Bull Put Spread How to Video

Post on: 13 Апрель, 2015 No Comment

Short or Bull Put Spread

Hello, my name is Brian Overby. I am the Senior Options Analyst at TradeKing, and author of The Options Playbook. Today we’d like to highlight one of the plays inside the Playbook called bull put spreads, sometimes known as short put spreads, and also as short vertical spreads. Inside The Options Playbook the convention is that we would call it a short put spread, so I’m going to stick with that convention today.

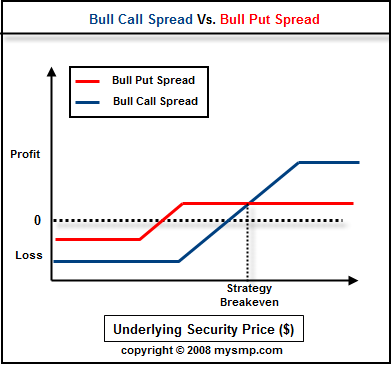

Bottom line is if I am doing a short put spread. my forecast on the underlying stock is that I am bullish, I either want the marketplace to go up, or I usually want the marketplace to stay right where it is. My whole goal is that it doesn’t go below the put that I have sold. So let’s walk through a scenario here.

Let’s say we have an underlying stock that’s trading at $73. We’re going to go out, and in this instance we’ll just use a two-month option contract, just to look at a specific expiration. Obviously the expiration that you want to choose is going to depend on your forecast, but just to make things simple we’ll look at a two-month option contract. That basically means it expires in 60 days.

The underlying stock, like I said, is at 73. A short put spread means that we’re going to sell the 70 put and then go out and hedge that position, because there’s a lot of risk that’s involved, and we’ll talk about that, and buy the 65 put which is one strike below that 70 strike. So, the main focus of a short put spread is that we want to receive as much credit as possible for selling that put, and that credit that we receive is the main factor in the gain on the position. So the short put is really the one that we’re going to focus on here.

If I sold the put option at 70, the underlying stock’s at 73, my goal here is that the underlying stock continues on up, or just doesn’t come down below the 70 strike. If it goes down to 69, they can actually take the stock at 69 and put it to me at 70, hence, the name put, that’s where that name comes from. But if the stock continues on up there’s not going to be any benefit to doing that. Stock goes to 75, 76, 77, or it stays at 73, the benefit to be able to go out on the marketplace and sell it at 73, as opposed to putting it to me at 70, in that situation means that I will not have to make good on my obligation.

So just selling a put outright, in general, my maximum loss on that position is—that stock could go all the way down to zero, theoretically, and they could take the stock at zero and put it to me up at 70. So that’s a lot of risk from just selling a put outright. So what will a lot of people do? They will do a short put spread and they’ll say, okay, I’m taking on that obligation to buy the stock at 70, but that’s too much risk for me. What I’m going to do is then hedge my position and buy a put that’s a little bit lower cost but helps me stop the pain, if you will, if the underlying stock keeps moving down.

So in this instance if the stock goes down, let’s say it’s down at 20, 30, $35, somewhere in there, they can take that stock, whoever is on the other side of my short put, and put it to me at 70, but then I say, hey, wait a minute, and I exercise my right and put it to someone else at 65. Hence, my maximum risk if I do a short put spread is the difference between the strikes, 5 points, minus the net credit received.

Now, the downside here is that if I just sold the put outright I could get more of that credit, because I’m not using any of that credit to help pay for my “hedge” so I use a little bit of that money to protect myself in case the worst case scenario happens. So if you ever thought about just selling a put as a neutral to bullish strategy, doing a short put spread as an alternative brings in a little bit less credit, but it does hedge the potential loss, or fixate the potential loss that you can have on the position.

I must also say that if you’re looking to do a multiple leg strategy, sell one put, buy one put, there are increased commissions that are involved with it, and also there might be complex tax treatments so you might want to think of that. But this is a great alternative to just selling a put outright.

My name is Brian Overby. I am the Senior Options Analyst at TradeKing, and author of The Options Playbook. If you’d like to learn more about investing, please check out our education center on tradeking.com, the companion website for my book, optionsplaybook.com, and our Trader Network, where investors connect to share ideas and strategies for trading stocks, options and more.