BRIC Nations Invest in Emerging Market BRICS Free Weekly Report

Post on: 13 Июнь, 2015 No Comment

By Mike Swanson of WallStreetWindow.com

Brazil, Russia, India, and China. Jim O’Neill the head of global economic research for Goldman Sachs gave these four countries the nickname BRICS in a emerging market report he published in 2001.

In his paper he argued that by 2050 the combined economies of these four countries would overtake the current richest countries of the world.

The countries hold 40% of the world’s population and make up 25% of the world’s land mass.

Brazil for instance is the world’s 5th most populated country and has the 9th largest GDP in the world, while Russia has the 7th biggest GDP.

India is the second most populated nation in the world with the 4th biggest GDP, while China of course is the most populated country in the world and is second in GDP only to the United States.

What is key is the BRIC countries are projected to overtake Japan, Germany, France, and the United Kingdom by GDP over the next 40 years. Japan for instance is currently second in GDP, but is expected to fall to 8th by GDP by 2050. All these projections are from a bric economies research paper done by Goldman Sachs a few years ago.

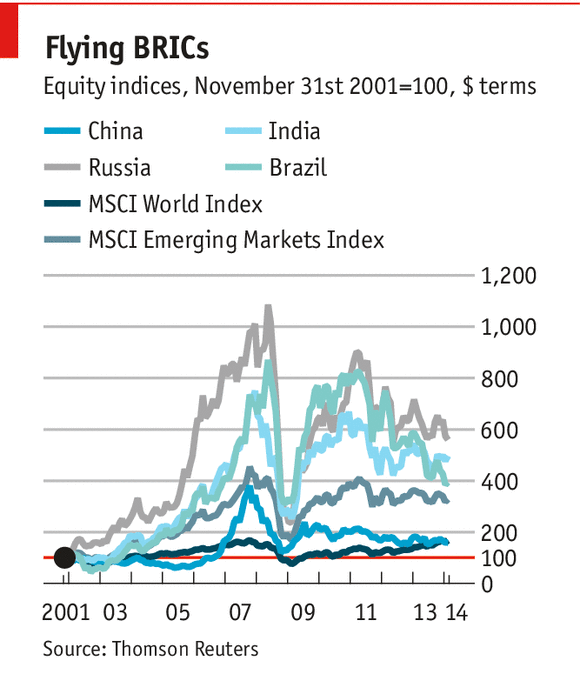

For investors the BRIC countries hold incredible promise and growth. At a time of financial turmoil of wild booms and busts we have seen cycles based on credit expansion and pure bubbles in much of the West. Some of that money that has trickled into emerging markets at times to create massive gyrations as we have seen in the Chinese stock market the past few years, however the growth in the BRIC countries is much more sustainable and is going to simply accelerate over the next couple of decades.

The future is definitely in the BRIC nations and an investor who wants to supercharge his portfolio most figure out a way to participate and also be to navigate the wild swings that come from emerging markets which can double one year and fall in half the next.

US based investors have access to several BRIC focused exchange traded funds, such as the BIK S&P BRIC 40, which tracks a basket of blue chip stocks in Brazil, Russia, India, and China. There is also the Claymore/BNY BRIC, which holds 75 companies that trade in the US as American depository receipts.

There are several hundred BRIC companies that trade in the US stock exchanges as ADR’s, that US investors can buy. They also can buy directly into BRIC countries through some brokerages, such as Etrade, which now allow their customers to invest in overseas stock exchanges, but for now ADR’s are the simplest route to go, because more information on companies with dual listing is available, with full SEC filings.

I published a free weekly stock market newsletter, with updates on BRIC investments, because I believe over the course of the next few decades some of the best opportunities to make money will be in these emerging markets. To subscribe just click here .