Best Mutual Funds Companies in the Philippines 2013

Post on: 16 Март, 2015 No Comment

Share this on your favorite social media network and receive blessings:

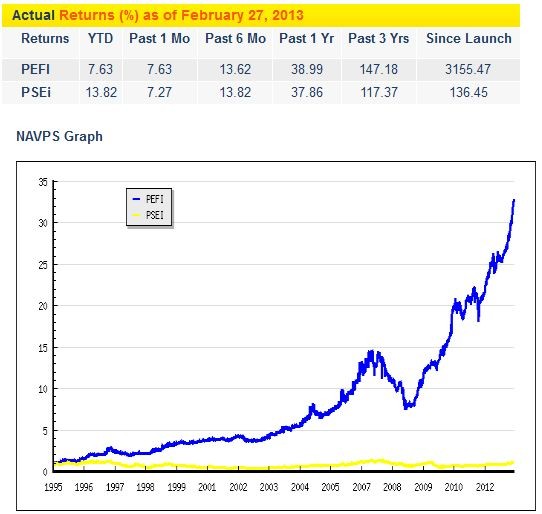

In this page are the best mutual funds to invest with in the Philippines for 2013. I call them as top and best performing equity mutual fund companies in the country, too. Some of these companies also offer UITF or Unit Investment Trust Funds which offer specific features according to the investor’s options and status. I choose Equity Fund from the types of all mutual funds since it gives the most earning potential.

If youre looking for the latest list, go here. Best Mutual Funds in the Philippines 2014.

photo CC BY seniorliving.org

There are lots of mutual funds companies in the Philippines to start investing with but it’s always best to know and choose the top ones and the ones with impressive performance for the past years because they will give higher assurance of successful investing and earning potentials. One of the great tips I won’t forget about stock market and mutual funds is “invest in a well-proven company that’s been here for so many years .” Well, I’ve got more tips and I will share them in this website under the MONEY topics in case you’re curious of more…

What is Mutual Fund?

Mutual Fund has a broad definition but to make it more simple, I’m gonna be straightforward – it is a type of investment wherein you join other investors and corporations to form a massive fund which will be handled by an expert/professional fund manager for diversified portfolios of stocks, bonds, securities, money markets and other mutual funds.

Why Invest in Mutual Funds?

Investing in mutual funds and equity funds are favorable to those who don’t have enough knowledge on stock market and other investments. If you don’t have enough time to monitor and assess your money performance, choose mutual funds. Investing is always risky so we must have enough knowledge and time about what’s happening with the market and the economy. And because money is always unpredictable, let a fund manager do the works for your money and profits .

Mutual Funds earnings are also beneficial to retirement. The money you will invest today could be millions in the future. There are also types of mutual funds that suits low investment every month but high yield and return, too. Choosing short term and long term would still produce earnings, it’s just depends on you, your mutual fund company and the type of fund you chose.