Build a HighYield Portfolio

Post on: 2 Июнь, 2015 No Comment

Buy 10 to 15 high-yielding large-cap stocks today and hold them — forever.

Yes, you read that right

That’s the basic philosophy of the High-Yield Portfolio (HYP) strategy put forth by our friends at Motley Fool U.K. back in 2000.

At first glance, the whole idea sounds a bit crazy. I mean, buying stocks with the intention of never selling them comes off as, well, perhaps a bit naive.

After a closer look, though, the HYP strategy offers some distinct advantages.

But first, let’s take that closer look

So how does the HYP strategy choose its 10 to 15 stocks? It chooses only:

- Large-cap stocks,

- With a history of increasing dividends,

- Relatively low debt levels, and

- Sufficient dividend coverage,

- That hail from diverse industries.

The original UK HYP, for example, picked 15 stocks from the FTSE 100 index, including Rio Tinto and Scottish & Newcastle.

The only permissible reasons to sell or remove a stock from the HYP portfolio are (1) the dividend is halted or cut, or (2) the company is acquired.

All about growth

Like other dividend-focused investing, the HYP strategy relies on the power of dividends to strengthen overall returns. Dividends, after all, have made up more than a third of the S&P 500’s return since 1926.

But what sets the HYP strategy apart is its focus on growing dividends. By buying companies with a history of raising their dividend payouts, you’re betting that they’ll continue to raise those payouts — providing you with an ever-increasing income stream.

The point of the HYP isn’t capital appreciation, although that’s usually an added bonus. The HYP is all about those growing dividends, aiming to provide an annual income that exceeds that of the current 10-year Treasury note (currently yielding 3.6%).

Best of all, that income is flexible. Investors far from retirement can reinvest the dividends to increase their holdings, thus multiplying their payouts. Investors close to or in retirement can use the payouts as income that supports their standard of living. But because the income grows. it has the potential to beat inflation. And when you add that to the capital appreciation, you can end up sitting on a pretty penny.

OK, but do you really mean never sell?

Now, this idea of intentionally not selling seems counterintuitive. At some point, perhaps when the stock has reached our price target, doesn’t it make sense to sell and take the capital gain?

According to the HYP’s original author, Stephen Bland, the strategy demands a different perspective:

High yield portfolio (HYP) shares are not bought with the intention of selling. Quite the reverse. They are bought to hold for income and continue to be held until such time as it might very occasionally suit the investor to sell, perhaps never. Selling is not the reason for buying, unlike value trading, where selling is the only reason for buying.

It takes some getting used to, but this passive approach prevents you from overtrading and making poor valuation decisions — while simultaneously providing you with a growing income. Best of all? You don’t have to worry about daily market fluctuations.

Between November 2000, when the original HYP was started near the height of the U.K. market, and December 2007, it returned 68% capital appreciation without dividend reinvestment (while the FTSE 100 lost 8.3%), and included a 5.9% annual dividend yield to boot. What’s more, the dividends grew 29% in just seven years.

Now for the U.S. version

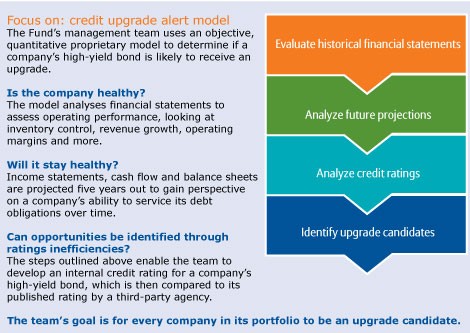

So what would a current U.S. version of the HYP portfolio look like? To compile the list below, I followed the HYP methodology and selected a diverse group of 15 S&P 500 stocks:

- Capitalized at more than $10 billion,

- With a strong history of increasing dividends,

- An above-market dividend yield,

- And sufficient ability to service current debt.

Here are a few of those stocks.