Best Margin Rates

Post on: 15 Май, 2015 No Comment

Using margin can be a powerful tool, if used carefully. Though finding out which stock broker has the lowest margin rate can be time consuming. Weve collected the most popular brokers and list the best margin rates at various deposit amounts.

I personally dont use margin that often, but my taxable accounts are margin based by default. It doesnt cost anything additional to setup a brokerage account on margin. I have my accounts setup up with margin just in case I ever have the need to use it. It can be helpful when youve sold one stock, and dont have enough money to cover a new purchase. Otherwise without margin you are forced to wait until the stock sold is cleared and the money is deposited within your account. This can take a few days for this to occur, and you could lose out on an investment opportunity.

The margin rates listed here are whats publicly listed on the respective brokers web site. In some cases, its possible to get a better rate than what is advertised. So if you are with an existing broker and want a lower margin rate, its best to contact them first before switching. Like credit card terms, it is possible to negotiate a better rate.

Why Use Margin?

Some use margin accounts to borrow money for investments outside of their stock portfolio (ie a downpayment on a house), without having to sell stocks. If planned carefully it can be a wise decision so you dont have to sell your stock and pay tax on the capital gains.

Other investors use it as form of arbitrage like Interactive Brokers mentions in their commercials. You borrow at a lower interest rate than the dividend payout rates. There are many dividend aristoctrats higher than Interactive Brokers margin rates. You pocket the difference between the two.

Is Using Margin Risky?

Leveraging using margin can also backfire on you, if you arent careful. You could be forced into a margin call because the stocks you own have decreased in value and are below your margin limit. So you experience double jeopardy, forcing you to sell stocks at the worst time. So its critical you dont leverage too much, if you use margin.

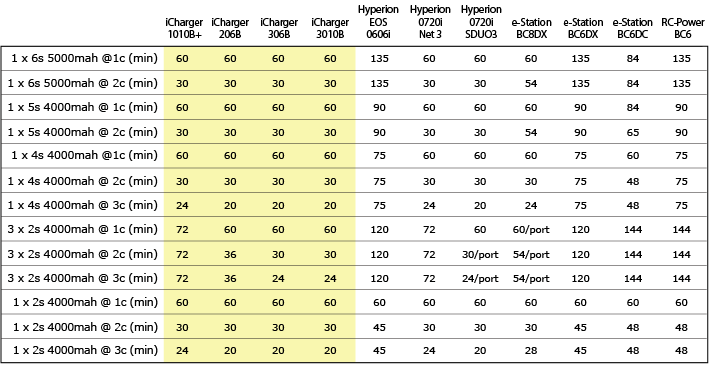

In most cases you are paying for a heavy premium for it. The current Federal Funds Rate is at 0% 0.25% at least until mid 2015, and you would expect margin rates would also be low. If you see the table below, most of the brokers make off very well with the interest they charge. The three exceptions to this are: Interactive Brokers, tradeMONSTER. and OptionsHouse with a big deposit amount. It would be very difficult to profit on margin with TD Ameritrade since many dividend stocks and fixed income earn less than 7.00%.

Though not listed on the table, Interactive Brokers offers margin rates below 1.00% for deposit amounts $2,000,000 or greater. Im assuming this is outside the scope of most investors. If you are ultra high net worth individual, this could be a great way to borrow against your stock assets.

If you do use margin for investing or short term loans, make sure you understand the risks and the costs. Otherwise, it could be a costly investment lesson. Depending upon the broker you choose and the amount invested, it might be better to get a short term loan from another source. Using unsecured debt from credit cards has less risk, or a loan from P2P lenders like Lending Club or Prosper .