Best Stock Sectors of 2013 Healthcare and Consumer Discretionary stocks up over 30%

Post on: 5 Апрель, 2015 No Comment

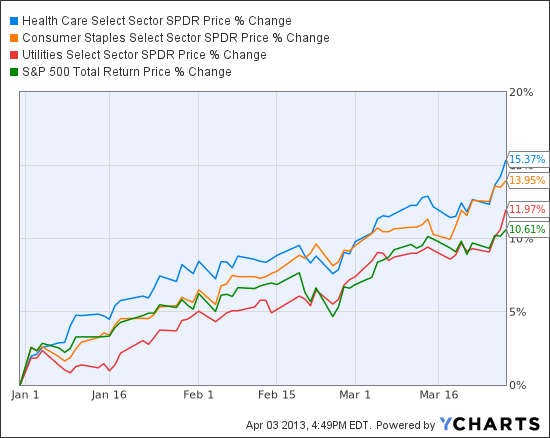

It’s been nearly impossible for investors with broad equity exposure to go wrong in a year where the stock market has reached historic heights seemingly every week. The S&P has gained nearly 21% year to date, and the Dow is up close to 20%, handsomely rewarding many investors that stuck by their market-tracking mutual funds. While the market indices have enjoyed outstanding years, not all of the underlying sectors have performed similarly. Below is a summary of the year-to-date performance of the S&P 500 broken down by sector:

S&P 500

What’s changed? Part of the reason is due to a shifting regulatory environment — the FDA approved 39 drugs in 2012. the most in over a decade. Also, with Obamacare set to begin its final phase of implementation in 2014, an estimated 30 million Americans are expected to gain coverage. While profitability may come under pressure, insurance companies are likely to benefit in addition to other parts the health care supply chain that expect to see an increased demand for their products and services. The development of a strong product pipeline has been another important factor. Many big biopharma companies have struggled to innovate in recent years despite runaway R&D budgets, and have been forced to turn to acquisitions to make up for the lack of innovation. Many of these acquisitions are finally beginning to transition from projects to approved products that can now be commercialized.

Healthcare stocks have historically been the bane of public market investors for many years until recently. Strong demographic tailwinds have always existed in the sector (average lifespan is always increasing and people always need healthcare), but this hasn’t been able to translate into performance until 2012. Prior to this year, healthcare stocks had not led gains in U.S. equities since 1998.Given how well the broader market has performed, it is no surprise that nearly every sector within the S&P has generated returns in excess of 15%. That said, not all sectors have achieved the same level of success — both healthcare and consumer discretionary stocks have achieved pretty significant outperformance, while utilities and telecom have done quite a bit worse.

Despite the many positive trends, there still are some concerns. One of the main problems that has been facing the industry is the patent cliff, or the wave of patents that are due for expiration on blockbuster drugs. This continues to be an issue, as many big pharma companies stand to lose billions of dollars in revenue. Despite the upswing in public valuations, healthcare earnings growth on the year has actually been slightly negative.

Consumer discretionary stocks, the companies that sell non-essential goods and services like retailers, automobiles, travel companies, are heavily tied to consumer spending and have also been big winners this year. Netflix and Best Buy are two of the largest gainers on the S&P, both increasing over 200% YTD. The driver for this has been a more confident consumer — the economic environment has become a lot more favorable to consumers, as the job market is beginning to look healthier and the housing market continues to to improve. Also, earnings growth is expected to be up 3% from 2012, higher than any sector except financial stocks according to Factset .

Given the strong outlook for both these sectors, does it make sense to chase performance and concentrate in healthcare or consumer discretionary companies? Conventional wisdom suggests that this would be an awful way to approach portfolio management. After all, one of the main benefits of owning an index fund is the fact that risk is diversified across sectors that aren’t perfectly correlated with each other. Although both healthcare and consumer sectors remain are positioned nicely to outperform the broader index, most investors should remain steadfast in their approach to mirror the market, not beat it.

Read More From NerdWallet:

1 Performance represents total return (includes reinvested dividends) as of closing on 9/18/13