Building a Growth Portfolio Using ETFS

Post on: 16 Март, 2015 No Comment

The flexibility and diversification potential of ETFS are very important benefits for individual investors who want to step up their investing potential. For a serious individual investor building a portfolio for growth may not be as difficult as it could have been years ago. We bring to perspective the core considerations involved in building a growth portfolio with ETFS.

Growth Portfolios are typically built using ETFS that focus on companies that are showing respectable growth potential now. These companies will be growing in the present rather than in the future. For example, in the last few years, Apple has been a classic growth stock. Portfolios that combine many such stocks are branded as Growth Portfolios.

Type of Growth Portfolio

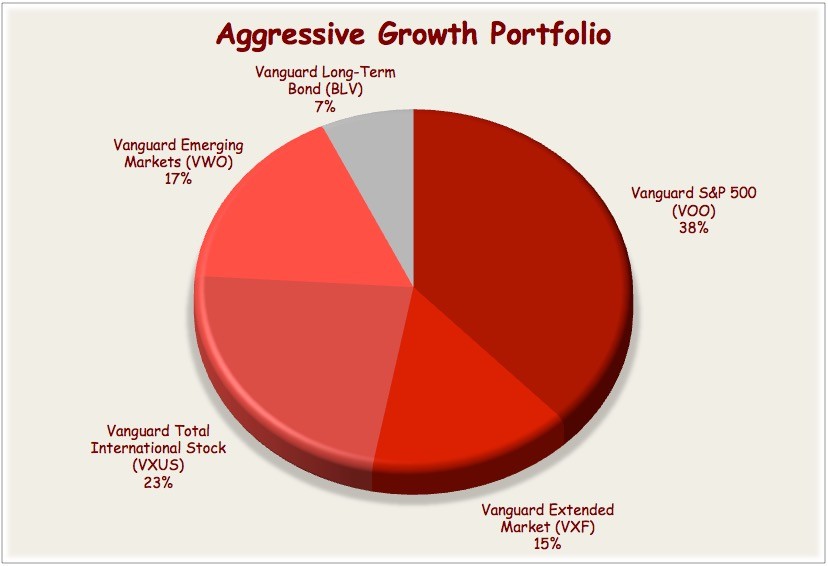

Growth Portfolios come in various flavors. We have Balanced Growth , Aggressive Growth portfolios each constructed slightly different. Within these larger categories, we have sub categories associated with the capitalization of the securities. We have Large Cap , Mid Cap. and Small Cap portfolios each focusing on a specific niche of companies. Choosing the type of growth portfolio is directly linked to risk profile and risk aversion of the individual investor. A typical, moderately risk averse investor may lean toward Large Cap Growth. Another investor who has the stomach for experiencing more volatility may like Small Cap Growth. Others, may prefer a mix of all these three capitalization blends.

Decide Regional Mix

This is an important consideration for the individual investor now that faster growth is occuring in economies outside of the US. Not all regions are constructed alike. Here again the investor can opt for a wider or narrower regional mix. For instance, IJK focuses on S&P 400 Mid Cap Growth Stocks and EMGX focus on Emerging Market Growth stocks. Just these 2 ETFs can provide an investor a tremendous exposure to a variety of growth stocks.

Capital Outlay

The next decision the individual investor has to make is to decide on the capital outlay. If only a small amount of capital is available, for example, the money should not be spread across too many ETFS. Instead, a carefully selected smaller but diversified set of ETFS may be more effective. Investors must remember that a single broad index based equity ETF offers instant diversification. For example, investing in SPY gives the instant diversification of investing in the entire basket of the S&P 500 index.

Deciding the Allocation Mix

The key to building a growth portfolio is to get the allocation mix working in the individual investors favor. For example, with Europe going through so much uncertainty now, allocating a growth portfolio focusing on Europe may not be a profitable growth portfolio allocation strategy. If, for example, the individual investor is seeing the relative strength of China, Brazil, and US Small Cap Growth ETFS improving when compared to other growth ETFS, they can bundle

Periodic Review

This is an important factor that cannot be overlooked. After setting up the initial allocation mix, an individual investor cannot afford to just let go and let the portfolio be in the same state for a longer period. At least once in 6 months or an year, the growth portfolio has to be revisited and adjustments have to be made after considering the prevalent conditions.

Careful consideration of the above factors may help an individual investor build an effective growth oriented portfolio for the long term.