Bitcoin 2015 the year of adoption and regulation

Post on: 16 Март, 2015 No Comment

20 January 2015

Simon Hamblin, CEO, Netagio

If 2014 was the Year for Bitcoin exchanges and ATMs, 2015 will be the Year of Adoption and Regulation

2014 has been a great year for Bitcoin in many ways. The Bitcoin industry has matured, and this bankless money is changing the way we use currency. Bitcoin exchanges and ATMs have been set up, driven by consumer demand to purchase goods and services with digital currencies. And very much like the Internet has shaped the way we communicate, digital currencies are impacting on how we transact, deal, barter, buy, sell, exchange, save and use money; a trend set to continue in time.

Bitcoin established itself effectively as an alternative to traditional government-backed currencies, taking off because of the benefits of being a cheaper, instant, borderless and transparent currency — consensus driven, decentralised, not centrally owned, community governed, not centrally run!

Year on year, 2013-2014, we have seen a 31.6% increase in wallets and a 29.5% increase in Bitcoin transactions, clearly illustrating how Bitcoin is growing in popularity, with the 2014 total exchange trading volume growing by over 50%.

Merchants are increasingly embracing Bitcoin. Over 75,000 merchants now accept Bitcoin, most notably Expedia, Overstock, TigerDirect, Newegg, Dell, Time and Microsoft — the second largest company in the world — recently announcing at the back end of 2014 that it would accept Bitcoin for digital content and games. Mainstream payment services, such as PayPal and Square also announced Bitcoin payment integration in the same year.

Following Bitcoins increasingly established position as a credible alternative to traditional currencies, in April 2014 Bloomberg added Bitcoin to their market data pages enabling retail and institutional investors to view Bitcoin related market information. Furthermore, Google Finance launched a Bitcoin price tracker.

The worlds leading entrepreneurs have also been very vocal in their support of Bitcoin and digital currencies, including Sir Richard Branson:

Theres a real desire for greater levels of control, freedom and scrutiny over what happens with our money, Bitcoin addresses these concerns and that is why so many people believe it represents the future. .I hope to be a part of what could be a democratisation that helps to put more power and control back into the hands of the everyday citizen.

Crucially, private equity and Venture capital (VC) companies have stepped up their investment into Bitcoin ventures. In 2014, the total amount of VC money invested into crypto-currencies, including Bitcoin, was estimated to exceed US$400million with investment coming primarily from the US and Canada, followed by Europe, Asia, the Middle East and Latin America. According to some studies, Bitcoin VC investments are expected to have surpassed early stage Internet investments in 2014, and there have been some notable VC investors, such as Bitpay, being a real game changer to the currencys future.

Hurdles remain

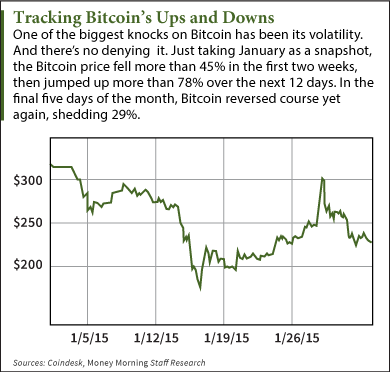

With any new technological innovation, there are initial setbacks. September 2014 saw the British banks pulling out of Bitcoin, serving a devastating blow to entrepreneurs and innovators based in the UK. It is unclear what the future holds for Bitcoin and the banking industry. However, some banks are already looking at potential benefits of Blockchain to the financial markets. In 2014, there was also no rise in the trade value of Bitcoin, however adoption was on the increase and perhaps the market is now currently less about speculation and more about real time users.

Regulation is coming

As a result of the increased activity in digital currencies, regulators have on the whole been playing catch-up with Bitcoin, some in a more considered fashion than others. In the UK, the Treasury is looking into the use of digital currencies and has been undergoing a process of consultation. We expect the government to make their views known in the Budget in March 2015. The Bank of England has come out in support of the digital currencies as alternatives to government backed currencies and values the innovation brought by Blockchain technology, especially its potential for the financial industry.

In the US, positions differ significantly. In California, Bitcoin has just been legally approved, while in New York the Bit-license plans have come in for some criticism and the government is working on a second draft. There is still a significant fragmentation regarding the adoption of digital currencies at an international level, with some countries banning the use of digital currencies outright, i.e. Russia is considering fining users, while China has prohibited banks from clearing Bitcoin transactions, and Iceland, Bolivia and Ecuador banned it completely; while others embrace them and even create Bitcoin Boulevards for the retail consumer.

So what does 2015 hold for Bitcoin? Will the stars align?

We will certainly see an increase in the adoption of Bitcoin as consumers continue to drive the demand for instant transactions and reduced costs to purchase goods and services.

The remittance market is also likely to see further adoption of Bitcoin. Currently, sending 120 from the UK to China, for example, costs on average 6.50 (with the Bank of China charging 25), whereas with Bitcoin the costs are zero. The number of merchants accepting Bitcoin will also grow, attracted by lower fees when they receive Bitcoin payments (avoiding credit card fees of 2-3%, as Bitcoin payments are free of charge). Technological innovation will continue to make Bitcoin wallets and payment systems more user friendly.

Many think 2015 will be the year for Blockchain. Technological developments of the Blockchain are occurring, with the soon to be launched 2.0 version expected to go beyond storing and transactions. We are also likely see Blockchain technology used in other sectors. For example, the financial services industry is looking at how this technology could revolutionise the back offices in banks and financial institutions. Applications could also be developed for political sectors and voting pools, to avoid tampering election results.

Blockchain technology could also be used to create a centralised ledger for storing documents and legal contracts, to confirm a change of ownership has taken place. Ethereum, the decentralised publishing platform, is already reported to leverage Blockchain technology for contracts and financial transactions. Google and IBM, according to CNBC, are also looking to invest in Blockchain. As future Blockchain uses become more realistic, Bitcoin can only benefit from these positive developments.

With the consumer pushing for Bitcoin, merchants seeing the benefits, many large organisations embracing it and VCs investing, the future for this digital innovation looks nothing but highly exciting. Meanwhile, the regulator has followed the rapid digital currency developments in order to protect the consumer and financial institutions are awaiting regulatory guidance expected this year in order to define their next move.

With all these developments in motion, the stars are set to align to make 2015 even more exciting than the previous year!

By Simon Hamblin, CEO, Netagio