Bollinger Bands Tool Kit Bollinger Bands Strategy Bollinger Bands Trading Calculation

Post on: 16 Март, 2015 No Comment

What are Bollinger Bands?

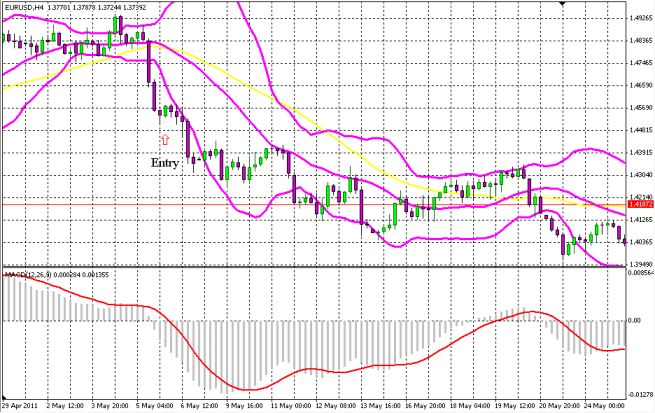

Bollinger bands are used to study movement of prices it consists of a center line and price channels above and below specific line. The center line functions as an exponential moving average and a standard deviation is calculated on the price of a stock which is being watched. The bands expand and contract as the price becomes volatile — expanding and contracting. The default parameters on this tool consist of 20 periods and 2 standard deviations and have to be adjusted to suit your needs.

Who created this tool?

Bollinger Bands is a technical tool used by Forex traders created in the early 1980s by John Bollinger from which the tool has been got its name from. He created this tool because there was a need for adaption to observe dynamic movement in the markets and the prices were indeed volatile and dynamic, not static as previously thought.

How to use the tool:

With Bollinger Bands, the upper and lower bands are your price targets on a particular stock that you are watching. If the price goes below the lower band and is still above the 20 day average (the middle band), the upper band is the price target that you have to hit. In strong uptrends, prices always fluctuate between the top and 20 day moving average bands. This is an indicator that the prices are going to reverse and go down. This is a great tool to gauge the direction of assets and profit from the price fluctuations.

How Traders read the market:

Stocks tend to trade in trends for a long period and see movement from time to time. Traders are able to get a better idea on price action using moving averages and gather information. Market trading is erratic every day trading is either up or down. Using Bollinger Bands, traders can stay reasonably sure that prices are behaving as they should, as long as they stay in the channel defined by Bollinger Bands. Important points to note are:

- If stock price is continually at the upper Band, it is considered to be overbought.

- If it is sitting closer to the bottom Band, it is considered oversold and one can buy into the stock.

Bollinger Bands are good indicators and well regarded by traders. It takes a while to start recognizing trends in the market in this case practice makes perfect. Use these and then slowly incorporate other indicators to enhance your performance and profits.

The Bottom Line

Every strategy has strengths and weaknesses. Bollinger Bands are the most useful tool that every trader needs in his arsenal. Traders have used this tool a lot to take advantage of oversold conditions and make a good profit when the prices stabilize and stay closer to the center line.