Bond Funds Boost Income Reduce Risk

Post on: 18 Апрель, 2015 No Comment

Bonds are often considered to be plain and boring when compared to equities. This may be the case, but bonds can provide a level of stability that equities, due to their volatility, generally can’t match. This is especially true of bond funds. which can provide a safe and stable source of income as well diversification to a portfolio.

In this article we will look at some factors, including investment style and risk tolerance. that investors should consider before making an investment in bond funds. (For background reading, see Evaluating Bond Funds: Keeping It Simple .)

Income Generation

The goal of most bond funds is to generate a return for investors by investing in a variety of bonds that generate a healthy and consistent income stream. For most funds, there isn’t a focus on capital appreciation like there is for equity funds.

Investors must, as part of their research process, determine whether the income generating characteristics of a bond fund fits their investment objectives. For example, a retired investor who is focused on supplementing his income may be well suited to a bond fund investment. On the flip side, a couple looking to save money for their children’s education might be better off investing their money in a 529 plan that invests in stocks, because their goal is to grow their money, so that when the child reaches college age they’ll have enough to fund the tuition. In this case, the retired professor is most concerned about generating a relatively reliable source of income, which bond funds can provide. The couple, on the other hand, is looking for growth, not income. As such, the short-term volatility of equity investments is not an issue, as they do not intend to use the money for a long time.

In general, many bond and bond funds are considered to be lower risk because, for the most part, a bond holder will receive the principal on the bond as long as the bond is held to maturity.

However, there is the risk of default. which can lead to a partial or total loss of principal that can make some bond funds risky. It is important to determine the risks involved in any investments including bond funds as the risk characteristics vary.

For example, investors should feel very safe in a fund that is fully invested in government-backed securities, such as Treasuries. but would have to be more cautious of funds invested in mortgage-backed securities or junk bonds as these instruments have higher risks. (For more on bond risks, see Six Biggest Bond Risks .)

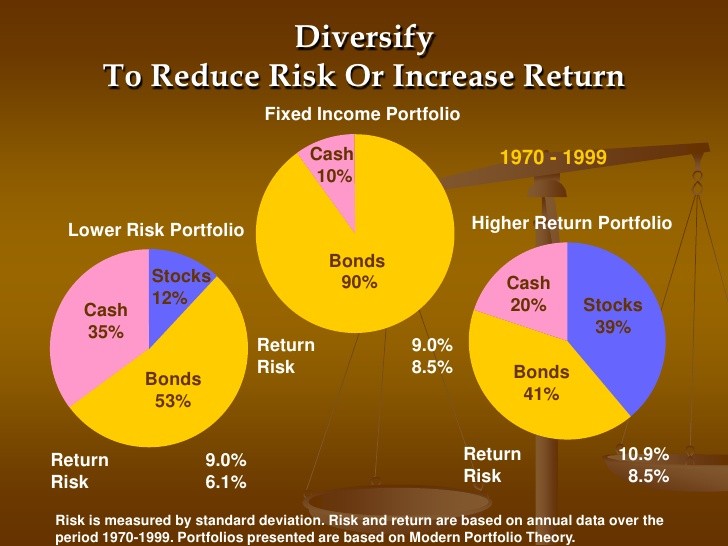

Also, because bond funds may purchase quite a number of bonds as part of their diversification process, they are able to more effectively spread their risk. In other words, because a bond fund spreads investors’ investment over a number of different bonds, investors are more insulated against major losses than they would be if they invested in the bonds themselves. As such, bond funds tend to attract risk averse investors. (For more insight on risk tolerance, check out Personalizing Risk Tolerance .)

Portfolio Management

Most of us don’t have the experience or skill set to manage a large portfolio of bonds or the portfolio size to get a properly diversified portfolio of bonds as many trade at a price of $1,000 or more. In addition, m any of us don’t have the time to dedicate to conducting thorough research, such as meeting with management and analyzing Securities and Exchange Commission (SEC) documents. However, bond funds have the same advantage as any mutual fund in that they have portfolio managers and a research team who try to choose the best possible securities to add to the fund’s portfolio. Therefore, when investing in a bond fund, an investor can benefit from a managed investment and can own a share in several different bonds at a much lower cost than buying the bonds themselves.(For more insight, check out Does Your Investment Manager Measure Up? )

Liquidity Advantage

If an investor who owns an XYZ Company corporate bond needs to sell his or her holding in a hurry, they would have to check the market, or with a broker for a current quote and see which parties might be interested in purchasing the bond. This is not a particularly difficult task, but because there may be a general lack of demand for the issue, selling the security at an advantageous price may not be easy. (To learn more, see Corporate Bonds: An Introduction To Credit Risk .)

In contrast, it is much easier to liquidate a position in a bond fund. If an investor wants to sell part or all of an investment, he or she can simply place a sell order with the broker and it will be executed that night or they can put in a redemption with the fund, which needs to be executed within seven days of the request. Also, when selling a bond fund there is usually little difference between the selling price and the market value, excluding transaction fees.

Bottom Line

Bond funds aren’t for everybody, but for those seeking professional management, diversification and income generation, they could do the trick. Of course, before purchasing any security or fund, review your needs and objectives, and seek the advice of your accountant or other advisor.