in the direction the stock had moved.)

The graph shows that the portfolio should gain over 15% in two weeks if the stock remains absolutely flat or goes up by about $10. Surely, this is a better place to be compared to what the stockholders have. If the stock stays flat, they will not make anything.

If the stock falls about $5 in two weeks, the owners of stock would lose that amount while the portfolio should break even. If the stock falls about $10 in two weeks, the options portfolio would do just about the same as the owners of stock would do. If it falls more than $10, the options portfolio would suffer a greater loss than the stock would, but we would have made an adjustment to reduce or eliminate that possible loss (by rolling down short calls to lower strike prices).

This may sound confusing, or maybe even too good to be true, but Terry’s Tips Insiders are generally not confused, and they know full well from experience that these results are real. We feel that we have definitively proved that an options portfolio can significantly outperform the outright purchase of stock if you pick a stock that goes up.

Actually, we are a little confused why anyone who really believes in a particular stock would buy shares in it rather than setting up an options portfolio like this one. Do you understand why? Other than it taking a little more work? Surely, learning a little about options is something that could pay off every year for the rest of your life. Why not start off right now by clicking here ?

Andys Market Report 1/31/12

Tuesday, January 31st, 2012

January’s rally was admirable. Its perseverance frustrated bears. The infrequent single day declines maxed out at -0.6%.

And the last nine days of the month were more than mind-numbing for most traders as the market traded in a very tight range.

There’s no doubt the bears are ready. Almost every technical and sentiment measure I follow has pushed into a bearish state. Typically, I am ecstatic by the weight of the bearish measures, but it seems everyone is aware of the measures and have joined my short-term bearish camp. And when the herd is anticipating something a bearish move might have a hard time coming to fruition.

That was certainly the case last month.

We must remember that January is one of the strongest month of the year for the market. February not so strong with a historical return of 0.0%.

February swoon? Not yet.

After Friday’s unemployment report, the bulls managed to push the indices, particularly the Dow to highs not seen since before the financial crisis in 2008. A drop in the unemployment rate to its lowest level in three years (8.3%) propelled stocks.

In this economy only one variable matters right now and that variable is employment, said Lawrence Creatura, an equity portfolio manager at Federated Investors.

This report was great news. It was beyond all expectations, literally. The number was higher than even the highest forecast.

After three months of gains a decline seems the likely scenario. Again, almost all technical and sentiment measures have reached short to intermediate-term extremes, but will they win out for the bears or will the mighty power of the bulls push through the consolidation that has lasted nine long trading days?

Talented analyst Jason Goepfert of Sentimentrader.com recently stated that when “the S&P 500 closed at a six-month high with volume 10% off its low from the past month (as it did on Thursday), then the next two days were positive only 12 out of 46 times.”

Out of the 12 positive occurrences, only twice did it advance more than 1%. Thirteen times it closed with a loss greater than 1%.

Another interesting stat provided by Mr. Goepfert is “the last 8 Fridays when the Nonfarm Payroll report was released” all have closed lower than the prior trading day.

In fact, if you went back to September 2009 and purchased shares of the S&P and sold at the close of the trading day you would have only made a paltry 1%.

Couple the aforementioned studies with short-term overbought readings in three out of the four major indices and I expect to see a short-term pullback over the next 1-5 days.

The two best performing days (on a historical basis) in February are now behind us and now we are entering into a period of bearish seasonality.

Just more food for thought.

Trading Rules for New 5%-a-Week Strategy

Tuesday, December 27th, 2011

Today I will list the trading rules for the new strategy that has made an average 6.4% gain every week since we set it up in early December.

More importantly, we are repeating of our offer of becoming an Insider for the lowest price we have ever offered.

Trading Rules for New 5%-a-Week Strategy

Our goal is to make 5% a week. Admittedly, that sounds a little extreme. But we did it for the first 3 weeks we tried it in a real account. In fact, we gained an average of 6.4% after commissions.

We call it the STUDD Strategy . STUDD stands for Short Term Under-Intrinsic Double Diagonal. Hows that for a weird acronym?

Here are the Trading Rules:

1) Purchase an equal number of deep in-the-money (5 8 strikes from the stock price) puts and calls for an expiration month which has 3 to 7 weeks of remaining life.

2) At the same time, sell the same number of at-the-money or just out-of-the-money Weekly puts and calls.

3) Make the above purchases and sales at a net price which is less than the intrinsic value of the long options. (Intrinsic value is the difference between the strike prices. For example, we purchased IWM January-12 70 calls and 80 puts, and the intrinsic value of these two options will be at least $10 no matter where the stock ends up. We paid a net $9.46 for the initial spreads, and as long as the short options are out of the money, the long options will eventually be worth at least their intrinsic value of $10). Any out-of-the-money premium collected in subsequent weeks would be pure profit.

4) During the week, if either of the short Weekly options become over $1 in the money, buy them back and replace them with another short option which is 2 strikes higher or lower (depending on which way the stock has moved). Move both short Weekly options by 2 strikes in the same direction, one at a debit (buying a vertical spread) and one at a credit (selling a vertical spread). The net amount that the two trades cost will reduce the potential maximum gain for the week.

5) On the Friday when the Weeklys expire, buy back the short Weeklys and sell next-week Weeklys at the just out-of-the-money strike price for both puts and calls.

6) On the Friday when the original monthly options are due to expire, close out all the positions and start the process over with new positions.

There will invariably be some variations to these trading rules. For example, instead of selling just out-of-the-money Weekly options, we might sell some which are a dollar more than the just out-of-the-money strike. We also might close out the original monthly options a week before the final Friday if they can be sold for appreciably more than the intrinsic price (the more the stock has moved during the month, the higher above the intrinsic value the options will be able to be sold for).

This all may seem a little confusing right now, but if you decide to make a serious investment in your financial future, it will all become clear as you can watch how an actual portfolio (or two) unfolds using these trading rules for the next two months as a Terrys Tips Insider.

As our New Years gift to you, we are offering our service at the lowest price in the history of our company. We have never before offered a discount of this magnitude. If you ever considered becoming a Terrys Tips Insider. this would be the absolutely best time to do it.

So whats the investment? Im suggesting that you spend a small amount to get a copy of my 70-page (electronic) White Paper. and devote some serious early-2012 hours studying the material.

And now for the Special Offer If you make this investment in yourself by midnight, December 31, 2011. this is what happens:

For a one-time fee of only $39.95, you receive the White Paper (which normally costs $79.95 by itself), which explains my two favorite option strategies in detail, 20 Lazy Way companies with a minimum 100% gain in 2 years, mathematically guaranteed, if the stock stays flat or goes up, plus the following services :

1) Two free months of the Terrys Tips Stock Options Tutorial Program, (a $49.90 value). This consists of 14 individual electronic tutorials delivered one each day for two weeks, and weekly Saturday Reports which provide timely Market Reports, discussion of option strategies, updates and commentaries on 8 different actual option portfolios, and much more.

2) Emailed Trade Alerts . I will email you with any trades I make at the end of each trading day, so you can mirror them if you wish (or with our Premium Service, you will receive real-time Trade Alerts as they are made for even faster order placement or Auto-Trading with a broker). These Trade Alerts cover all 8 portfolios we conduct.

3) If you choose to continue after two free months of the Options Tutorial Program, do nothing, and youll be billed at our discounted rate of $19.95 per month (rather than the regular $24.95 rate).

4) Access to the Insiders Section of Terrys Tips. where you will find many valuable articles about option trading, and several months of recent Saturday Reports and Trade Alerts.

5) A FREE special report How We Made 100% on Apple in 2010-11 While AAPL Rose Only 25% .

With this one-time offer, you will receive all of these benefits for only $39.95, less than the price of the White Paper alone. I have never made an offer anything like this in the eleven years I have published Terrys Tips . But you must order by midnight on December 31, 2011. Click here and enter Special Code 2012 (or 2012P for Premium Service $79.95 ) in the box to the right.

Investing in yourself is the most responsible New Years Resolution you could make for 2012. I feel confident that this offer could be the best investment you ever make in yourself.

Happy New Year! I hope 2012 is your most prosperous ever. I look forward to helping you get 2012 started right by sharing this valuable investment information with you.

Terry

www.terrystips.com/track.php?tag=2012&dest=programs-and-pricing using Special Code 2012 (or 2012P for Premium Service $79.95 ).

Invest in Yourself in 2012 (at the Lowest Rate Ever)

Monday, December 26th, 2011

For the last few weeks I have been discussing a low-risk strategy that is designed to gain at least 5% each week. The actual account where we conduct that strategy managed to reach the goal once again last week (gaining 5.5%). So far, the portfolio is batting 1000 and averaging a 6.4% gain per week even though last week was a challenge because SPY rose almost 4% (the strategy works best when the market doesnt move very much in either direction).

Tomorrow I will disclose the Trading Rules for this unique strategy, but today I would like to discuss something far more important your financial future.

Invest in Yourself in 2012 (at the Lowest Rate Ever)

The presents are unwrapped. The New Year will be upon us in few days. Start it out right by doing something really good for yourself, and your loved ones.

The beginning of the year is a traditional time for resolutions and goal-setting. It is a perfect time to do some serious thinking about your financial future.

I believe that the best investment you can ever make is to invest in yourself, no matter what your financial situation might be. Learning a stock option investment strategy is a low-cost way to do just that.

As our New Years gift to you, we are offering our service at the lowest price in the history of our company. We have never before offered a discount of this magnitude. If you ever considered becoming a Terrys Tips Insider. this would be the absolutely best time to do it. Read on

Dont you owe it to yourself to learn a system that carries a very low risk and could make 5% a week as our actual portfolio has done since we started it?

So whats the investment? Im suggesting that you spend a small amount to get a copy of my 70-page (electronic) White Paper. and devote some serious early-2012 hours studying the material.

And now for the Special Offer If you make this investment in yourself by midnight, December 31, 2011. this is what happens:

For a one-time fee of only $39.95, you receive the White Paper (which normally costs $79.95 by itself), which explains my two favorite option strategies in detail, 20 Lazy Way companies with a minimum 100% gain in 2 years, mathematically guaranteed, if the stock stays flat or goes up, plus the following services :

1) Two free months of the Terrys Tips Stock Options Tutorial Program, (a $49.90 value). This consists of 14 individual electronic tutorials delivered one each day for two weeks, and weekly Saturday Reports which provide timely Market Reports, discussion of option strategies, updates and commentaries on 8 different actual option portfolios, and much more.

2) Emailed Trade Alerts . I will email you with any trades I make at the end of each trading day, so you can mirror them if you wish (or with our Premium Service, you will receive real-time Trade Alerts as they are made for even faster order placement or Auto-Trading with a broker). These Trade Alerts cover all 8 portfolios we conduct.

3) If you choose to continue after two free months of the Options Tutorial Program, do nothing, and youll be billed at our discounted rate of $19.95 per month (rather than the regular $24.95 rate).

4) Access to the Insiders Section of Terrys Tips. where you will find many valuable articles about option trading, and several months of recent Saturday Reports and Trade Alerts.

5) A FREE special report How We Made 100% on Apple in 2010-11 While AAPL Rose Only 25% .

With this one-time offer, you will receive all of these benefits for only $39.95, less than the price of the White Paper alone. I have never made an offer anything like this in the eleven years I have published Terrys Tips . But you must order by midnight on December 31, 2011. Click here and enter Special Code 2012 (or 2012P for Premium Service $79.95 ) in the box to the right.

Investing in yourself is the most responsible New Years Resolution you could make for 2012. I feel confident that this offer could be the best investment you ever make in yourself.

Happy New Year! I hope 2012 is your most prosperous ever. I look forward to helping you get 2012 started right by sharing this valuable investment information with you.

Terry

www.terrystips.com/track.php?tag=2012&dest=programs-and-pricing using Special Code 2012 (or 2012P for Premium Service $79.95 ).

Using Options to Hedge Market Risk

Monday, September 12th, 2011

Another crazy week in the market. Investors vacillated from panic to manic and back to panic. The net change for the week was not so significant, but the fluctuations were huge. How can you cope with a market like this?

You might consider using options to hedge against market moves in both directions. Check out how two of our portfolios are doing it.

Some Terrys Tips subscribers choose to mirror in their own accounts one or more of our actual portfolios (or have trades executed automatically for them by their broker). We recommend to that they select two portfolios, one of which does best in an up market and one that does best in a down market.

Almost all of our portfolios do best if not much of anything happens in the market, but that has not been the case in the last few weeks. It is during times like this that both a bullish and bearish portfolio be carried out at the same time.

We have one bearish portfolio. It is called the 10K Bear . It is currently worth about $5000 (although we have withdrawn $2000 from it to keep it at the $5000 level for new subscribers it had gone up in value by 54% over the last couple of months while the market was weak).

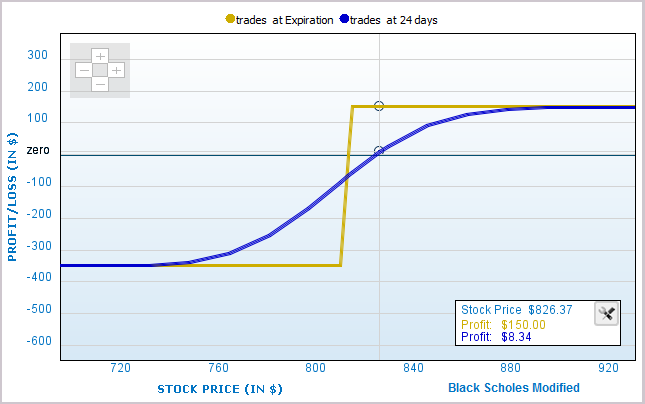

Here is the risk profile graph for the 10K Bear portfolio. It shows how much the $5000 portfolio should gain or lose by the regular September options expiration this Friday at the various possible ending prices for SPY (currently trading just under $116):

Using Options to Hedge Market Risk

Some Terrys Tips subscribers choose to mirror in their own accounts one or more of our actual portfolios (or have trades executed automatically for them by their broker). We recommend to that they select two portfolios, one of which does best in an up market and one that does best in a down market.

Almost all of our portfolios do best if not much of anything happens in the market, but that has not been the case in the last few weeks. It is during times like this that both a bullish and bearish portfolio be carried out at the same time.

We have one bearish portfolio. It is called the 10K Bear . It is currently worth about $5000 (although we have withdrawn $2000 from it to keep it at the $5000 level for new subscribers it had gone up in value by 54% over the last couple of months while the market was weak).

Here is the risk profile graph for the 10K Bear portfolio. It shows how much the $5000 portfolio should gain or lose by the regular September options expiration this Friday at the various possible ending prices for SPY (currently trading just under $116):

Remember, this is an actual brokerage account at thinkorswim which any paying Terrys Tips subscriber can duplicate if he or she wishes. The graph shows that if the stock stays absolutely flat next week, there could be a gain of over $1000 for the week. If the stock should fall by $2, an even higher gain should result. (Once the stock falls by $2, we would likely make some downside adjustments so that further drops in the stock price would generate higher gains. After all, this is our bearish bet.)

Where else could you expect a 20% gain if the market doesnt move one bit? In a single week? Or even more if the market should fall?

Admittedly, todays option prices are extremely high (in 92% of the weeks over the last 5 years, option prices have been lower than they are right now, so we are in truly unusual times). The risk profile graphs for our portfolios usually do not look as promising as they do right now.

One of the bullish portfolios that we recommend to be matched against the 10K Bear portfolio is called the Ultra Vixen . This portfolio is based on the underlying stock (actually an ETN, an exchange traded note) called VXX. This index is based on the short-term futures of VIX (the measure of SPY option prices, the so-called fear index). When the market drops, VIX generally rises (as do the VIX futures prices), and VXX usually moves higher. Over the last month while the market dropped over 10%, VXX has more than doubled in price. For that reason, many people consider VXX to be an excellent hedge against market crashes.

We dont like VXX as an investment possibility, however. Over time, due to a mechanism called contango (futures prices become more expensive in further-out months), VXX is destined to fall over time. It may be a good hedge as a short-term investment but is awful as a long-term holding. It fell for 12 consecutive months last year, for example, even though VIX fluctuated in both directions.

Our Ultra Vixen portfolio is set up to benefit when VXX goes down (which it does when the market is flat or goes up). We generally maintain a net short position on VXX with some call positions for protection in case the stock does go up. However, our portfolio does best if the market stays flat or moves higher, so it is a good hedge against the 10K Bear portfolio.

Here is the risk profile graph for Ultra Vixen for next Fridays expiration (September 16th). It is a $10,000 portfolio and the underlying stock (VXX) is trading about $45.83:

The graph shows that a 10% gain for the week is possible if the stock falls as much as $3 or goes up by as much as $2. (Historically, in about half the weeks, VXX fluctuates by less than a dollar in either direction.) Where else besides options do you find opportunities like this? In a single week?

Both the 10K Bear and Ultra Vixen portfolios should make excellent gains every week when the market is flat, and one or the other should make gains when the market moves more than moderately in either direction. Theoretically, if the two portfolios together break even in the high-fluctuation weeks and they both make gains when the market doesnt do much of anything, the long-run combined results should be extraordinary.

Some Thoughts About Options Trading

Tuesday, September 6th, 2011

Last week was a crazy one in the market four days of gains and then a big crash on Friday when the jobs report came out and said that there were no new jobs created last month, the worst showing in eleven months. It was a tough week for our portfolios (we generally hate volatility) but our bearish portfolio racked up a 5.5%, the seventh week in a row when it made gains. Over this period, this portfolio has picked up 58% in value while SPY has fallen by 8.8%.

This week I would like to share some of my thoughts about my favorite subject. Guess what it is?

I think the key to options trading success is the exact same key to stock trading success; the ability to pick stocks or ETFs that will perform exactly as you would like it to.

In stock trading, you make money only when you buy stocks that go up or short stocks that go down.

In options trading, you make money when you apply bullish options strategies on stocks that go up, bearish options strategies on stocks that go down, neutral options strategies on stocks that remain stagnant or volatile options strategies on stocks that stage quick and explosive breakouts.

You only lose money in options trading when you apply bullish options strategies on stocks that goes down, bearish options strategies on stocks that go up, neutral options strategies on stocks that breaks out and volatile options strategies on stocks that remain stagnant.

Even though the key to success in options trading is largely the same as the key to success in stock trading or any other forms of investment or trading, options trading does have a few tricks up its sleeves to help put the odds in your favor.

First of all is leverage and protection. The ability to risk lesser capital for the same profit or a lot more profit with the same capital already puts the benefit of risk in your favor.

Second is the ability to make a profit in more than one direction! Yes, since the key to success in options trading is the ability to guess the correct direction the underlying stock or index is going to take, wont your chances of success be dramatically increased if you could profit in more than one direction?

For example, the 10K Strategy which we employ at Terrys Tips (a strategy using calendar spreads at several different strike prices) makes a profit when the stock goes upwards, remains stagnant OR drops a little! Yes, all 3 directions. Wont your chances of success be dramatically increased with a strategy like that?

The key to stock investing is to pick the right stock(s). Almost no one, even the professionals can do that consistently. That is why options trading increases the odds of success in your favor if you use a strategy that profits from more than one direction. This is a huge advantage that you do not get when you invest in stock it only exists in option trading.

Some Thoughts About Options Trading

Friday, July 1st, 2011

I think the key to options trading success is the exact same key to stock trading success; the ability to pick stocks or ETFs that will perform exactly as you would like it to.

In stock trading, you make money only when you buy stocks that go up or short stocks that go down.

In options trading, you make money when you apply bullish options strategies on stocks that go up, bearish options strategies on stocks that go down, neutral options strategies on stocks that remain stagnant or volatile options strategies on stocks that stage quick and explosive breakouts.

You only lose money in options trading when you apply bullish options strategies on stocks that goes down, bearish options strategies on stocks that go up, neutral options strategies on stocks that breaks out and volatile options strategies on stocks that remain stagnant.

Even though the key to success in options trading is largely the same as the key to success in stock trading or any other forms of investment or trading, options trading does have a few tricks up its sleeves to help put the odds in your favor.

First of all is leverage and protection. The ability to risk lesser capital for the same profit or a lot more profit with the same capital already puts the benefit of risk in your favor.

Second is the ability to make a profit in more than one direction! Yes, since the key to success in options trading is the ability to guess the correct direction the underlying stock or index is going to take, wont your chances of success be dramatically increased if you could profit in more than one direction?

For example, the strategy which we employ at Terrys Tips (a strategy using calendar spreads at several different strike prices) makes a profit when the stock goes upwards, remains stagnant OR drops a little! Yes, all 3 directions. Wont your chances of success be dramatically increased with a strategy like that?

The key to stock investing is to pick the right stock(s). Almost no one, even the professionals can do that consistently. That is why options trading increases the odds of success in your favor if you use a strategy that profits from more than one direction. This is a huge advantage that you do not get when you invest in stock it only exists in option trading.

For the past year, we have been carrying out a demonstration options portfolio on one individual stock. Our favorite months are those when the stock stays absolutely flat and our portfolio gains value. This portfolio has consistently out-performed the gains that would have been made if we had just bought shares of the stock instead. In several time periods, our portfolio gained three times as much as the stock price did. Properly executed, options trading can be far more profitable the merely buying stock.