Bond and Stock Market Sharpe Ratios Have Likely Peaked

Post on: 31 Май, 2015 No Comment

Theres a strong case for expecting that Sharpe ratios will be lower, perhaps a lot lower, for the stock and bond markets for the foreseeable future. Whats the source of this outlook? Gravity.

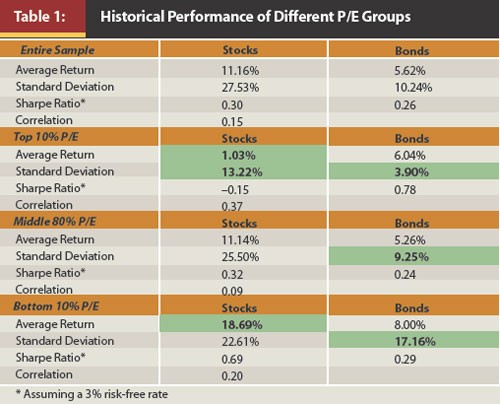

Reviewing the past two decades reminds that equity and fixed-income returns, after adjusting for volatility and the risk-free rate (3-month T-bills), have been soaring. Bonds, in particular, have recently posted extraordinarily high levels of risk-adjusted returns. Using the Barclays Aggregate Bond Index as a proxy, the fixed-income markets Sharpe ratio rose to a multi-decade high of 2.71 back in February of this year, based on trailing annualized 3-year data. The Sharpe ratio for the U.S. stock market (Russell 3000) didnt fly quite as high, but it appears to have reached a recent peak as well.

Earn 10% Interest or more investing in consumer loans

This type of analysis is hardly the stuff for day trading. Rather, the analysis here provides some general context for market behavior, and it should be considered as the first step in a deeper round of research for designing and managing portfolios and forecasting risk premiums. That said, the bond markets Sharpe ratio looks especially vulnerable to falling in the months (and years?) ahead. For example, running the numbers through anARIMA-based forecasting process (using software that automatically chooses a model based on the best fit of the data) projects that risk-adjusted returns for bonds will decline.

None of this should be terribly surprising. Sharpe ratios (along with returns and risk separately) fluctuate through time. Meantime, the economic turmoil in recent years makes its tempting to think that history of late hasnt been a productive landscape for investing, but the numbers tell us otherwise. The bond market (Barclays Aggregate) has earned an annualized 6.9% total return over the past three years through the end of July, or near the best levels for the past decade. Stocks (Russell 3000) have delivered more than twice that performance: 14.2% over the past three years on an annualized total-return basis, also near the best results for past decade on a rolling 36-month basis.

Overall, investing since the Great Recession ended in mid-2009 has been kind for those willing to hold risky assets. Will the future deliver more of the same? Maybe, but the potential for turbulence via the power of gravity suggests that the headwinds may be a little stronger.

Performance volatility, its safe to say, will endure. That doesnt mean that were headed for the dog house when it comes to earning risk premia. But its hard to ignore the fact that U.S. stocks and bonds have had a strong run over the last three years. Can it go on? Sure, but the mistake is thinking that the recent past will roll on indefinitely.

Whats the antidote to the routine installment of uncertainty? Rebalancing a broad mix of asset classes is one responseand perhaps a timely one, considering the lofty levels in Sharpe ratios this year.