Building A Core Investment Portfolio For The Next 20 Years Gold

Post on: 14 Апрель, 2016 No Comment

Summary

- A 5%-10% weighting toward gold in a portfolio hedges against market weakness.

- Gold has historically shown it is a safe haven for wealth during times political and economic instability.

- Hedging a portfolio with a small weighting toward gold can allow investors to opportunistically take advantage of drastic market sell-offs.

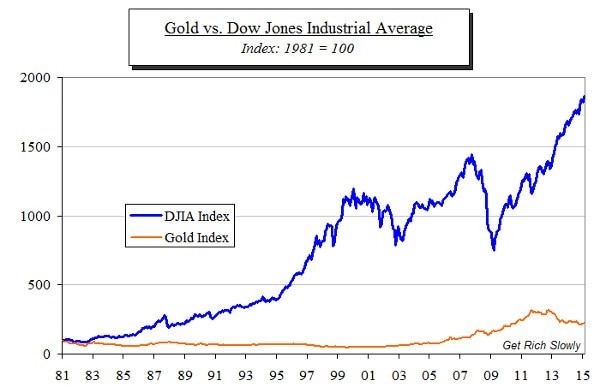

The seventh article in this series exploring stocks and ideas to build a core investment portfolio will take a slight twist. This article won’t focus on one stock as a core holding, but rather one idea to hedge your portfolio against market weakness and recessions over the long-term. Gold as an investment is one of the most difficult assets to forecast, predict and understand. Investors hold gold for a variety of reasons including as a hedge against inflation and as a hedge against a declining dollar. However, I believe gold belongs in every investment portfolio as a hedge against economic and political turmoil. During recessions or extreme market weakness, even the best stocks will see substantial declines, but gold holds up remarkably well, making it a great hedge to help protect your portfolio. Over the next 20 years, another substantial economic recession is all but guaranteed. No one can predict when or how it will happen, but recessions are part of the economic cycle and investors should have a plan in place.

The recession of 2008-2009 is a painful memory of how far stocks can fall in a very short time period. In just over 12 months, the S&P 500 dropped roughly 50%. This dramatic decline wiped out retirement portfolios of very astute investors. While a 5%-10% allocation to gold wouldn’t save an entire portfolio, it does give investors options. When you see a large decline in the value of your portfolio, the last thing you want to do is have to sell your investment on substantial loses. Life changing events that require large unexpected financial sums don’t care what the market has done over the past year, and can further devastate a portfolio if they pop up during a recession. Having a virtually recession proof core holding can allow investors to take out funds from a holding that has maintained its value when all other holdings are down. Another positive is being able to take advantage of gold’s stability, by using these funds to buy in close to a market bottom. This gives the patient investor the ability to take advantage of the most basic, but powerful investing philosophy. Buy low and sell high. Had an investor taken their 5% allocation in gold to buy the S&P 500 index close to the market lows in 2009, they would nearly tripled their investment (assuming an early 2009 buy-in date).

Ways to invest in gold

There are several ways to invest in gold and determining which strategy is up to the individual investor. I’ll briefly outline 3 basic options for investors to add gold as a core holding. First, investors can go out and buy physical gold. Second, investors can invest in a gold ETF through a brokerage account. Third, investors can buy individual gold miners.

Physical Gold

The obvious advantage of holding physical gold, is the physical value of the asset. Investors are able to hold and physically store gold coins/bars and not need to rely on trusting that a gold ETF will accurately track the real value. The downside are transaction costs and the cost of storing the commodity. Buying and selling physical gold generally comes with a small transaction fee where the buyer takes small percentage of the value off the top. In order to safely hold gold, investors must also properly secure their asset. Whether it’s in a bank deposit box or a home safe, investors must be prepared to spend money to safely secure their physical gold.

Gold ETFs

The easiest way for investors to establish a position in gold in their core portfolio is through a gold ETF. SPDR Gold Shares Trust (NYSEARCA:GLD ) and iShares Comex Gold Trust (NYSEARCA:IAU ) are two popular ETFs that track the value of gold while offering low expense ratios. These ETFs track the price of gold by holding bullion. For the average risk adverse investor, gold ETFs are the simplest and easiest way to allocate a portion of your portfolio to gold.

Gold Miners

Another option to have a weighting toward gold in a portfolio is through gold miners. When looking for a quality gold miner, investors should look at two key elements: cost of production and total debt. Cost of production is the level at which a miner can produce gold at a profit. This number varies significantly among gold miners, but generally within a range from $900-$1300/oz. Another element that can vary significantly is a company’s debt level. Gold mining is a tremendously capital intensive job and high debt burdens can significantly hinder a company. For example, Barrick Gold (NYSE:ABX ) has roughly $13 billion in debt compared to Randgold Resources (NASDAQ:GOLD ), which has essentially zero debt. As with any industry, gold miners aren’t created equal so investors need to do their due diligence before selecting a gold miner, if that’s the route in which they plan to hold gold. Two good choices are Goldcorp (NYSE:GG ) and Randgold Resources. Both of these companies have low all-in production costs and low levels of debt. In addition, an added benefit of gold miners is that many pay a dividend. Goldcorp stands out in this area with a forward dividend yield of 3.1%.

Conclusion

Whether investors want to sleep better at night or opportunistically use gold assets to buy stocks during market sell-offs, gold deserves a spot as a core holding. There are a variety of ways to accomplish this, but gold ETFs may offer the easiest solution for the average investor. I have no idea where gold will be in 1 year or 10 years, but it is historically viewed as a safe haven during times of intense political and economic unrest that can provide a degree of stability to any portfolio.

Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More. ) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.