Bull Put Spreads 3 Targeting Monthly Income

Post on: 6 Июнь, 2015 No Comment

This is the fifth and final article in a series on vertical options spreads and the third of three specifically on bull put spreads. Vertical spreads are an intermediate-level options strategy with a wide variety of uses. Traders who use vertical spreads must first understand the strategy mechanics, i.e. what happens at expiration. Second, it is necessary to understand the nuances of the price behavior of vertical spreads prior to expiration, and, third, a two-step plan for trading a vertical spread is an important part of using vertical spreads successfully.

Bull Put Spread Reviewed

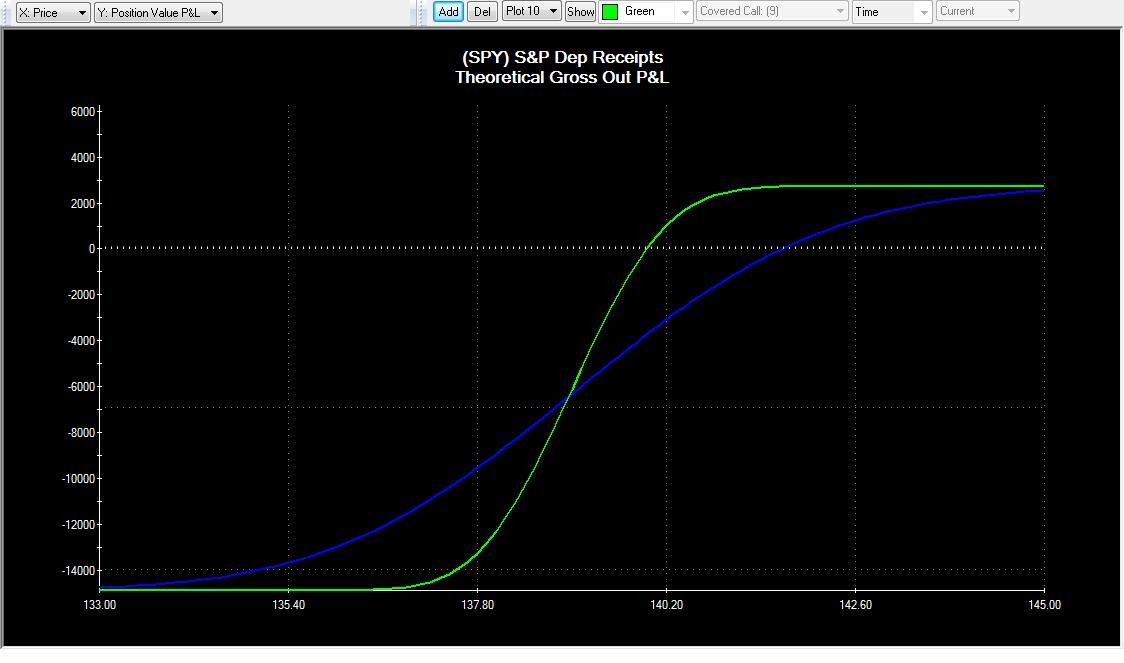

The sale of one put and simultaneous purchase of a second put with the same underlying and same expiration but with a lower strike price is known as a bull put spread. Graph 1 illustrates a Bull Put Spread in which one XYZ 50 Put is sold for 1.70, and one XYZ 45 Put is purchased for 0.60.

Bull Put Spreads as a Trading Strategy

As the following example describes, the bull put spread strategy is suited for investors who seek to add monthly income and limited risk at the same time.

Gary is an aggressive investor who wants to increase his monthly income and is willing to accept a moderate amount of risk if that risk is truly limited. Gary follows several stocks, and when he believes that a stock is either in an uptrend or near the lower end of a trading range, he will trade out-of-the-money bull put spreads in an attempt to earn 5% in a month on the capital he places at risk. Let’s follow Gary as he makes this month’s trade.

XYZ is one of the stocks that Gary follows. It is currently trading at $88, which, in Gary’s opinion, is near the low end of a bullish channel. Gary feels that there is little risk of XYZ declining to $80 between now and April expiration, which is 23 days away. He, therefore, establishes the XYZ April 75-80 bull put spread by selling one XYZ April 80 Put at 0.90 (90 cents) and, simultaneously, purchasing one XYZ April 75 Put for 0.60 (60 cents).

The resulting bull put spread is established for a net credit of 0.30 (30 cents) per share, or $30 per spread, before commissions. $30 is also the maximum profit potential. The amount of capital at risk and the margin deposit required is $470 per spread. The maximum risk of a bull put spread is the difference between the strike prices less the net credit received, not including commissions. Since 30/470 is approximately 0.06, or 6%, this spread meets Gary’s target of 5% potential profit on capital at risk in one month.