Bluebird aims $400 million IPO in 201 what is the fair value of the company

Post on: 30 Апрель, 2015 No Comment

PT Blue Bird (Bluebird or the Company) is planning for an IPO in November which could potentially raise about $400 million (approx. IDR 4.9 trillion). According to Reuters, this could be the biggest IPO fund raising in Indonesia this year. The initial offering price ranges from IDR 7,200 IDR 9,300. So as curious as I am, I tried to estimate Bluebirds intrinsic value . Intrinsic value is based on macroeconomic factors and the companys historical performance or fundamentals with no regards of its current market value. In other words, the valuation is earned based on how well the company has been performing.

If you are interested in the stock, then how much should you buy/sell the stock for? When you buy the stock at price IDR x, is it considered a premium or discount? At what discounted price are you willing to buy the stock for and at what premium price will you sell the shares? To answer these questions, it would be nice if you know the stocks intrinsic value.

Therefore I performed a Discounted Cash Flow (DCF) valuation based on Bluebirds publicly available data. I performed a valuation method which relies heavily on the Companys historical performance and minimizes subjective views. As a result I came up with a range of IDR 6,000 – IDR 7,500 per share. Let’s use the price average of IDR 6,700 as the intrinsic value .

Given this result, any price above IDR 6,700 can be considered as premium price, and any price lower can be considered as discounted price. For example if you buy the stock at IDR 6,700 and willing to gain 20%, ideally you would sell it when the stock is trading at IDR 8,040. Similarly if the stock is trading at IDR 5,360, this is 20% lower than its intrinsic value and may be a good indicator to buy the share.

Okay good, so I have the intrinsic value, but how reliable is the result? To answer that I will show you how I calculate the intrinsic value and what assumptions are used. The assumptions used in the DCF calculation are derived from Bluebirds financial statements (FY 2011, FY 2012, FY 2013, April 2013, April 2014, June 2013, and June 2014):

- Tax rate: 25% Reinvestment rate: 171.1% stabilizing to 35.9% Return on Invested Capital: 19.5% Growth on EBIT (1-tax): 33.4% stabilizing to 7% Perpetuity growth: 7% WACC: 14.2% 14.9% High growth period: 2014 2019 Stable growth period: 2020 2024 and beyond

Tax rate

25% is the standard corporate income tax rate. Although historically the effective tax rate varied between 24.4% and 26.7%, it is safe to assume a long term 25% rate.

Reinvestment rate on EBIT after tax

A rate of which the Company need to invest or reinvest in order to sustain future growth. It consist capital expenditure (net of depreciation expense) and working capital requirements.

Return on Invested Capital (ROIC)

Calculated as an operating profit after tax from total invested capital.

Growth on EBIT (1-t)

Earned not given, you may have heard of this saying which I believe should also be applied to earnings growth. Growth has to be earned, not endowed. The growth is calculated based on Bluebirds reinvestment rate and ROIC.

I use EBIT after tax because it reflects the Companys true performance, excluding non-operating income/expense such as interest, tax, and non-recurring items (which usually fluctuates over time).

Perpetuity growth

Calculated based on arithmetic average of Indonesian inflation rate published by Bank Indonesia.

WACC (Weighted Average Cost of Capital)

I dont have access to Bloomberg terminal or Capital IQ, so I estimated WACC by calculating its components myself, which consist:

- Risk free rate Default spread Beta Equity market risk premium Cost of debt Tax rate Long term proportion of Bluebirds debt and equity

High and stable growth period

Im using a ten-year (and six month) projection. The intrinsic value is calculated as per June 2014, based on the latest available financial data in the prospectus. It is assumed that during the first five years and six months the Company will experience high growth after raising capital from IPO. Thereafter Bluebirds growth is assumed to stabilize towards its long term perpetuity growth within five years.

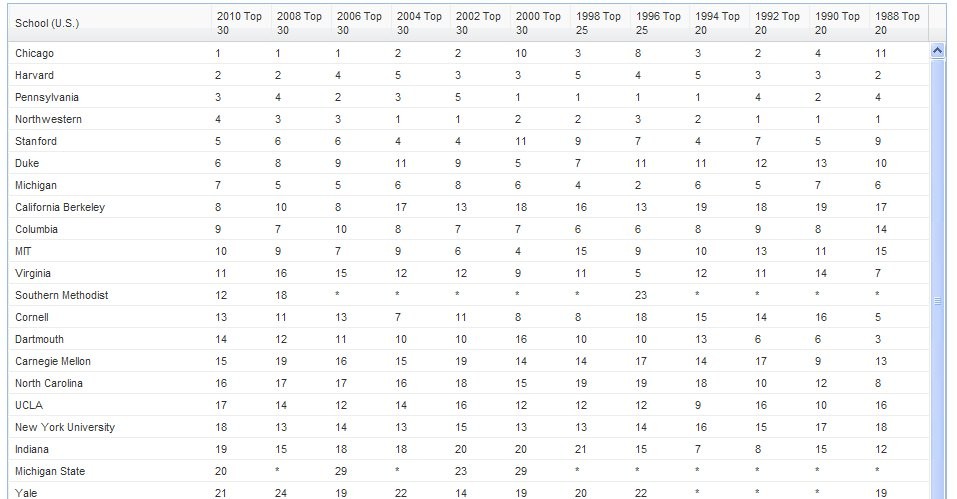

Comparable companies

I analyzed Bluebird’s comparable companies in Indonesia as part of my sanity check and found that Bluebird’s intrinsic valuation multiple would be trading at 25.1x P/E 2013 multiple and 18x forward P/E 2014 multiple. Comparing to its peers, Bluebird’s higher multiples could be explained by its market leading position (about 33% market share in number of fleet). It should be noted however that Express Transindo Utama is the closest comparable to Bluebird based on its business model. Comparing with Express, Bluebird has 26% and 19% premium of P/E 2013 and forward P/E multiple 2014 respectively.

Source: Company financial statement, Yahoo finance *) Based on historical annualized net income of the comparable companies

Conclusion

Valuation is an art, it is dependent on several factors such as market condition, industry type in which the company is operating, maturity state of the firm and most importantly your own personal judgement. Personal view may be different from one to another; therefore I tried using assumptions and methodology where objective views are emphasized. Consequently I came up with a valuation range of IDR 6,000 – IDR 7,500 per share. This implies market capitalization range of IDR 15.9 trillion 19.9 trillion and IDR 3.2 trillion IDR 3.9 trillion capital from IPO.

I hope this post can be valuable to you. Cheers and happy investing!

Disclaimer: This post is created for information purpose only. Any usage of information in this post shall be users responsibility.