Bond Yield to Maturity Calculator for Comparing Bonds

Post on: 16 Март, 2015 No Comment

Explains what bonds are and how they work, and calculates the annualized rate of return of a bond for you using the YTM formula.

This free online Bond Yield to Maturity Calculator will calculate a bond’s total annualized rate of return if held until its maturity date, given the current price, the par value, and the coupon rate.

Using this calculator to calculate yield to maturity (YTM) will help you to quickly compare the total return on bonds with different prices and coupon rates.

What is Yield to Maturity?

In order to understand yield to maturity, it’s important that you have a basic understanding of what bonds are, how they work, and how they are bought and sold.

What Are Bonds?

Basically, bonds are IOU’s issued by a government entity or corporation, which promise to pay you interest on a sum of money borrowed from you — along with the promise to repay the sum of money borrowed at the end of loan (referred to as the maturity date ).

When a government entity or corporation issues bonds (looking to borrow money), the bonds have a stated par value. a stated maturity date. and a stated coupon rate.

What is Par Value?

The par value (also referred to as the face value) is the amount the issuer (borrower) promises to pay at the end of the loan period. Typically bonds are issued with par values of $1,000 and can be purchased for close to their par value on the day they are issued.

What is Maturity Date?

The maturity date is the date the issuer promises to pay the holder of the bond an amount equal to the par value. Bonds can have maturity dates that range anywhere from 1 day up to 30 years, or more. Generally, the longer out the maturity date, the higher the interest rate the bond will pay. That’s because longer maturities expose the bond holder to more risk than bonds with shorter maturities.

What is Coupon Rate?

The coupon rate is the annual interest rate the issuer will pay on the amount borrowed. For example, if a bond has a par value of $1,000 and a coupon rate of 8%, then you will receive annual coupon (interest) payments of $80 (1000 X .08 = $80) until the bond’s maturity date. Most bonds make coupon payments semi-annually, so you would likely receive a $40 coupon payment two times each year.

What Makes Bond Yield Comparisons Difficult?

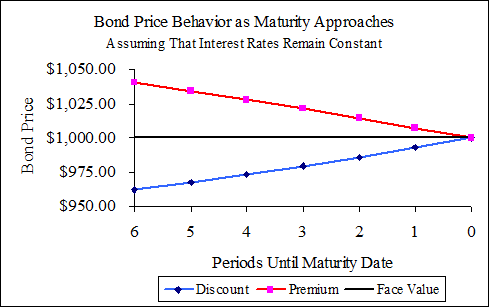

What makes comparing bond yields difficult, is that bonds are often bought and sold in between their maturity dates — with the prices of the bonds constantly changing due to changing interest rates and the demand for borrowing money. In other words, you could buy a newly issued $1,000 bond today at close to face value, but a month from now the bond might be selling for more or less than what you paid for it.

Generally, if interest rates rise, the prices of bonds fall. And if interest rates fall, the prices of bonds rise. If you’re not sure why prices and rates move in opposite directions, please visit the Bond Value Calculator page for a simple explanation. In any case, the important thing to realize is that bonds are rarely bought and sold at par value.

This means that if you are looking to invest in bonds, you will likely be purchasing bonds at prices that are higher or lower than their par value. And it’s this price-to-par-value variance that makes it difficult to compare yields on bonds with different maturities, prices and coupon rates.

If you were to purchase a bond at a par value of $1,000 and held it until maturity, the yield would be roughly equal to the annual coupon rate. However, if you purchase a $1,000 bond for $900 (purchased at a discount) with a coupon rate of 6%, how would you know how the actual yield will compare to a $1,000 bond selling for $1,100 (purchased at a premium), but that has a coupon rate of 7%?

Enter the Yield to Maturity Calculation for Comparing Bonds

Yield to maturity is a rather complex return on investment calculation that accounts for both coupon payments and the gain or loss of principal that occurs when bonds are purchased for less than or greater than the par value. But in your case, all you need to do is to enter 4 variables for each bond and the yield to maturity calculator will do all of the complex calculations for you.

Please keep in mind that while the yield to maturity calculator can help you compare total returns on bonds, it cannot predict the future. Bonds, while considered to be safer than equities (stocks), do carry a risk that the issuer may default on the repayment. Of course, this risk is less when it comes to U.S. government bonds and Municipal bonds, and more when it comes to corporate bonds. And as with all types of investments, the greater the risk, the higher the expected return on investment.

With that, let’s use the Bond Yield to Maturity Calculator to calculate the total annualized rate of return of a bond so you can quickly compare the actual yield to yields of bonds having different maturities, prices and coupon rates.

Bond Yield to Maturity Calculator