Boiling Point Why Owning Gold Matters

Post on: 16 Март, 2015 No Comment

QE2, and the prospects of QE3 and QE4, all but ensure precious metals are heading higher.

Precious metals have proven once again that they are the best insurance against deteriorating government credibility and central bank money printing. The back story of why SPDR Gold Trust (NYSEArca: GLD) and iShares Silver Trust (NYSEArca: SLV) have more than doubled in the last three years sheds light on what the future holds for these insurance products.

In October 2007, the S&P 500 was making all-time highs even as debt markets were grinding to a halt and repo markets were in disarray. I remember being puzzled about how stocks, the greatest predictor of future economic growth—as I was told—could be rising while a credit crunch was turning into a full-fledged freeze.

I reasoned that there must be some conspiracy wherein banks would simply dump their bad debts and losses onto the Fed, which in turn would make up the difference by printing money. But that was as far as that thought went, as I concluded that this would never be allowed to happen.

Now, with the benefit of hindsight, it’s clear to me this is essentially what has played out—not only with the Fed but with central banks around the world. The Financial Times reported last Thursday that the ECB stepped up its bond purchases of euro-denominated Portuguese and Irish debt, creating a squeeze for those who had shorted those bonds or the euro.

More confirmation on the scale of the operation came as the Fed disclosed details of its $3.3 trillion emergency lending programs it deployed throughout the crisis. Most notably, the $74 billion in commercial paper to UBS—a foreign bank—made it clear that the Fed served as lender of last resort on a global scale. While I’m as skeptical as they come about what the Fed is up to these days buying bonds to try stimulate the economy with its quantitative easing program, I agree that most of those measures were vital at the time.

But, like I said, I can’t say the same for the current QE2 action, and would be even more skeptical about QE3 or QE4, should they ever come to pass, as Fed Chairman Ben Bernanke suggested is possible on the TV program “60 Minutes.”

All In Due Time

It’s through its purchases that the Fed is able to artificially compress yields and therefore subsidize bank credit losses. In addition, it prematurely encourages consumption at a time when demand is depressed because of persistently high joblessness. This is similar to the cash-for-clunkers program and the $8,000 first-time homebuyer tax credit that encouraged near-term purchasing, thus poaching from future purchases.

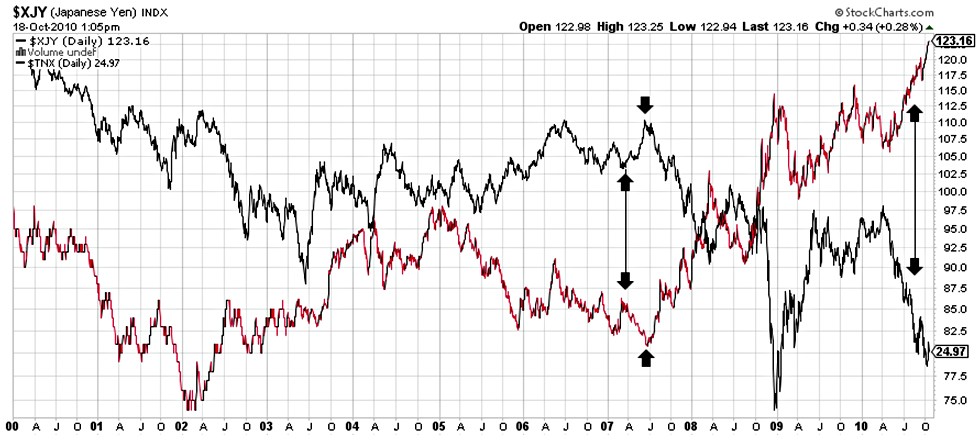

The ultimate limitation on these money-printing policies, which is still theoretical at this point, will ultimately become evident as interest rates rise. Alan Greenspan and others have speculated that a 4 percent yield on 10-year Treasurys is where red warning lights start flashing.

We can debate whether an eventual increase in bond yields for developed nations will be attributable to rising inflationary pressures or eroding sovereign creditworthiness. My sense is that it will be a little of both and, in any case, both explanations constitute reasons to own gold or some other precious metal monetary alternative.

New options for investors looking beyond gold have been coming to market, notably products from ETF Securities, such as the ETFS Physical Precious Metal Basket Shares (NYSEArca: GLTR ), which combines gold, silver, platinum and palladium, and the ETFS Physical WM Basket Shares (NYSEArca: WITE). an ETF launched last week that isolates silver, platinum and palladium in one security.

Gold, which is again flirting with all-time highs, has risen more than 25 percent this year, as measured by GLD, while SLV, the iShares physical silver ETF, is up 73 percent in 2010.

At the end of the day, if you believe that these “when-in-doubt, print” policies can and will be sustained in the face of continued deflationary threats and future recessions, then gold and silver and the other precious metals will continue to climb.

The latest round of QE and now chatter about the European bailout increasing in size are just more indicators that the printing will continue. In the short term, precious metals are looking overbought and are overdue for a correction. But long term, it’s hard to imagine this insurance getting cheaper.

Chadd Bennett is a trader and former financial adviser specializing in fixed income. He worked at Bear Stearns when it collapsed, then joined Morgan Stanley Smith Barney.