Bullish Option Strategies

Post on: 9 Август, 2015 No Comment

A guide to option strategies that fit either bullish or bearish outlooks.

Due to the growth of online stock trading. smaller investors have seen increased accessibility to the markets. This is due to lower commissions and transaction costs. In addition to buying stocks, online traders have gotten more involved in the options markets, which can be responsive and dynamic. For the investor, the advent of online options trading like that at TradeKing, has created a convenient online approach, with fewer barriers to entry. These include providing extensive options education and lower cost options trades. Access to in-depth options education may help traders choosefind appropriate option trades for any market outlook or environment.

These trading environments can be largely categorized as bearish, bullish, neutral or volatile. As such, options trading strategies usually fall within these four groups. Examples of bullish and bearish strategies are set out below.

Bullish Option Strategies

Bullish strategies are used when the online trader forecasts an increase in a security’s price. In options trading this security may be referred to as the underlying or simply the stock. The basic concept behind bullish options strategies is for these trades to result in a gain if the trader’s forecast of the underlying is correct. If the trader’s projections did not come to fruition in the prescribed time, the option trade may result in a loss.

Examples of Bullish Option Strategies

The most basic of all bullish strategies is simply buying the stock online. If the stock rises in price higher than the online trader’s cost, the trader will realize a gain. If the stock declines, the trader will realize a loss. However, an online trader may not have enough capital to buy 100 shares of a stock.

One alternative to buying the shares is to buy a call option online for that stock. A call option provides the buyer the right to buy the underlying shares (usually 100 per contract) at a pre-negotiated price on or before a specific date. Simply speaking the idea is if the stock increases in price, the call option’s price may increase as well, therefore allowing the online option trader to profit with a bullish option trading strategy. If the call option’s price increases above the amount paid, the online trader will realize a profit. However, it is possible for the call option to lose value and the trader to incur a loss. Some reasons include the passage of too much time, a decline in the corresponding equity’s price, or other factors. If this happens, the online option trader may lose a portion of or the entire amount of the call option’s value. Although this outcome is not desirable, the online option trader cannot lose more than the initial investment paid for the call option.

Buying a Protective Put

If an online stock trader owns or is long 100 shares of a stock, the trader may decide to protect this investment during times of market uncertainty or increased market volatility. If the online trader’s longer term outlook is bullish, one option trading strategy would be to buy a put option online in order to hedge or protect the long stock position. The buyer of the put option obtains the right to sell the individual equity shares (usually 100 per contract) at a predetermined price on or before a certain date. This means if the stock declines in value, the put buyer has the right to sell the shares potentially for an amount higher than the current stock price. The put option acts like a home insurance policy. You hope you never need to use it, but it’s nice to know you have it. This comes at a price, known as the option premium. Even though the asset is now insured there is no limit to the upside profitability of the stock if the stock increases by more than the cost of the put option. If the stock stagnates or only increases slightly, the purchase of the put option may not have been necessary in hindsight. The trader would then incur a loss on the put trade.

Bearish Strategies

Bearish strategies are employed if an online trader foresees a decline in a stock’s value. Bearish online options trading strategies are used when the trader aims to take advantage of a decrease in the underlying asset’s price. This may then cause the options trading strategy to realize a gain. If the trader’s forecast is incorrect, the option strategy could net a trading loss.

Examples of Bearish Strategies

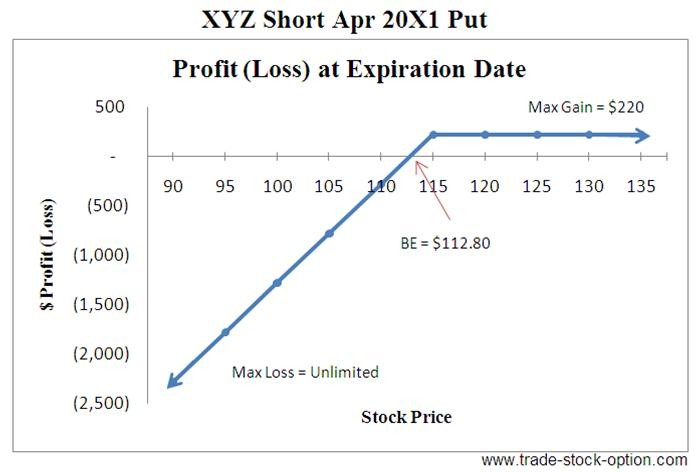

The first bearish strategy most online traders learn is how to sell a stock short online. This bearish trading strategy becomes profitable if the stock declines in price lower than the online trader’s sell short price. Then the stock trader buys back the shares that he was short and closes out the short stock position. If the stock increases in price, the short seller incrementally incurs losses as the stock rises in price. Because there is no limit on how high a stock may rise, short selling may result in unlimited losses.

Buying a Put Option

If an online trader has the same market outlook as a short seller, but wishes to employ a trading strategy with lower and predefined risks, a trader may wish to purchase a put option online. Note that unlike the Protective Put strategy, the trader does not own the underlying stock.

As explained above, the buyer of a put option has the right to sell shares of the stock (usually 100 per contract) at a fixed price on or before the expiration of the put option contract. If the stock decreases, the put option may become more valuable as the stock trades lower and lower in price. This increase in the put option’s value allows the online option trader to then sell his put option for more than he paid, netting a profit. Trades don’t always turn out as planned and the same is true for buying put options online. This bearish trading strategy may lose money if the put price declines in value. One reason this may occur is if the stock movement is opposite to the trader’s forecast and actually increases. Another reason maybe too much time has passed or other factors. However, the trader’s loss is limited to the cost paid for the put option.

Naturally, online options trading strategies aren’t all black and white — there are numerous shades of grey when it comes to identifying a suitable approach. Indeed different trading scenarios will require a different approach to investment. In fact, some of the more successful trading approaches are more market neutral strategies than those classified as strongly bullish or bearish. Market neutral option trading strategies attempt to take advantage of a stock that is expected to be range bound or stagnant in price over a period of time. Although any price movement is possible, it’s unlikely that a stock will move severely in either direction during orderly trading conditions.

There are times however that an online options trader foresees increased volatility in a certain stock. It is then that the options trader would construct an online options trading strategy to maximize his exposure to increased implied volatility in options. Increases in implied volatility infer that the stock has a greater propensity to move either up or down. The trader uses certain strategies to make a profit if the stock makes an extreme price move. If the stock stagnates or implied volatility decreases, the trader may incur a loss.

The successful implementation of any online options trading strategy is dependent on building a strong understanding of the underlying stock, and as a result research is of paramount importance. Online options trading platforms such as TradeKing’s provide access to invaluable market data and statistics, which play a fundamental role in establishing which strategy to employ in a given scenario.

By adopting a flexible approach to your online options trading, and absorbing relevant trend data in relation to both the underlying asset and the wider market, an investor may improve the effectiveness of his chosen investment strategy, with a view to potentially realizing a greater proportion of successful trades.

Open a TradeKing Account Today

TradeKing is an online broker with a simple mission: we want to help investors like you become smarter, more empowered stock and options traders. At TradeKing we offer the same fair and simple price to all our clients — just $4.95 per trade, plus 65 cents per option contract. You’ll trade at that price, no matter how often you trade, or how big or small your account may be.