Bill Gross lost his stockpicking cat so he says to reduce duration The Tell

Post on: 22 Июнь, 2015 No Comment

There is a tragic end to all living things, says Pimcos Bill Gross in his latest investment outlook.

No, the fixed-income money manager is not talking about the bond market. He is referring to his cat, whose feminine grace earned her the name Bob in the Gross household. And it sounds like the kittys daddy has good reason to be upset: Bob was a prized stock picker.

Reuters Bill Gross

Gross remembers fondly: I often asked her about her recommendations for pet food stocks, and she frequently responded – one meow for no, two meows for a you bet. She was less certain about interest rates, but then it never hurt to ask.

In the absence of his trusty companion, Gross appears to be trudging on, and hes untangling the complexities of todays bond market without Bobs help.

The topic of the month is asset pricing and volatility. Gross notes that the yield investors receive on their securities per unit of duration is very low at the moment. That means investors have to either extend their duration, a measure of sensitivity to interest rates, to get more yield, or lower their duration even further. So what does he suggest investors buy?

PIMCO recommends overweighting credit and to a lesser extent volatility and curve. Underweight duration. Although credit spreads are tight, they are not as compressed as interest rates, which are now in the process of normalization. While PIMCO agrees with Janet Yellen that such normalization will be a long time coming (the 12th of Never?), probabilities suggest that as the Fed completes its Taper, the 5–30 year bonds that it has been buying will have to be sold at higher yields to entice the private sector back in.

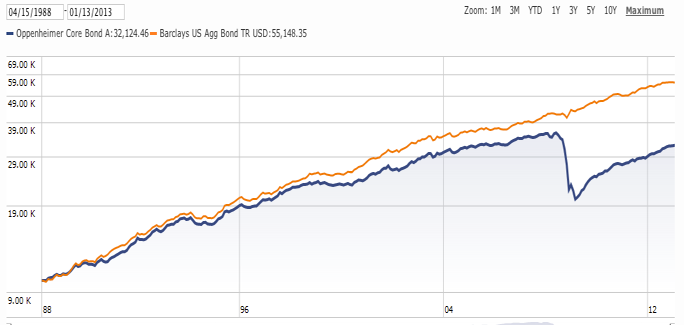

Whether thats enough to outperform his competitors remains to be seen. Grosss flagship Pimco Total Return Fund /quotes/zigman/132344/realtime PTTRX underperformed 95% of peers in March. and continued to bleed assets. Investors pulled $3.1 billion from the fund last month, in the 11th consecutive month of outflows. The firm has been in the center of controversy following reports that tensions between Gross and former CEO Mohamed El-Erian led to his resignation in January.

But perhaps Bob will help turn things around in her remaining eight lives. Says Gross: She was always more certain about pet food stocks, but then maybe kitty heaven has given her some additional insight. I shall have to ask her in my dreams. Sometimes dreams come true you know.

Some readers were less than optimistic on Twitter:

– Ben Eisen

Follow Ben on Twitter @beneisen .

Follow The Tell @thetellblog .

More from the Tell: