Bonds Intelligent Investing Ideas from Forbes Investor Team

Post on: 27 Июнь, 2015 No Comment

Income Investor Alert: Buy These Asset Classes When Rates Rise

What do Baby Boomers want to achieve with their investments? Income generation and capital preservation top the list for many who are retired or planning to retire within a few years. Their goals are simple but achieving them may not be. For classic fixed-income instruments, there is no getting around the fact that when interest rates go up, prices go down.

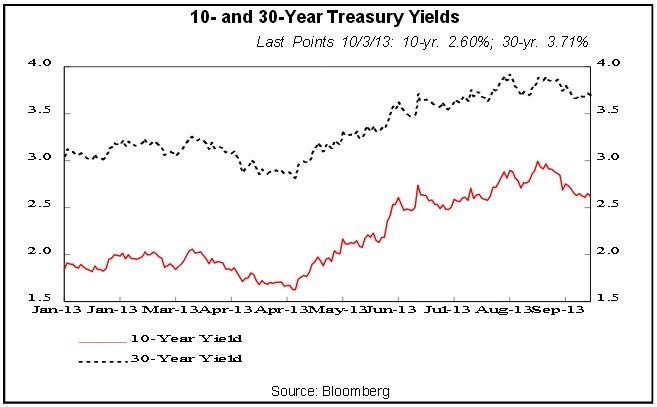

The challenge of dealing with higher long-term interest rates will not arise in the short run if the near future turns out to resemble the recent past. Last year the ten-year U.S. Treasury rate confounded most forecasters by falling, rather than rising. If long-term rates hold steady or drop further during 2015, notwithstanding whatever the Fed winds up doing in the short end, holders of high-grade bonds should not be hit with a loss of principal.

It is a different story over the course of the Baby Boomers’ retirement years, however. The ten-year Treasury yield, currently around 2%, will probably migrate at least part of the way back to its 30-year average of 5.6%. Preserving capital will be tougher under those conditions.

As for their goal of generating income, investors need to think in real (adjusted-for-inflation) as well as nominal terms. Even at today’s comparatively low inflation rate, the purchasing power of a fixed level of bond coupons will decline severely over two decades of post-retirement life expectancy. At 2% per annum, inflation reduces the value of a dollar by one-third over 20 years.

These numbers make it imperative to take a broader view of income investing than the easy approach of just buying high-grade bonds. Three types of diversifying instruments can be particularly helpful in pursuing the dual goals of generating income and preserving capital—real estate investment trusts (REITs), master limited partnerships (MLPs), and dividend growth stocks.

The table below shows price changes during the four most recent large jumps in interest rates. In each of these episodes, the ten-year Treasury rate increased by about one percentage point over a 12-month period. High-grade corporate bonds fell in each case except for the 12 months ending December 2009, when just about every asset class was rebounding from the Global Financial Crisis. In contrast, the prices of REITs, MLPs and dividend growth stocks usually rose when Treasury yields went up sharply. The sole exception was a minor decline by the MLPs in the 12 months ending June 2006.

Interest Rate Sensitivity of Income Investing Asset Classes