Better Dividend Stock Annaly Capital Management iIncome Corp

Post on: 26 Май, 2015 No Comment

September 15, 2014 | Comments (0)

Forget for a moment that Annaly Capital Management ( NYSE: NLY ) and Realty Income ( NYSE: O ) are real estate investment trusts, or REITs. Forget that because they distribute 90% of their taxable income they can support a 10.5% and 5.1% dividend yield, respectively. And instead, remember that every great dividend stock – whether it’s high-yield or not – needs to meet the same three requirements:

- Its dividend is safe and consistent,

- its stock price appreciates over time,

- and it has a durable business model.

With this in mind, because Realty Income has the more consistent dividend, stronger stock price growth, and safer and more durable business model – despite having a lower yield — it is the more attractive long-term investment.

Consistent dividend

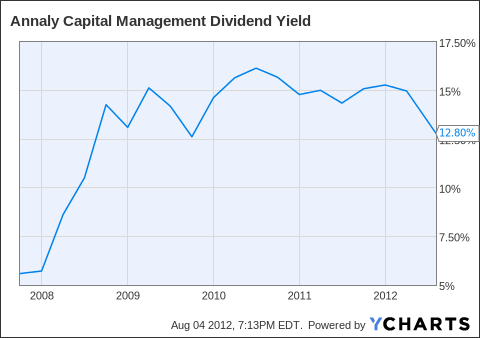

Consider the chart below, the blue bars shows Annaly’s dividend yield at the start of each year, or assumed yield, and the orange shows the actually dividend return for the year. What this means is that in six of the ten years – between 2003 and 2013 – Annaly had to make cuts their dividend.

Source: Ycharts and Company Filings

In the same time, Realty Income increased its dividend every year. Because dividend yield (the formula ) assumes a stable dividend, investors would have received a greater dividend return than the assumed yield every year.

Source: Ycharts and Company Filings

I prefer Realty Income’s more consistent dividend return. However, it should be noted that despite Annaly’s dividend being less consistent, its average dividend return over that time period was nearly 11% — which smoked Realty Income 7% dividend return.

The game changer

There is a great and important difference between dividend return, and total return. This is why previous section is a bit misleading. But it helps show the importance of accounting for the dramatic effect rising and falling stock prices can have on your total return.

As mentioned, Annaly returned 11% per year in dividends while Realty Income returned just 7%. However, because Annaly’s stock price was cut nearly in half between 2003 and 2013, and Realty Income’s stock price doubled, their annualized returns shake out to 6% and 15%, respectively.

In fact, Realty Income outperformed Annaly eight of the 10 years shown below.

Source: Yahoo! Finance

Owning a business that yields a strong dividend means much less if the stock cannot appreciate overtime. Because, as you can see, stock price depreciation can wash away your returns in a hurry. This is why it’s so important to invest in a company with a durable business model that supports growth.

Business model

Realty Income borrows using either notes or mortgages to buy properties, and rents them to retail businesses under long-term contracts. Rinse and repeat since 1969, and the company, today, has over 4,000 properties.

Annaly’s relies on borrowing short-term to fund it’s longer-term investments, primarily, in residential mortgage-backed securities — which are pools of residential housing debt. Today, Annaly holds about $80 billion worth of these securities.

Both business models come with shortfalls — for instance rising borrowing costs or falling real estate prices will hurt Realty Income — however, Annaly’s volatile returns are a product of their major asset class being extremely sensitivity to interest rates, and the company’s use of leverage .

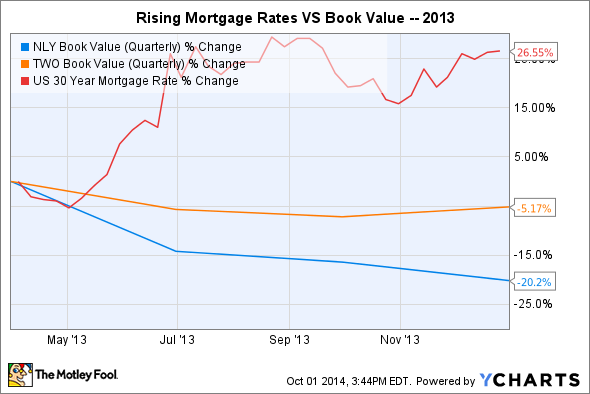

As the chart below shows, when interest rates rise the value of the company’s assets — or NAV, for net asset value — decreases significantly. The opposite is true when interest rates fall.

Source: Company filings

Annaly also uses leverage — or, borrow against their equity — to magnify returns. The more leverage the company uses, the more dramatic interest rates changes effect assets values. This is why when interest rates likely to rise, Annaly will reduce its leverage, and therefore hold less assets and make less income.

Because Realty Income doesn’t use leverage nearly to the same extent – in fact, the company’s equity is currently greater than its liabilities – changes in the value of real estate or interest rates does not affect them nearly as dramatically.

The last word

Comparing Realty Income and Annaly reminds me of the story of the tortoise and the hare. By investing in liquid securities and having opportunity to amplify returns using leverage Annaly can create massive short-term returns.

However, because of the vulnerabilities inherent in their strategy, over the long-term Realty Income can slowly but surely build its portfolio of properties, grow its dividend, and ultimately, be the greater dividend stock.

Top dividend stocks for the next decade

The smartest investors know that dividend stocks simply crush their non-dividend paying counterparts over the long term. That’s beyond dispute. They also know that a well-constructed dividend portfolio creates wealth steadily, while still allowing you to sleep like a baby. Knowing how valuable such a portfolio might be, our top analysts put together a report on a group of high-yielding stocks that should be in any income investor’s portfolio. To see our free report on these stocks, just click here .