Brazil Inflation Nowhere to go but up

Post on: 28 Апрель, 2015 No Comment

Current Affairs & Opportunities

Brazil Inflation: Nowhere to go but up?

By Thais Thimoteo

If in 2013 producers and consumers split the cost of price increases evenly, in 2014 the cost of inflation has fallen squarely on the consumer. Through November 2013 12-month inflation went up to 5.6% as measured by the General Price Index 10 (IGP-10) calculated by the Brazilian Institute of Economics, Getulio Vargas Foundation (IBRE/FGV); the Producer Price Index (IPA) was 5.2% and the Consumer Price Index (IPC) 5.4%. This year, prices of farm products rose only 1.7% but the cost of the goods on supermarket shelves went up 6.6%. The difference between producer and consumer inflation lies with inflation of services, which has been stubbornly high, and adjustment of controlled prices.

Salomão Quadros, FGV/IBRE deputy superintendent of Inflation, explains that the IPA inflation was much less than the IPC inflation because major crops harvested this year were plentiful and commodity prices in U.S. dollars have fallen recently —, iron ore dropped 40% and soybean products fell 13%.

The decline of commodities prices reflects a worsening of the international economic outlook, particularly for China, which has reduced the pace of imports. IPA inflation closely tracks the behavior of the world economy because its basket of goods includes commodity prices. With the fall of prices of both iron ore and soybean products, which are flagship Brazilian exports, the external trade balance deteriorated, Quadros says. Consumer prices, in contrast, reflect the domestic market and goods not traded externally, such as services, which take into account the high cost of labor.

IBRE expects that by the end of 2014 the official inflation rate (IPCA) will not breach the ceiling of the inflation target range (2.5–6.5%) but it will scrape it at about 6.4%, in line with the Central Bank survey of market inflation projections. Actually, the government is treating the ceiling of the inflation target as a benchmark instead of the mid-point target of 4.5%, Quadros points out. In the 12 months to November, the IPCA reached 6.4%.

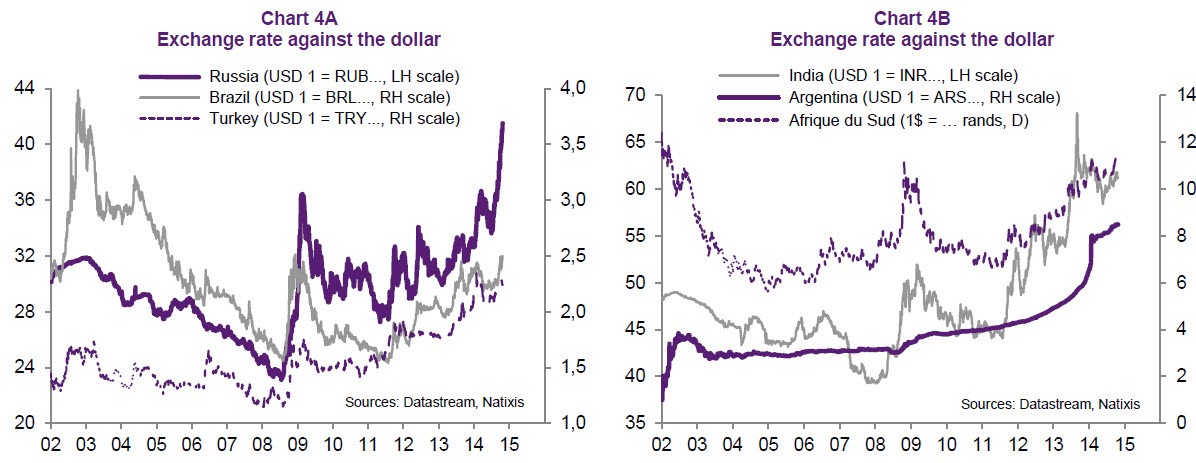

For 2015, expectations are not favorable. Inflation for the year is likely at best to repeat the current outcome and may well exceed the 6.5% ceiling. The main source of inflationary pressure will come from adjusting prices controlled by the government. In 2013, inflation of controlled prices was low, 1.7%. In 2014, it may be ten-fold higher at 17%; next year it is expected to exceed 20%, especially considering the urgent adjustment of electricity tariffs as well as higher fuel prices and bus fares. Quadros says, The prices of electric energy may well determine the inflation outcome because there is more room to raise those prices after the 20% discount imposed in 2013. That led to the disorganization of the electric sector. Other than being outdated, the price of gasoline is less flexible. However, devaluation of the exchange rate may affect the adjustment of gasoline prices next year.

Quadros believes service inflation will continue on its 2014 path, pushing up inflation. Nevertheless, there is a surprise factor that may cause service prices to drop: if the labor market cools, vacancies would decline and wage growth would slow. November data from the General Register of Employed and Unemployed shows that 30,000 job vacancies closed. With these signs and a recession perhaps taking shape, wages may grow more slowly than before. However, the government could act to prevent a serious deterioration in the labor market. As the government is firmly committed to maintaining employment and wages, Quadros still sees service inflation continuing on an upward course in 2015.

If in 2013 tomatoes were so expensive —prices went up 60% that they vanished from Brazilian tables, in 2014 it was beef that was hurt by a 17% rise in its price over 12 months. The drought that damaged pastures, forcing producers to pay the higher costs of cattle feed, and heavy international demand for beef were responsible for raising the beef live weight price at the cattle ranch by 40% to R$9.33 per kg, up from R$6.67 per kg a year earlier. Food prices rose because of the drought earlier this year. In March, we had some relief, but summer brought new increases in food prices. As for beef, when the exchange rate devalues, producers earn more if they export, and domestic consumers pay more, Quadros says. He notes that “Market surveys project a 15% devaluation of the exchange rate in 2015. That will put pressure on food prices. One favorable factor as far as food prices are concerned, he says, is that Brazil and the United States have large stocks of food staples. If there is a change in the weather, which is unpredictable, the stocks would smooth out the effect of price shocks.”

Published with permission of FGV-IBRE