Big Stocks v Stocks I Understanding Penny Stocks

Post on: 3 Апрель, 2015 No Comment

As you review the following differences between blue-chip equities and penny stocks, you may be able to see why professional analysts and institutional investors usually shy away from these speculative shares.

The kind of money that the big players use could crack the backs of many of these penny stock companies. There would not be enough volume on the other side of their trades to enable the transaction, because some penny stocks often trade only a few thousand dollars worth per day.

The negative connotation towards penny stocks among financial industry insiders needs to be kept in context. Sure, these investments are often low-volume, inexpensive shares of unproven companies. However, that is the beauty of penny stocks, and is partly why you can acquire such potentially rewarding stocks at such bargain prices.

As well, the lack of institutional interest is one of the keys to our methodology of picking winning penny stocks. Getting involved early, then holding on as the company gets discovered and explodes in price, is partly dependent upon the previously unknown company suddenly gaining interest from bigger players.

Speculation

Speculation is based on penny stock companies having lower available information about their operations, minimal revenues, unproven management, and often an unproven product or industry.

A big-name company like General Electric or Ford Motors will have very little speculative value. In other words, you will probably not make hundreds of percentage points on your shares, but instead would be happy with returns of 10% to 20% per year.

In some cases, traders even use large-cap stocks to hedge or protect their portfolios, out-perform the market, preserve their capital, or diversify their exposure.

On the other hand, trading penny stocks with hopes of selling when you have realized a 20% gain might be folly. Penny stocks make their gains by the hundreds of percentages, and thousands, not just by the tens.

There are many bad investments in the penny stock field, so the best way to succeed is by isolating those with superior speculative value. The chance of buying into shares of the company that could multiply 10 or 20 or 50 times in price is the whole idea of speculation.

Value and Predictability

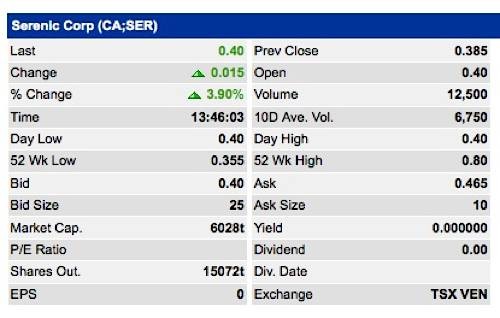

Large-cap companies usually have more predictable revenues and earnings. Many analysts and investors follow the companies, so that day to day events are quickly factored into the share price, and the stock often reflects a pretty accurate ‘worth.’

In contrast, it is not possible to calculate the actual worth of most penny stocks. Some do not have inventories, a revenue stream, or even a proven product. The shares rise and fall based on buying and selling demand, and that demand is driven mainly by waves of speculation.

By their nature, it is nearly impossible to know what price a penny stock share should be trading at, and conventional financial ratios and industry comparisons are rarely effective measures for realizing a penny stock’s tangible value.

Compare Penny Stocks to More Conventional Blue-Chip Stocks