Betterment Review The Simple Dollar

Post on: 28 Март, 2015 No Comment

Searching for the best low-fee, no-hassle retirement options.

As I explained last week, Im on a quest to find the best retirement plan to roll over my old 401(k). I’m going to conduct the most thorough research I can publicly and then put my money where my mouth is, literally rolling over my old 401(k), worth approximately $85,000, into the best plan I can find.

Today, I will take a deep dive into the online financial advisor Betterment. one of the true automated account options out there.

In The Best Retirement Accounts and 401(k) Rollovers are Online. I explained how a new class of online financial advisors (OFAs) are fighting to lower fees and provide better service to main street investors. This idea appeal to me, because Im really after a no-hassle, hands-off approach to my own long-term investing goals.

If theres one thing I learned from trading the markets professionally, its that slow and steady wins the race when it comes to retirement planning. Thats why online financial advisers are so appealing to me. These types of accounts do all of the value-added tasks a managed account does, but with better execution and with remarkably lower fees.

Full disclosure: At the time of this writing, I do not have a Betterment account. However, as part of this ongoing series on online financial advisers, I will be rolling over my $85,000 401(k) balance after choosing the best service for me.

Betterment at a Glance

Betterment is a financial advisor that uses software to automate value-added tasks that most brokers charge big fees to do. Betterment is just like many of the biggest banks that pedal long-term wealth management and retirement solutions, except that Betterment does this with drastically lower costs and better execution.

Types of Accounts Supported

Fee Tiers

Registration/Regulation

Security

Betterment Details

What Is Betterment?

Betterment is an online brokerage just like many others, but it takes the view that fees eat into long-term investing account returns. So Betterment lowers fees by using ETFs (exchange-traded funds) that diversify like mutual funds, but are tradable like stocks. ETFs carry very low expense ratios. Betterment also uses software to create a low-cost, diversified plan for you, and then constantly manages your account through:

Betterments Main Features

Optimized, Globally Diversified Portfolio

Your money is placed in an optimized, diversified portfolio that utilizes very low-cost, liquid ETFs. This portfolio approach balances risk and reward. The initial allocation is based on your age and retirement timeline, but you are in complete control of your portfolio. So, you are free to manually adjust it based on your individual risk preference.

Automated Portfolio Rebalancing

Over time, the ETFs inside your portfolio will grow and shrink. However, the risk management side of portfolio theory is handled by allocating a set amount to each sector and maintaining that balance. When these allocations get out of whack, your returns can drift away from your goals.

For example, let’s say you want 10% of your portfolio in technology. After a big run in the Nasdaq, you might find that tech stocks now comprise 15% or more of your portfolio. Selling some of the shares that have risen to get your allocations back in balance ensures you’re buying high and buying lower, to keep your risk profile steady.

Betterment uses smart algorithms to automatically buy, sell, and reinvest cash flows to keep your allocations in balance.

I like this feature. Its a HUGE time saver, and in my opinion much better than rebalancing once a year with your broker.

Betterment Goals

You can divide your funds into multiple investment goals, each with its own allocation. Let’s say you want to set aside money for a home down payment, retirement, and a new car. You can split your contributions among those three goals, and set a different risk level for each.

This isn’t really a feature I will use in my retirement account, but it is attractive for many people who want to save for a variety of purposes.

Automated Tax Loss Harvesting

If you’re looking at tax-advantaged accounts like IRAs, then this feature doesn’t really apply, because your account is already tax-advantaged. So when I roll over my 401(k), I won’t use this feature.

However, if you have diligently maxed out your tax-advantaged accounts and have extra investable assets to put into a normal investing account, Betterment’s software makes sure you capitalize on any losses that you can use to offset your taxable income. This is done on a regular basis, as opposed to once a year as your human financial advisor might do.

Smart Dividend Reinvestment and Fractional Shares

When you receive dividends, those proceeds are first distributed to make sure your portfolio allocation is in line. So if you receive a dividend from a bond fund, instead of adding it to that bond fund, the software looks for an area where you might be low, say a stock fund, and automatically invests the money there.

This happens with every penny you own, since Betterment has the ability to invest in 1/1,000,000th of a share! You never have money sitting on the sidelines. This has been a real issue for me in my current 401k account. I constantly see cash in my account that I would otherwise like to have invested. I don’t have the time to constantly monitor this, so smart reinvestment is a great feature.

Additional Features

- Five-minute account setup

- No minimums for withdrawals or deposits

- No account minimum

- Automatic deposits

Who Might Betterment Be Good for?

Betterment is a great option for two segments of investors, in my opinion. I tend to fall into the first category.

- Long-term passive investors with some financial knowledge. I call this group the “Planners and Forgetters. These types of investors understand how to be patient with their money. They understand the concepts behind portfolio diversification and how fees impact long-term returns.

- Financial novices looking for an easy investing approach, the best bang for their buck, and time savings. This group may be intimidated by starting an investment program, and may not want to invest all their time to figure it out. This group may be young millennials skeptical of high-priced financial advice, or busy older professionals who need to get started on their retirement savings.

Who Is Betterment Not Good For?

If you want/need a lot of handholding, you may want to go with a human financial advisor, and pay a bit more. People who fall into this category may have limited knowledge of financial markets and want to learn about the process in more depth. Of course, not all financial advisors like handholding their clients!

Another group that might not like Betterment are people who think they can beat the market, or want to trade individual stocks. I do some short-term trading myself through a designated trading account at another online broker, but this is mostly event-driven and for fun. In my experience, it is hugely disadvantageous to “trade your long-term retirement funds.

The Betterment Onboarding Process

When you navigate to the site, you’ll notice that the first thing Betterment asks is your age. The number of years until your retirement is an important variable for determining a proper asset allocation. Generally speaking, the more years you have until retirement, the more risk you can take. So your “weight toward stocks (as opposed to fixed-income investments such as bonds) will be higher.

But, based on your goals, you may fall into a different risk allocation category. In the screenshot below, you can see three scenarios. If your goal was to build a short-term safety net or you expect to retire in just a couple of years, Betterment recommends a more conservative 40/60 stock/bond split. In my opinion, you should only build short-term reserves through cash savings or very short-term liquid bonds, but 40/60 is Betterment’s recommendation. You could conceivably go all short-term bonds by selecting your allocation on your own.

Another of Betterment’s recommended starting points is an 81/19 stock/bond split, for people within 15 years of retirement age.

My Allocation for a 401(k) Rollover

In the screenshot below, you can see that for a 33-year-old setting up an IRA, Betterment recommends a stock/bond allocation of 90% stocks and 10% bonds. I believe you can adjust this mix once you create an account, based on your own goals and risk profile.

So, based on this recommendation, my 90% stock allocation and 10% bond allocation would be spread across the ETFs in the screenshot below.

It was a little hard to find, but in the picture below, you can see how the basic Betterment portfolio is allocated. There is a cursor feature where you can drag your cursor over to your desired risk allocation and then see what your ETF weightings are. You can access this feature here .

For my 90% stock portfolio, here is how the weightings break down:

- Vanguard US Total Stock Market Index ETF (VTI): 16.2%

- Vanguard US Large-Cap Value Index ETF (VTV): 16.2%

- Vanguard US Mid-Cap Value Index ETF (VOE): 5.2%

- Vanguard US Small-Cap Value Index ETF (VBR): 4.5%

- Vanguard FTSE Developed Market Index ETF (VEA): 37.5%

- Vanguard FTSE Emerging Index ETF (VWO): 10.5%

- iShares Short-Term Treasury Bond Index ETF (SHV): 0.0%

- Vanguard Short-term Inflation-Protected Treasury Bond Index ETF (VTIP): 0.0%

- Vanguard US Total Bond Market Index ETF (BND): 3.2%

- iShares Corporate Bond Index ETF (LQD): 1.7%

- Vanguard Total International Bond Index ETF (BNDX): 1.6%

- Vanguard Emerging Markets Government Bond Index ETF (VWOB): 1.6%

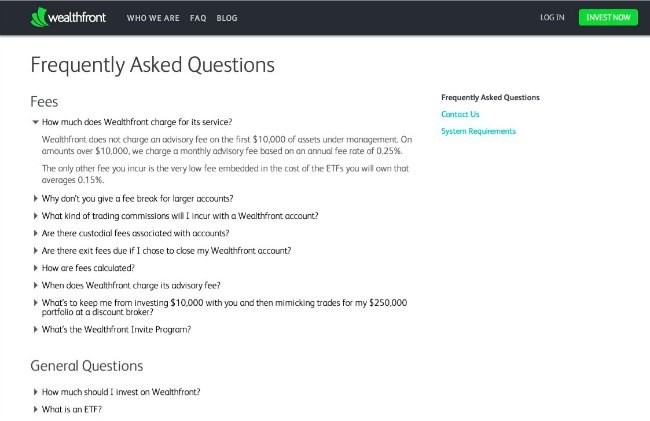

Betterment Fees

Betterment fees are low overall compared to traditional managed portfolios. As I outlined, a typical managed portfolio at a mainstream broker can run you 1.5% per year!

Betterment offers three fee tiers based on your portfolio balance. An investment balance of under $10,000 gets dinged with a 0.35% fee. Accounts over $10,000 are charged 0.25%, but for accounts with $100,000 or more invested, the fee is lowered to 0.15%:

For accounts under $10,000, you need to set up a $100 (minimum) monthly direct transfer into your account, or you’ll be charged an additional $3/month fee.

When I talked to Betterment’s customer service I found out that you can have multiple accounts and that the TOTAL balance counts toward your fee tiers. So it is possible for me to roll over my $85,000 401k balance and move my taxable account to achieve the $100,000 breakpoint and only pay 0.15%.

Remember that the Betterment fees stated above are only for their management services. I believe the services they offer are well worth the price, especially compared to regular investment advisors. However, the true cost of this service must include the expense fees for the ETFs themselves. This issue is not unique to Betterment. Any ETF you buy through any broker charges a fee. The fees are drastically lower than those for mutual funds, however.

So let’s take a look at ETF expenses. According to the Betterment support site. the expense ratios for ETFs Betterment uses are between 0.13% and 0.16%. So, we should add roughly 0.15% more on top of the Betterment management cost to arrive at a true figure. Still, a total of 0.3%-0.5% is dirt cheap when it comes to wealth management!

What Will I Do with my $85,000 Account?

Betterment has shown itself to be a viable option for me to roll over my old 401(k). I like the true automated nature of the account. I could set it up, and let it take care of itself.

Knowing what I do about portfolio theory, I trust the allocation decisions those don’t worry me. In long-term investing, I’m more worried about inefficiencies that pile up over time. Betterment seems to have a great handle on solving this problem. This removes a ton of anxiety from long-term investing.

Betterment, along with Wealthfront, seem to be the most heavily financed companies in this industry, and are winning the assets under management (AUM) competition. Both of these metrics are important to determine which of these online financial advisors will be around for the long haul.

The feature that could tip the balance toward Betterment is their pricing structure. By starting with roughly $85,000 in my account, this puts me within a stone’s throw of getting to the $100,000 breakpoint which can net me lower fees. Plus, all of my balances across all my Betterment accounts count toward that breakpoint. So I can have an IRA, taxable account, and accounts for my kids, too!

Lets see how Wealthfront, another online financial adviser, stacks up when I review it next week!