Black Scholes Stock Option Valuation How to Use Black Scholes to Value a Stock Option

Post on: 1 Июнь, 2015 No Comment

Since option grants to employees depend on a stock’s future price, they are difficult to value, but this model provides an accepted formula.

(LifeWire) — For years, companies that paid workers with stock options could avoid deducting the cost of those options as an expense. The rules changed in 2005, when the accounting industry updated its guidelines on share-based payments, in a rule called FAS 123(R).

Today, companies generally choose from one of two methods to value the cost of giving an employee a stock option: a Black-Scholes model, or a lattice model. Whichever one they choose, they must deduct the options expense from their profit, reducing per-share earnings.

The Black-Scholes model is a Nobel Prize-winning formula that can determine the theoretical value of an option on the basis of a series of variables. Because options grants to employees aren’t replicas of exchange-traded options, the Black-Scholes rules require some modification for employee options.

The model’s equation is complex, but the variables are simple to understand. They are also helpful in determining the consequences of investing in companies whose stocks have higher volatility. To see if a company uses Black-Scholes to value its options, and the assumptions it makes about the options, check its latest 10-Q quarterly report on the Web site of the Securities and Exchange Commission.

Why Options Are Hard to Value

When a company gives a $1 million cash bonus to its chief executive officer, the cost is clear. But when it gives the CEO the right to buy a million shares of stock at $25 a share sometime in the future, the cost isn’t easy to figure. For instance, the option could become worthless if the stock never rises above $25 during the time the option is valid. Black-Scholes can determine the theoretical cost of the option on the date it is issued to the employee.

Three factors generally affect the price of an option under Black-Scholes, according to the Options Industry Council, a trade group:

- The option’s intrinsic value.

- The likelihood of a significant change in the stock.

- The cost of money, or interest rates.

Intrinsic Value

The Black-Scholes pricing model considers the current price of a stock and the target price as two critical variables in putting a price on an option.

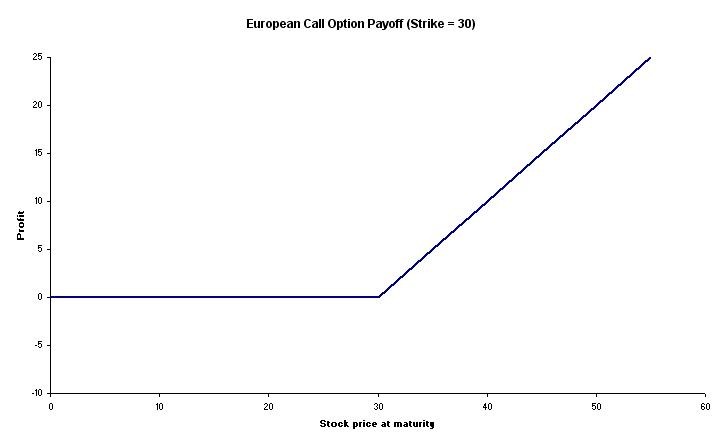

A call option, you may recall, gives the holder the right to buy a stock at a fixed target price within a specified time period, no matter how high the stock rises. Consider two call options on the same $10 stock — one with a target price of $12 and one with a target price of $15. An investor would pay more for the option with a $12 target price, because the shares would need to rise only $2.01 for the option to become valuable, or in the money.

Note that these factors are generally less significant for employee stock options. That’s because companies generally issue employee options with a target price that is identical to the market price on the day the options are issued.

Likelihood of Significant Change: Time Until the Option Expires

Under the Black-Scholes model, an option with a longer life span is more valuable than an otherwise identical option that expires sooner. This makes logical sense: With more time to trade, a stock has a greater chance of surpassing its target price. To illustrate, consider two identical call options on shares of ABT Corp. and assume it currently trades for $37 a share.

- ABT July 43

- ABT November 43

The option that expires in November has an additional four months to rise above $43, so it will be more valuable than an identical July option.

Employee stock options often expire many years down the road, sometimes a decade later. But employees often exercise options long before they expire. As a result, companies don’t need to assume that the option will be exercised on the last day of its validity. When calculating the cost of an option, companies will usually assume a shorter span — say, four years for a 10-year option. It makes sense why they’d want to do this: Under Black-Scholes, shorter terms reduce the value of an option and so reduce the cost of the options grant to the company.

Likelihood of Significant Change: Volatility

With Black-Scholes, volatility is golden. Consider two companies, Boring Story Inc. and Wild Child Corp. which both happen to trade for $25 a share. Now, consider a $30 call option on these stocks. For these options to become in the money, the stocks would need to increase by $5 before the option expires. From an investor’s perspective, the option on Wild Child — which swings wildly in the market — would naturally be more valuable than the option on Boring Story, which historically has changed very little day to day.

There are various ways to measure volatility, but all of them aim to show a stock’s tendency to rise and fall. The implication for investors is that companies whose stock prices are more volatile will pay a higher price to issue options to employees.

The Cost of Money

Higher interest rates increase the value of a call option, raising the cost of issuing stock options to employees. When the Federal Reserve increases interest rates, this tends to make stock option grants more expensive for companies.

Rates affect options prices because of the importance of the time value of money in options. Consider a person buying options for 100 shares of ManyPenny Inc. with a target price of $20. The investor may pay only a small amount for the option but may set aside $2,000 to cover the eventual cost of exercising the option and buying the 100 shares of stock. When interest rates rise, the options buyer can earn more interest on that $2,000 reserve. As a result, when interest rates are higher, buyers of call options are generally willing to pay more for an option.

For More Information

The Financial Accounting Standards Board, an independent board that establishes standard accounting procedures, provides an online statement about its rule FAS 123(R). which pertains to the pricing of employee stock options and other stock-based compensation.

The Options Industry Council offers an online tutorial on options pricing.

The Royal Swedish Academy of Sciences posts its citation from 1997, when it awarded the Nobel Prize in Economics to Robert C. Merton and Myron S. Scholes, who, in collaboration with the late Fischer Black, developed the Black-Scholes option pricing model.