Brazil Russia India China Stock Funds Beat Emerging Markets

Post on: 13 Июнь, 2015 No Comment

By Michael Tsang — August 16, 2006 12:14 EDT

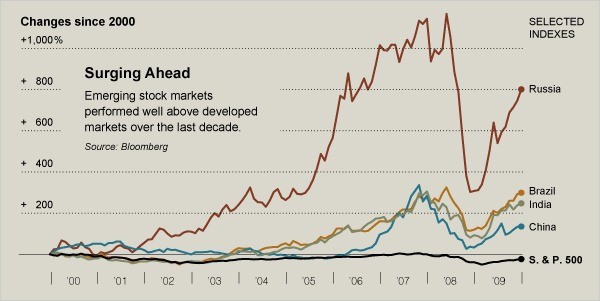

Aug. 17 (Bloomberg) — Funds investing in Brazil, Russia, India and China are outperforming emerging markets by combining the worlds two most populous nations with two countries feeding their expansion.

«The four countries all have high economic growth and there seems to be virtuous cycle between them, said Grant Yun Cheng, who co-manages the $491 million dit-BRIC Stars fund in Frankfurt. Demand for commodities and building materials in China and India is injecting money into the economies of oil-producing Russia and natural resources-rich Brazil, he said.

Money managers from HSBC Holdings Plc to Franklin Resources Inc. are capitalizing on the groundswell of interest in so-called BRIC funds. The four countries stock markets have posted some of the best gains in the world in the past 12 months.

Of the 30 BRIC-related equity funds tracked by Bloomberg data, 75 percent were started in the past year. Assets in 12 of the biggest have more than doubled to $10 billion in 2006, according to Boston-based Emerging Portfolio Fund Research.

The Morgan Stanley Capital International BRIC Index has gained 25 percent this year. That compares with an 8.9 percent advance in the broader MSCI Emerging Markets Index of 25 developing countries.

Among BRIC funds with track records from the start of the year, London-based Schroders Plcs BRIC fund and the HSBC Holdings Plcs BRIC Freestyle Fund have been the best performers, returning 26.7 percent and 24.4 percent in 2006.

Commodity Demand

Both funds held Russias OAO Gazprom, the worlds largest natural gas producer, and Petroleo Brasileiro SA, Brazils state-controlled oil company, among their top three holdings at the end of June. Those shares have gained 61 percent and 31 percent in dollar terms this year amid rising energy prices.

Gains in the four BRIC markets are being driven by China and India, the fastest-growing economies of the worlds 20 largest. Their expansion is in turn driving demand for commodities such as iron ore from Brazil and oil from Russia.

«China needs a lot of raw materials, which Brazil and Russia provide, said Cheng, whose Deutscher Investment Trust is a unit of Allianz Global Investors AG; he started the fund last September. «India is also moving to more infrastructure spending, so it will also need a lot of commodity investment.

The acronym BRIC was coined by Jim ONeill, chief economist at Goldman Sachs Group Inc. in a report published in November 2001 titled «Building Better Global Economic BRICs.

Four-Letter Bonanza

He said the four countries would join the U.S. and Japan as the biggest economies in the world by 2050, eclipsing most of todays developed nations.

BRIC markets have proved to be more resilient than other developing countries since a global sell-off in May and June caused the MSCI Emerging Markets Index to lose almost a quarter its value. All four markets have gained more than the MSCI index since their troughs in mid-June, with the dollar-denominated Russia Trading System Index jumping 33 percent.

Chinas economy has grown 10-fold since then-leader Deng Xiaoping began loosening regulations in 1978, overtaking the U.K. as the worlds fourth-biggest in 2005. China grew at the fastest pace in a decade in the second quarter, and will grow 10.4 percent this year, according to the median forecast of 26 economists surveyed by Bloomberg News last month.

China, the worlds second-largest energy user, may consume 5 percent more oil this year as growth boosts demand and reliance on fuel imports increases, the government said Aug. 7.

Asian Promise

Hong Kong-listed shares of PetroChina Co. the nations biggest oil company, have surged 43 percent this year. Shares of Cnooc Ltd. Chinas biggest offshore oil producer, have jumped 36 percent.

Indias $775 billion economy grew 9.3 percent from a year earlier in the quarter ended March 31. Growth for the financial year was 8.4 percent, the fastest pace after China among the worlds 20 biggest economies. Prime Minister Manmohan Singh plans to increase infrastructure spending by 24 percent to 992 billion rupees ($21 billion) in the year to March 31.

Shares of Associated Cement Companies Ltd. the nations biggest cement maker by capacity, have soared 66 percent this year, the biggest gain on Indias Sensitive Index, or Sensex.

Russia this month raised its economic growth forecast for 2006 to 6.6 percent after prices surged for oil, the countrys biggest export earner. The $770 billion economy is heading for its eighth straight year of growth, the longest period of economic expansion since the fall of the Soviet Union.

On the Cheap

The largest member in the dollar-denominated Russian Trading System Index is Moscow-based OAO Lukoil, the nations biggest oil company. The stock has jumped 47 percent this year.

The economy of Brazil, the largest in Latin America, may expand 4 percent this year according to estimates by its central bank. This compares with a 2.3 percent expansion in 2005.

Brazil is home to Cia. Vale do Rio Doce, the worlds largest iron-ore producer. Shares in Rio de Janeiro-based Vale have risen 5.6 percent in dollar terms this year, after jumping 49 percent in 2005.

«Brazil is a cheaper way of buying growth stories such as China and India, said Alfredo Rotemberg, who manages $200 million in international equities for OppenheimerFunds Inc. in Beechwood, Ohio.

For some money managers, BRIC funds represent a marketing ploy with little more than a catchy name.

«Its a random selection of four large markets that have outperformed recently, said Gerald Smith, who helps manage about $9.5 billion in emerging-market equities at Baillie Gifford & Co. in Edinburgh. «Its a great marketing concept that doesnt really make sense as an investment strategy.

`Easily Reverse

Dimitri Chatzoudis, who manages the $1.13 billion ABN Amro Global Emerging Markets Equity Fund in Amsterdam, says much of the recent gains in BRIC markets have been exaggerated by inflows themselves.

«All the money going into BRIC funds is perhaps why they have done so well, he said. «That can easily reverse.

Mark Mobius, who oversees about $30 billion in emerging-market equities at Templeton Asset Management Ltd. in Singapore, counters that grouping the four countries together makes sense because they all have large, comparatively young and increasingly wealthy populations.

The combined population of the four countries stood at 2.68 billion at the end of 2004, according to data compiled by Bloomberg. The proportion of Chinas population under the age of 15 was 21.4 percent, while in India it was 31.3 percent. In Germany, it was just 14.4 percent.

Strength in Numbers

«You have a lot of people in these countries born in the last 20 years that are coming of age and thats very important for consumption, Mobius said via mobile phone from Vienna. «The combination of the four fulfills a lot of requirements you want to find in when you invest in emerging markets.

Mobius, who runs the $934 million Franklin Templeton BRIC Fund for Franklin Resources, the largest U.S. asset manager by market value, held China Mobile Ltd. and Banco Bradesco SA among the funds top 10 holdings at the end of June.

Shares of China Mobile, the worlds biggest cell-phone operator by users, have jumped 43 percent this year. Banco Bradesco SA, Brazils biggest non-state bank by assets, has added 15 percent in dollar terms in 2006.

While the funds all track the same countries, the investment strategy differs from manager to manager.

Oil and Gas

DITs Cheng says his fund, which has returned 18.9 percent this year, seeks to maintain an equal proportion of shares in each of the four BRIC markets. It can also invest as much a third of its assets in companies of other emerging markets that are benefiting from growth in those four countries.

At the moment he holds shares of Brazils Vale and Bharat Heavy Electricals Ltd. Indias biggest power-equipment maker. Shares of the New Delhi-based company have more than doubled over the past 12 months.

Eight of the top 10 holdings for the HSBC BRIC Freestyle fund were oil and gas producers, accounting for 31.5 percent of the funds $3.74 billion at the end of June, according to the companys Web site.

Both HSBC and Deutsche Bank AGs DWS unit have skewed their funds toward Brazil and Russia. The Russia Trading System Index has led gains among the four countries in dollar terms in the past 12 months. The Bovespa Index in Brazil has gained 51 percent.

In India, the Sensex has gained 38 percent over the past 12 months. The Hang Seng China Enterprises Index, which tracks the so-called H shares of mainland companies listed in Hong Kong that overseas investors can be freely buy and sell, has added 28 percent.

Brazilian Bargain

Even after beating Chinese and Indian stocks, Brazil is still a cheaper investment, according to Thomas Gerhardt, who runs the $3.1 billion DWS Invest BRIC Plus fund from his office in Frankfurt.

Companies in Brazils Bovespa are valued at 9.44 times forecast earnings, compared with 13.02 times for the H share index of Chinese mainland companies and 16.83 times for Indias Sensex, according to data compiled by Bloomberg.

His biggest bets are on Brazilian banks, which stand to benefit from increased lending as the country gets richer from selling commodities and interest rates decline. Brazils central bank has slashed the benchmark rate 5 percentage points since September to 14.75 percent, the lowest in at least 20 years.

Gerhardts top holding is Uniao de Bancos Brasileiros SA, Brazils third-biggest non-state bank. Shares in Sao Paulo-based Unibanco have advanced 18 percent this year in dollar terms.

«Brazil is the market that offers the biggest earnings growth potential, Gerhardt said.

To contact the reporter on this story: Michael Tsang in Tokyo at mtsang1@bloomberg.net

To contact the editor responsible for this story: James Regan at jregan8@bloomberg.net.