Bottoms Up Investment Method

Post on: 7 Апрель, 2015 No Comment

by ABC

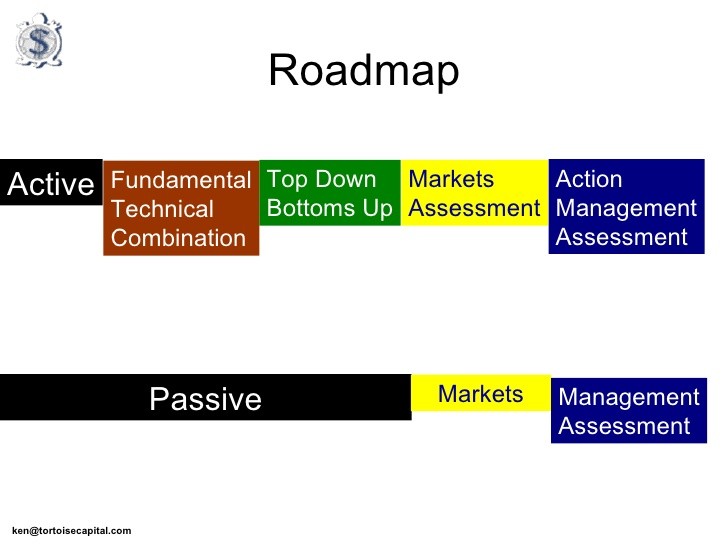

If you read the business pages or investment in mutual funds you will often hear portfolio managers described as bottoms up or top down investing in their investment approach. Here is an explanation of bottoms up (and no, it nothing to do with alcohol).

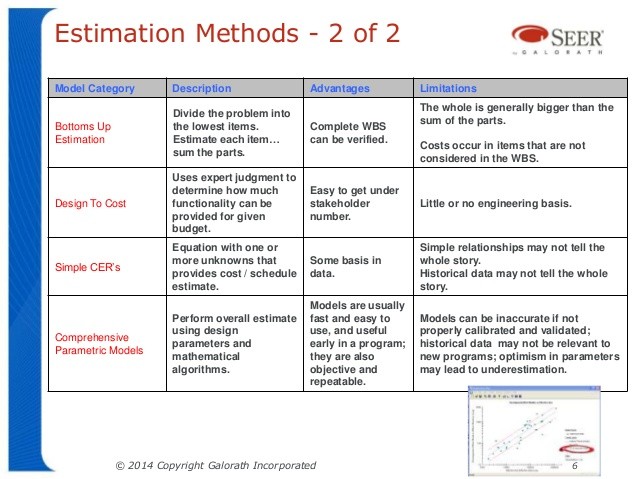

In the bottom up investment approach, the details matter. An investor concentrates on the fundamental analysis of the company – its market prospects, sales growth, profitability, cash flow, debt ratio, price earnings valuations and dividend yield among other variables. Each company’s numbers are then compared to that of its competitors to decide which stock offers more upside potential.

Macro economic variables (such as inflation or national GDP ) do not figure in the analysis, neither does market timing. The premise is that a well-run company will do well regardless of the economy. Investors usually start with a screening filter such as a low price-earnings ratio or PE relative to the market or sector. Once the undervalued stocks are identified, your next step is to drill down to even finer details. The idea is to identify a handful of companies you feel confident about.

It is important to remember that in a bottom up strategy different valuation techniques are required for different industries. For example, in analyzing a drug company, it is necessary to estimate possible revenue streams not only from existing drugs, but also from new ones, and to estimate a fall in sales and loss of market share once a patent expires. It is also important to know what new drugs are in the pipeline and which ones are likely to get approval.

On the other hand, a small manufacturing company is relatively easy to analyze. Expected sales, pricing policies, competitive pressures, demographics, market share, cash flow, inventory and debt management are the appropriate metrics to consider.

Astute investors such as Warren Buffet know intimately how their stocks operate and understand precisely how the smallest changes will affect earnings. For example, in 1988 when most investors were still gloomy after the 1987 crash, Warren Buffet bought Coca Cola Company on the cheap, foreseeing its unshakeable growth prospects as a global company.

The hitch to this approach is that all stock prices are affected in a market downturn which is brought on by negative macro conditions, or a company’s stock price could be badly affected by an unforeseen event.

A recent example would be that the onset of swine flu not only badly affected sales of pork and pork products, it also marred cruise ship revenues. Royal Caribbean and Carnival had poor earnings due to the economic downturn and to people staying at home from health concerns.