Bonds and Preferred Stocks Differences and Similarities Financial Web

Post on: 13 Июль, 2015 No Comment

Both bonds and preferred stocks are very similar investments that are commonly issued by many corporations. While these investments are similar, they also have a few key differences. One of the biggest differences between these two types of investments is the type of security that they represent. When you invest in a bond, you are considered to be a creditor of the company. This means that you are lending money to the company that issued the bond. Preferred stock, on the other hand, is considered to be an equity instrument. This means that you are going to become a partial owner of the company instead of a creditor.

Payments

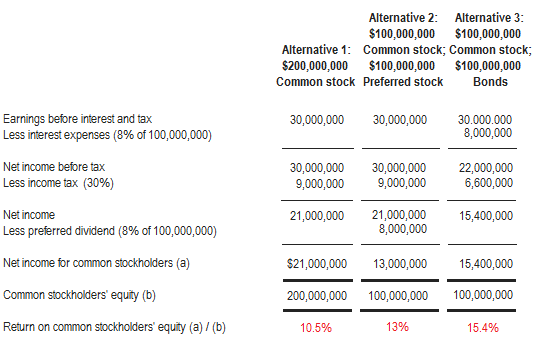

One of the largest similarities between bonds and preferred stocks is that they both receive regular payments from the company. With bonds, you will receive interest payments on the debt that is owed by the company. With preferred stock, you will receive regular dividend payments from the company. The dividend payments will be based on a percentage of the face value of the preferred stock. This means that the two investments offer different types of payments from the company, but they are regular payments nevertheless.

End Date

Another difference between these two types of investments is how long they can last. Bonds have a definite date of maturity. When this date occurs, the bond matures and the company returns the face value of the bond to the investor. With preferred stock, there is not a specific maturity date. This means that preferred stock could potentially last forever. However, preferred stock is callable which means that the company could decide to end it at any time. If that happened, the company would pay back the investor the face value of the preferred stock.

Convertible

Another common feature between bonds and preferred stocks is that many of them are convertible. This means that you can sometimes convert both of these securities into common stock if you choose to do so. With this option, you can receive regular payments from the bonds or preferred stock for a certain amount of time, and then convert it over to common stock in order to take advantage of capital appreciation in the company.

Seniority

One of the biggest differences between these two types of investments is the way that they ranked in regards to the company’s debt. Bonds have a senior position to preferred stock and common stock because they are a form of debt. Preferred stock is junior to bonds, but is senior to common stock. This means that if the company were to go into bankruptcy, it would issue the available cash to the bondholders first, and the preferred stockholders would be paid back second. If any cash was left over at this point, it would be distributed to the common stockholders in the company.

$7 Online Trading. Fast executions. Only at Scottrade