Build A Dividend Portfolio That Grows With You

Post on: 20 Апрель, 2015 No Comment

In investing, knowledge is power. To paraphrase Ben Graham’s investment advice, you should strive to know what you are doing and why. If you don’t understand the game, don’t play it. Stay away until you do.

If you are considering building a portfolio for income, this article will help guide you toward success, which means getting portfolio income that provides for your financial needs long after you’ve stopped working. We’re not proposing a get-rich-quick plan. In fact, we’re saying the best investments come with patience and common sense.

The Scourge of Inflation

Inflation and market risk are two of the main risks that must be weighed against each other in investing. Investors are always subjecting themselves to both, in varying amounts depending on their portfolio mix. This is at the heart of the dilemma faced by income investors: finding income without excessive risk.

At 5%, a $1-million bond portfolio will provide an investor with a $50,000 annual income stream and will protect the investor from market risk. In 12 years, however, the investor will only have about $35,000 of buying power in today’s dollars assuming, a 3% inflation rate. Add in a 30% tax rate and that $50,000 of pre-tax and pre-inflation adjusted income turns into just under $25,000.

Is that enough for you to live on? Welcome to the scourge of inflation.

Why Dividends?

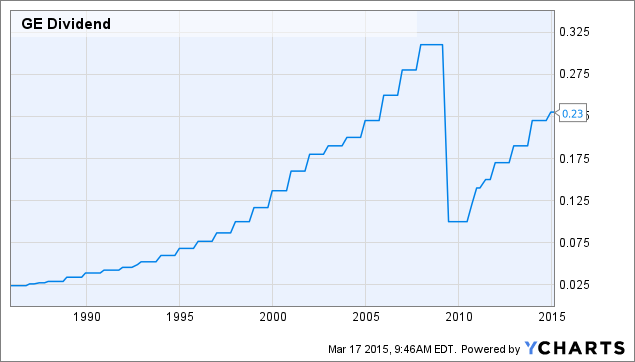

An equity portfolio has its own set of risks: non-guaranteed dividends and economic risks. Suppose that instead of investing in a portfolio of bonds, as in the previous example, you invested in healthy dividend-paying equities with a 4% yield. These equities should grow their dividend payout at least 3% annually, which would cover the inflation rate, and would likely grow at 5% annually through those same 12 years. If the latter happened, the $50,000-income stream would grow to almost $90,000 annually. In today’s dollars that same $90,000 would be worth around $62,000, at the same 3% inflation rate. After the 15% tax on dividends, (also not guaranteed in the future) that $62,000 would be worth about $53,000 in today’s dollars. That’s more than double the return provided by our interest bearing portfolio of certificate of deposits and bonds.

A portfolio that combines the two methods has both the ability to withstand inflation and the ability to withstand market fluctuations. The time-tested method of putting half of your portfolio into stocks and half into bonds has merit, and should be considered. As an investor grows older, his or her time horizon shortens and the need to beat inflation diminishes. In this case, a heavier bond weighting is acceptable, but for a younger investor with another 30 or 40 years before retirement, inflation risk must be confronted or it will eat away earning power.

A great income portfolio, or any portfolio for that matter, takes time to build. Therefore, unless you find stocks at the bottom of a bear market, there is probably only a handful of worthy income stocks to buy at any given time. If it takes five years of shopping to find these winners, that’s OK. So what’s better than having your retirement paid for with dividends from a blue chip with great dividend yields. Owning 10 of those companies or, even better, owning 30 blue-chip companies with high dividend yields!

Motto: Safety First

Remember how your mom told you to look both ways before crossing the street? The same principle applies here: the easiest time to avoid risk in investing is before you start.

Before you even start buying into investments, set your criteria. Next, do your homework on potential companies and then wait until the price is right. If in doubt, wait some more. More trouble has been avoided in this world by saying no than by diving right in. Wait until you find nice blue chips with bulletproof balance sheets yielding 4 to 5% (or more). Not all risks can be avoided, but you can certainly avoid the unnecessary ones if you choose your investments with care.

Also, beware of the yield trap. Like the value trap. the high yield trap looks good at first. Usually, you see companies with high current yields, but little in the way of fundamental health. Although these companies can tempt investors, they don’t provide the stability of income that you should be seeking. A 10% current yield might look good now, but it could leave you in grave danger of a dividend cut.

Diversify Among Five to Seven Industries

Having 10 oil companies looks nice — unless oil falls to $10 a barrel. Dividend stability and growth is the main priority, so you’ll want to avoid a dividend cut. If your dividends do get cut, make sure that it’s not an industry-wide problem that hits all of your holdings at once.

Choose Financial Stability Over Growth

Having both is best, but if in doubt, having more financial wherewithal is better than having more growth in your portfolio. This can be measured by a company’s credit ratings. Also, the Value Line Investment Survey ranks all of its stocks from A++ to a D. Focus on the ‘As’ for the least risk.