Biotech ETFs Head To Head XBI V

Post on: 21 Апрель, 2015 No Comment

Zacks Funds — Seeking Alpha — Thu Mar 12, 7:15AM CDT

- Article Comments (0)

After a blockbuster 2014, the healthcare space continues its strong performance this year thanks to strong earnings growth, a merger and acquisition frenzy, corporate deals, and encouraging industry trends. While pharma stocks are flying higher, biotech yet again emerged as a leader in the healthcare world and the broader market from the year-to-date look (read: 3 Biotech ETF Winners from 2014’s Best Performing Sector ).

The industry is clearly benefiting from promising drug launches, cost-cutting efforts, an aging population, insatiable demand for new drugs, ever-increasing healthcare spending, expansion into emerging markets and the Affordable Care Act or Obamacare. A larger number of insured Americans would be able to afford medicines under Obamacare that would drive up revenues on biotechnology companies and lead to more profits.

If these weren’t enough, worldwide growth worries, the uncertain timing of interest rates hike in the U.S. weakness in Europe, Japan and key emerging markets like China, Brazil and Russia, as well as geopolitical tensions are compelling investors to move toward defensive sectors like healthcare.

Given promising trends and the sector’s high growth potential, the biotech ETFs have seen smooth trading since the start of the year. While most of the biotech ETFs gained in double digits, two simple vanilla products — SPDR S&P Biotech ETF (NYSEARCA:XBI ) and First Trust NYSE Arca Biotechnology Index Fund (NYSEARCA:FBT ) — are leading the way with 20.9% and 16.2% gains, respectively (read: 3 ETFs Surging at Start of 2015 ).

Being introduced in 2006, both funds provide relatively equal exposure across a number of securities and have a Zacks ETF Rank of 2 or ‘Buy’ rating with a High risk outlook. While the duo might appear similar at first glance, there are a number of key differences between the two that are detailed below:

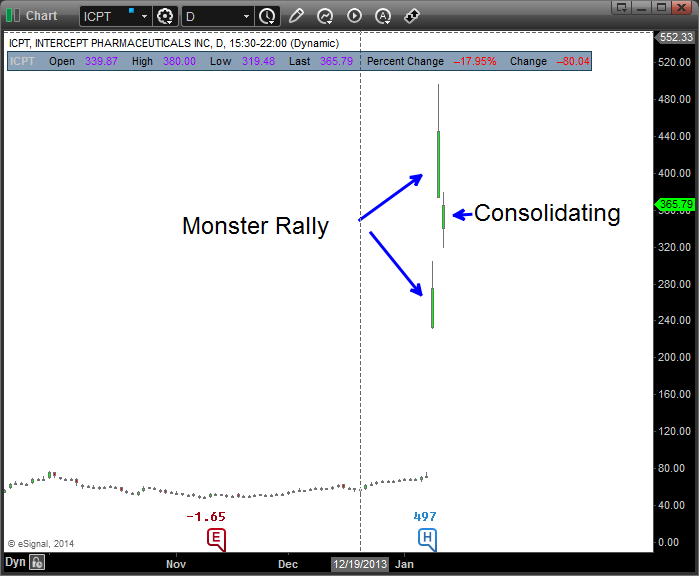

This is by far the most popular choice in the biotech corner with an AUM of $2.2 billion and average daily volume of more than 565,000 shares. The fund tracks the S&P Biotechnology Select Industry Index and holds about 87 securities in its basket with none accounting for more than 2.18% of assets. Exelixis, Foundation Medicine and Intercept Pharmaceuticals occupy the top three positions in the basket.

The product has a certain tilt towards small cap stocks as these account for three-fourths of the portfolio while the rest is almost evenly split between mid and large caps. It charges 35 bps in fees per year from investors.

This fund follows the NYSE Arca Biotechnology Index and holds about 30 securities in its basket. Intercept Pharmaceuticals (NASDAQ:ICPT ), Pharmacyclics (NASDAQ:PCYC ) and Celldex Therapeutics (NASDAQ:CLDX ) are the three top elements with none holding more than 5.41% of assets. The ETF has a nice mix of all cap securities with 37% allocated to large caps, 32% to small caps and the rest to mid caps.

The fund has amassed $3 billion in its asset base and trades at a good volume of more than 201,000 shares a day. It charges investors 60 bps in fees per year.

The following table summarizes the similarities and dissimilarities between the two biotech ETFs:

To sum up, XBI and FBT track different indices and hold different sets of stocks in their top 10 holdings with a larger concentration on First Trust product. Further, FBT is expensive than XBI by 25 bps and has a relatively higher bid/ask spread. However, in terms of performance, both are performing exceptionally well and generated returns of over 41% over the trailing one-year period.

Investors should note that XBI focuses on small cap stocks while FBT offers a diversified exposure to all caps, suggesting their varied preferences.

Read more articles from Seeking Alpha:

- Smart Alpha Addresses Inherent Risks Of Smart Beta

- New Report Concludes Alternatives Needed For Changed Market

- When Will The VIX Tell Us It’s Time To Buy SVXY?

- Chicago Fed Evans’ Forward Guidance And GLD

- What Could Replace PIMCO High Income Fund?