Beta financial definition of Beta

Post on: 18 Апрель, 2015 No Comment

Beta

A measure of a security’s or portfolio’s volatility. A beta of 1 means that the security or portfolio is neither more nor less volatile or risky than the wider market. A beta of more than 1 indicates greater volatility and a beta of less than 1 indicates less. Beta is an important component of the Capital Asset Pricing Model. which attempts to use volatility and risk to estimate expected returns .

beta

A mathematical measure of the sensitivity of rates of return on a portfolio or a given stock compared with rates of return on the market as a whole. A high beta (greater than 1.0) indicates moderate or high price volatility. A beta of 1.5 forecasts a 1.5% change in the return on an asset for every 1% change in the return on the market. High-beta stocks are best to own in a strong bull market but are worst to own in a bear market. See also alpha. capital-asset pricing model. characteristic line. portfolio beta .

Beta.

Beta is a measure of an investment’s relative volatility. The higher the beta, the more sharply the value of the investment can be expected to fluctuate in relation to a market index.

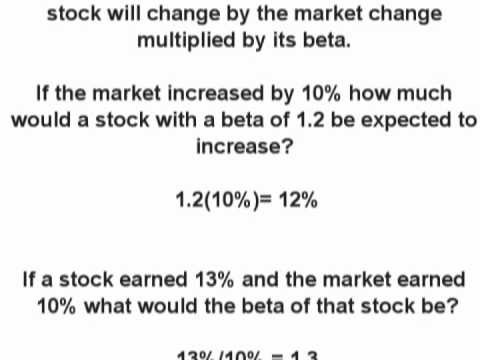

For example, Standard & Poor’s 500 Index (S&P 500) has a beta coefficient (or base) of 1. That means if the S&P 500 moves 2% in either direction, a stock with a beta of 1 would also move 2%.

Under the same market conditions, however, a stock with a beta of 1.5 would move 3% (2% increase x 1.5 beta = 0.03, or 3%). But a stock with a beta lower than 1 would be expected to be more stable in price and move less. Betas as low as 0.5 and as high as 4 are fairly common, depending on the sector and size of the company.

However, in recent years, there has been a lively debate about the validity of assigning and using a beta value as an accurate predictor of stock performance.

Beta

What Does Beta Mean?

A statistical measure of the volatility of an investment in relation to the market as a whole; also known as “beta coefficient” or “systematic risk.”

Investopedia explains Beta

Beta is calculated by using regression analysis; one should think of beta as the tendency of a security’s returns to respond to swings in the market. A beta of 1 indicates that the price of a security will move in tandem with the market; a beta less than 1 means that the security will be less volatile than the market. A beta more than 1 indicates that the security’s price will be more volatile than the market. For example, if a stock’s beta is 1.2, theoretically, it’s 20% more volatile than the market. Many utilities stocks have a beta less than 1. Conversely, most high-flying tech stocks have a beta greater than 1, offering a chance for higher returns but with far greater risk.