Bollinger Band explained with examples

Post on: 16 Март, 2015 No Comment

What is Bollinger Band?

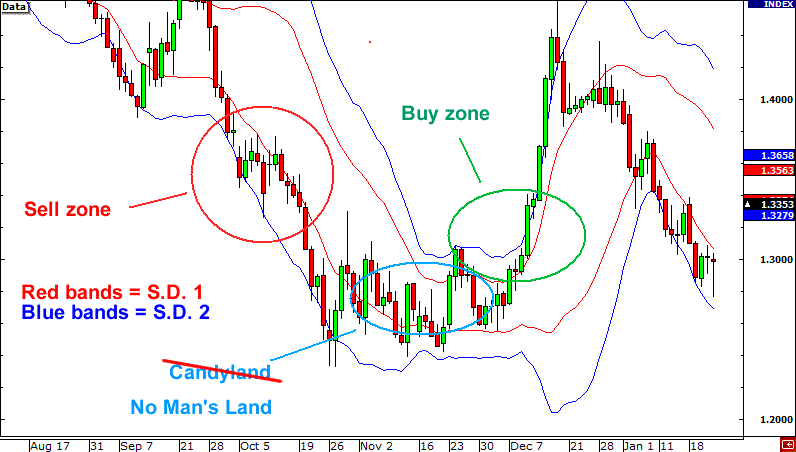

Bollinger Bands, one of the most popular indicators, is an envelop around stock price indicating price range of the stock based on stock volatility. When price moves towards upper band it is often considered as overbought and when it is near lower range it is considered as oversold.

Who created Bollinger Band ? John Bollinger a noted technical analyst invented Bollinger Bands. His finding was influenced by J.M. Hurst’s who came with notion of trading envelop around stocks.

What are the components of Bollinger band? Bollinger band has three important dynamic lines

1. Middle Bollinger Band - This is a plot of 20 period simple moving average.

2. Lower Bollinger Band - Middle band — 2 * 20 period standard Deviation.

3. Upper Bollinger Band - Middle band + 2 * 20 period standard Deviation.

Concept of Bollinger Band

Bollinger Band indicates volatility around price of a stock. When price reaches upper band it is considered as overbought and could be a good exit point and when stock approaches lower band it is considered as good entry point. These are highs/lows or support and resistance. When stock has high price fluctuation the band expands and when volatility is low they contract to adjust with change in price volatility.

In normal distribution, 68% of the time price should be within one standard deviation and 95% of the time it should be within two standard deviation.

Usages of Bollinger Band

a. They provide excellent support and resistance in sideways market. To identify sideways market look for stocks where 50/100 DMA is flat (parallel to date axis).

b. They can be used for to determine trend reversal. When stock breaks upper band and stay above it for few trading sessions then it is considered to be bullish and when stock breaks lower band ans stays below for some trading sessions bearish signal is generated.

c. In strong bullish cycle when stock is moving along with upper band and then moves towards middle band it can be considered as bullish trend reversal. In the same way when stock is moving lower band and then moves towards middle bearish trend reversal can be detected.

d. They gives very good idea of volatility of the stock. The wider the band the more volatility it has.

e. A very narrowing band means indecision on price movement and a possible break out is imminent.

Breakout of Bollinger Band

1. When the price break upper Bollinger band and both upper & lower band is expanding then probability of further up movement is high. If both bands are expanding fast means trend reversal has happened. If the price breaks below lower band and both upper & lower is expanding then chances are that it will further go down.

2. When price break upper band and and both bands are not expanding means false signal of break out.

3. When bands starts contracting after a trend means momentum in trend is loosing.

Our Website provides free Stock Screening Reports on Support/Resistance By Bollinger Bands at:

Limitation a.They alone do not provide absolute buy and sell signal.

b. In strong trending market. Bollinger bands looses its significance. They tend to give many wrong signals. Its best to avoid they in such situations.

c. In actual scenario, Price break above Bollinger band is far more than 95% (as per normal distribution) and not all break gives signal of trend reversals.

d. They often need support of another technical indicator to determine action.

Color Convention of Bollinger Band and TopStockResearch

1. Dashed grey lines which represents bollinger band.

2. Black lines represent price.

Caution for new Traders

Bollinger bands are dynamic and they move depending on volatility. So the support/resistance to may not be valid on any other day. That is why it is said it provides relative highs and lows or support/resistance.