Building An ETF Portfolio

Post on: 29 Март, 2015 No Comment

Regular readers of this blog are aware that we recently sold my wifes expensive mutual fund holdings a couple of weeks ago. This has been long time coming and we finally got the funds transferred to a discount brokerage. Now comes the part of picking the ETFs. This article captures the exercise of building an ETF portfolio. Hope it helps you in your decision if you decide to go the route of passive investing.

The overall strategy remains as I mentioned earlier: my wifes portfolio will use index funds via ETFs to invest in the broad markets using some rules of thumb in mind as discussed below. My portfolio will continue investing in more focused dividend growth stocks.

Goals

The goals of this portfolio are:

- Passivity: We will be taking a more passive approach of investing in this portfolio and using broad index funds to gain exposure to the markets. Instead of stock picking, we will be tying our portfolio directly to the markets. This way, we will not be making bets on one company vs another. We will be going with the flow and moving with the markets.

- Simplicity: We want this portfolio to be simple. I want my wife to maintain this portfolio and should be easy to understand.

- Diversification: We want the funds to be diversified across markets and asset classes. This is a very important factor for us as discussed earlier.

- For asset class diversification, we will be splitting the portfolio into stocks and bonds, keeping some basic investing rules of thumb in mind such as: between stocks and bonds each asset class will make up a minimum of 25% and maximum of 75%.

- For the equities (stock) portion, we will have some decent exposure to the local market (Canada), but a bigger portion will be outside Canada, with a big part of it invested in the US market.

- For the fixed income (bond) portion, we will be using only Canadian bonds.

- Expense Check: One of the main reasons to sell the mutual funds was to cut down on the high expense fees. While most index ETFs are cheaper than mutual funds, there are still some ETFs with high fees of over 1%. We will be avoiding such funds and keeping the expenses under check.

- Dollar Cost Averaging: We will not be making lump sum investing and will be dollar cost averaging in order to avoid timing the market. This works for us as our discount brokerage provides us with free ETF purchases (except the ECN fees, which adds up to a few cents per trade) and does not add any more added expenses.

The Portfolio

Passive investing is supposed to be simple and easy, but there are a plethora of index funds out there, with new funds added regularly. This makes life a bit harder in trying to compare, but some bloggers and reporters have put together simple portfolios which I really like.

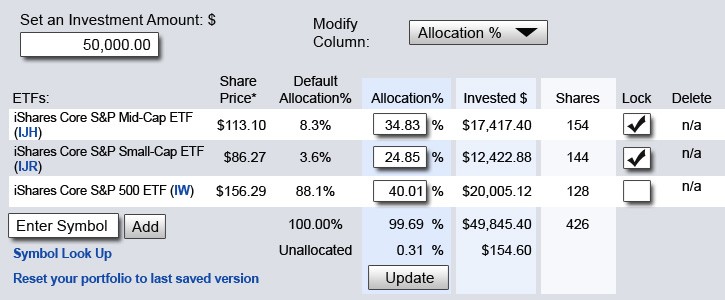

Rob Carrick is a personal finance columnist at The Globe And Mail and has put together the following set of data for Canadian passive investors: ETF Buyers Guide Canadian Equity. US Equity. Bond ETFs. Income-Paying ETFs . Canadian Couch Potato blogger Dan Bortolotti and PWL Capitals Justin Bender write extensively about passive investing both on their blogs and the Money Sense magazine and have model portfolios here and here . The Vanguard ETFs put together by CCP caught my eye, which consisted only of three funds.

Source: Canadian Couch Potato

After reviewing the details and discussing with my wife (based on her risk tolerance), we have decided to go with a more Balanced approach, which consists approximately of 40% in bonds, 20% in Canadian stocks and 40% in International stocks.

The Funds

We have decided to go with the three fund approach (for now) thanks to the availability of the Vanguard ex-Canada fund instead of buying a US-focused ETF and a different one for international stocks. Choosing the actual funds for the others came with some dilemma.

- Canadian Equity: Here, we had a dilemma between a few different funds shortlist included

- Vanguard FTSE Canada All Cap Index ETF (VCN.TO)

- BMO S&P/TSX Capped Composite Index ETF (ZCN.TO) and

- iShares S&P/TSX Index ETF (XIU.TO)

The MERs range from 0.05% to 0.17%. After looking through the details, we discarded XIU.TO as it is expensive and a very thin ETF (with just 62 holdings) even though it has the heaviest volume on the market compared to others. Between VCN.TO and ZCN.TO, it was a close call they both have similar number of holdings (252 in ZCN vs. 247 VCN) and have same MER fees. We eventually decided to go with the BMO S&P/TSX Capped Composite Index ETF (ZCN.TO) as it has a better diversification and higher yield.

- International Equity: We will use the Vanguard FTSE All-World ex-Canada Index ETF (VXC.TO) for this portion. It was an easy decision as it is a one of kind product. We flirted with the idea of using a mix of two funds for international exposure one specific to US and other for the rest, but this one product covers the whole international market. The fund consists of stocks investing in over 3000 companies with just over 50% of its holdings in the US. The fund has an MER of 0.25%. Details here . Canadian Fixed Income: Again, we had a bit of dilemma to pick the right ETF. We discarded ETFs which invested only in corporate bond market since we wanted a mix of federal, provincial and corporate bonds in the holdings. We narrowed it to the following three.

- Vanguard Canadian Aggregate Bond Index ETF (VAB.TO)

- BMO Aggregate Bond Index ETF (ZAG.TO)

- iShares DEX Universe Bond Index ETF (XBB.TO)

MER fees range from 0.12% to 0.33%. The average duration of the bonds are almost identical hovering around 7.4 to 7.6 years. The yield ranges are 2.7% (VAB), 3.1% (ZAG) and 2.9% (XBB). Number of holdings are 539 (VAB), 608 (ZAG), and 844 (XBB). Based on all consideration, we decided to go with the BMO Aggregate Bond Index ETF (ZAG.TO) as it has fairly decent MER (0.20%), good diversified portfolio of holdings and a good yield.

We will be starting to add funds to work for us later this month and make regular contributions every month.

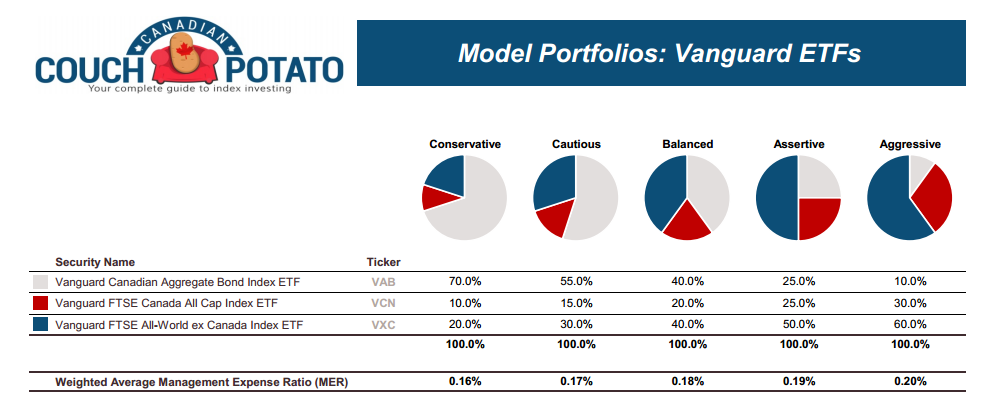

After evaluating options available in the market, we have decided to make a three-ETF portfolio for my wifes account based on all the goals discussed above. The three funds chosen are summarized below.