Best Small Cap Stocks for 2013 Small Cap Stocks

Post on: 16 Март, 2015 No Comment

Best small cap stock picks for 2013. Come see how we trade small cap stocks. Explore the best online resource for small cap growth and value. 100% Free.

Risks of Small Cap Stock Trading and Investing

While it is true that the rewards of small cap growth stock investing can significantly out-perform other stock market investments, there is also the risk of substantial loss. Never trade or invest in small cap stocks with money that you can’t afford to lose. Before you invest, seek more information regarding the risks of equity investing by visiting the SEC website and by consulting with a certified financial planner.

Best Small Cap Stocks for 2013 Why Small Cap Stocks?

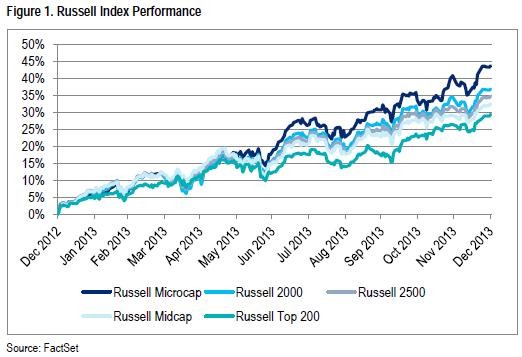

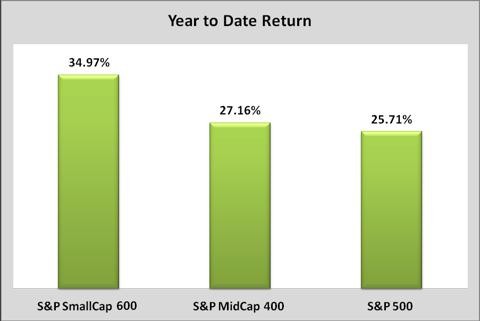

Small cap stock investing and trading is generally for Investors with a high tolerance for risk. Assuming this risk has paid off, however and small cap stocks have offered the best long-term investment returns over time as compare to mid cap and large cap stocks.

Since 1978, the Russell 2000 Small Cap Value Index has produced average annual returns of 13%. In the same time period, the Russell 2000 Small Cap Growth Index has produced average annual returns of 9%. Large cap stock indices such as the Dow Jones Industrial Average and the Standard and Poors 500 Index have typically averaged 8% growth in comparison.

Past performance is no guarantee of future results.

Best Small Cap Stocks for 2013 Small Cap Growth

When selecting small cap growth companies to invest in, we generally seek rapid and accelerating sales, revenue, and earnings growth. We dont always care so much if the stock price itself is expensive. If anything, it makes sense to select growth stocks with strong relative strength. We want to see companies that provide a product or service that is making money hand over fist. We also want to see that Wall Street agrees with the analysis (relative strength).

The following small cap growth stocks have met this criteria for the start of 2013:

CRUS A semi-conductor company with a strong recent history of revenue growth. Over the past 5 years, CRUS has grown its earnings by an average of over 50% per year. For more information on CRUS, click: CRUS Small Cap Growth Stocks .

ARIA — Ariad Pharmaceuticals, is a semi-speculative and risky small cap growth stock with explosive growth potential. They had only $1 million in sales this year and are expected to see $46 million next year. You can click the chart of ARIA to enlarge. For more on ARIA, click ARIA Small Cap Growth Stocks

SWSH Swisher Hygiene is a small cap growth stock that could make a potential “Home Run” trade. They have been cleaning house (no pun intended) over there and expect heavy revenue growth next year. According to analysts, supposed to see revenue growth of about 57% next year. For more info about SWSH, click: SWSH Small Cap Growth Stocks

KOG — Kodiak Oil & Gas Corp. is a small energy company (oil) with forecast sales and earnings growth of about 70% next year. The name suggests an interest in Alaska, but much of KOGs efforts are concentrated in places like Wyoming, North Dakota, and Montana states with large amounts of untapped resources. For more on KOG, click: KOG Small Cap Growth Stocks

Best Small Cap Stocks for 2013 Small Cap Value

When choosing small cap value stock for investment, we like to look for companies with strong and stable balance sheets and earnings history. Combining that with good share valuation, we are seeking companies that can earn their way right out of any trouble with broader economic conditions. The small cap value investment strategy has proven to be the strongest over time, though there is no guarantee for future results.

Here are our top 2013 small cap value stock picks:

HMA Health Management Associates is expected to produce over $6.7 billion in sales revenue this year and the forecast is for nearly $7 billion in sales for next year. The current price to sales ratio (at the end of 2012) was only 0.36. Click to see more: HMA Small Cap Value Stocks

BMR — BioMed Realty Trust, Inc. This REIT focuses on renting to the science industry and yields about 4.5%. We like the idea of getting paid a dividend to own a small cap value stock and analysts are bullish on earnings growth. Click: BMR Small Cap Value Stocks

FLWS — 1-800-FLOWERS.COM, Inc. The price to sales ratio of FLWS is only 0.27. Analysts estimate sales growth of 7% next year and earnings growth of 16% per year over the next 5 years. Click: FLWS Small Cap Value Stocks

Please take a moment to quick subscribe to our small cap stock picks blog. We promise not to EVER spam you or try to sell you anything. You can participate in the comments and discussion forums. We will notify you when a new stock hits the blog – just one more tool in your trading arsenal. Subscribing via RSS (Simple News Feed) is also available.