Best Technical Indicators Learn The Stair Step Strategy

Post on: 18 Август, 2015 No Comment

Learn How To Use Some Of The Best Technical Indicators To Swing Trade Stocks

Yesterday I demonstrated how to take a simple stochastic indicator and create one of the best technical indicators for short term trading. Today Im going to expand and show you another entry method using the same indicator and the same settings. If you have not read yesterdays article or have not seen the video, theres a link to both at the bottom of this page for you to review.

Solid Technical Analysis Indicators Do Not Have To Be Complex

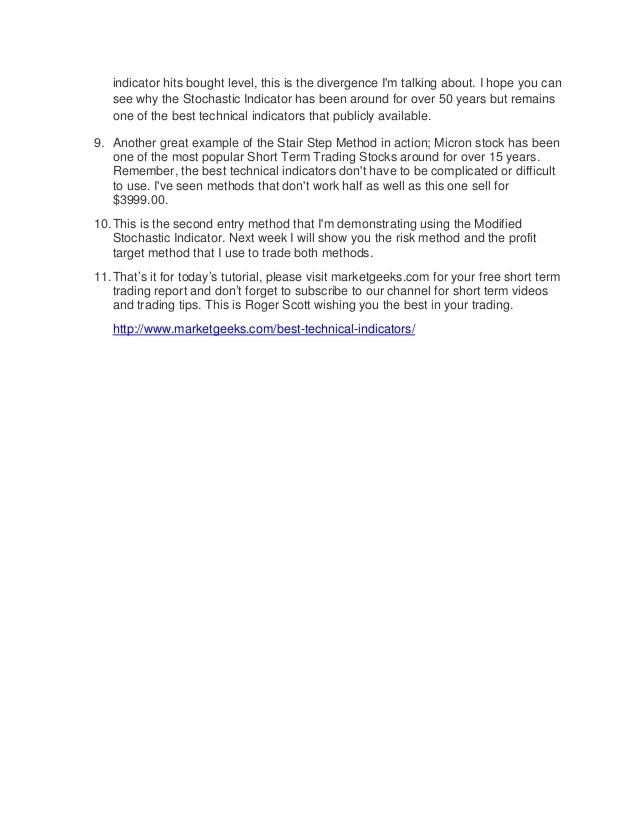

This entry strategy is called the stair step method and uses the modified stochastic indicator to measure retracements away from the trend. To review, you must change the settings on the Stochastic Indicator from 14 bars to 5 bars for the slow line and leave the fast line at 3 as is. This slight modification is necessary to turbo charger the Stochastic for short term trading and creates one of the best technical indicators for short term market swings.

Pick Stocks Or Other Markets That Are Technically Trending Strongly

The first thing you need to do is make sure that you select stocks or any other market thats trending strongly. If you need some basic tips on finding trending markets or what qualifies as a trending market, you can review several videos that I previously created that demonstrate this step. The Stochastic Indicator works much better for retracements than for picking tops and bottoms. Therefore you want to find a stock or any other market thats trending strongly either up or down.

What we want to see is the Stochastic Indicator creating a double bottom pattern. The only caveat is the second bottom has to be higher than the first bottom. Both have to be below 20 but the second one has to be higher than the first one. There should also be divergence between the second bottom and the market you are trading, in plain English this means the stock or other market you are trading must not drop very much compared to the indicator. Heres an example so you can see what I mean.

The modified Stochastic Indicator makes a second bottom but its not as low as the first one.

Notice the strong divergence between stocks price and the indicator; this is the type of divergence you want to see.

Another great example of the Stair Step method in action.

The Stochastic drops to below 20 but the stock barely lost 2 points, this is good divergence between the indicator and the stock. The second low is higher as well.

The second top is above 80 but still lower than the first one.

In the example below you can see how the Stair Step Strategy works with stocks trending down. You can tell by looking at Big Blue that the second high is lower but still manages to go above 80. Also notice how IBM barely rises while the indicator hits bought level, this is the divergence Im talking about. I hope you can see why the Stochastic Indicator has been around for over 50 years but remains one of the best technical indicators that are publicly available.

I typically avoid stocks under $20 dollars when I go long. This rule doesnt apply when you shorting stocks.

Another great example of the Stair Step Method in action; Micron stock has been one of the most popular Short Term Trading Stocks around for over 15 years. Remember, the best technical indicators dont have to be complicated or difficult to use. Ive seen methods that dont work half as well as this one sell for $3999.00.

This is the second entry method that Im demonstrating using the Modified Stochastic Indicator. Next week I will show you the risk method and the profit target method that I use to trade both methods. For more on this topic, please go to: Bollinger Bands Strategy How To Trade The Squeeze and Technical Analysis Basics The Moving Target Strategy