Best Insurance Stocks Paying Good Dividends

Post on: 11 Сентябрь, 2015 No Comment

- Page Title:

- Page URL:

This page has been successfully added into your Bookmark.

12 followers

Follow

Insurance companies have been constantly in the news recently and rightly so. They cover a variety of products and gone are the days when it was just about life insurance and general insurance. Now taking the right kind of insurance can cover you against property damages, accidents, health issues, vehicles and the like. The need to be covered is quite high among the citizens today. As long as this need is there, insurance stocks will continue to have a good run. With so many insurance stocks available in the market today, which is the best one in terms of dividend? The following details provide some of the best stocks among property, life insurance and health insurance companies.

Insurance against damages to property

One of the best property and casualty insurance stocks available in the market today is Cincinnati Financial Corp (CINF ). This is not only a great dividend stock, but also a wonderful dividend aristocrat, as it has been paying dividends for the last 60 years now. Out of these, for the last 54 years on the trot, the company has been announcing increase in its dividends as well. The company’s financials are great, with around $8.3billion market capitalisation and just about $900million in debt. It offers a dividend yield of 3.4% and its pay-out ratio is 71%. Currently the quarterly dividend is $0.44 per share and the following is the chart showing the history of dividends paid out by Cincinnati Financial:

Best bet among life insurance stocks

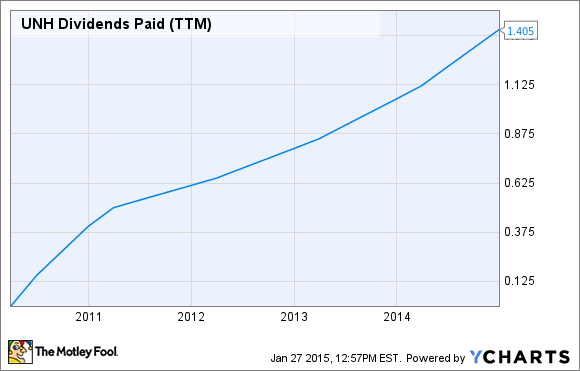

There is no dearth for life insurance stocks in the world today. To choose the best among these and that too in terms of dividend is indeed a huge challenge. However, after considering a lot of factors, one life insurance stock that clearly stands out from its peers is MetLife (MET ). Though it might not have paid dividends for a long period to be considered as a dividend aristocrat, MetLife’s 12 year dividend history is still good enough for the company to figure in this list. Pay-out ratio is one of the most impressive factors of the company. Currently it stands at just 23.8%, which means there is a lot of scope to grow in the future. The annual dividend pay-out is $1.40 at present, with a dividend yield of 2.74%. MetLife has a huge brand name riding on it and hence its dividends are expected to grow quite well in the future. Dividend history for the last few years can be seen from the chart below:

Insurance against accident and health insurance

With a market capitalisation of $27.5billion, Aflac (AFL ) is easily the largest insurance company that provides cover against accidents and health issues. Its stocks went down a bit in the recent past due to exchange rate problems. This is quite natural for a company that has close to 75% revenues coming in from an emerging market like Japan. What works for the company is that it has a dividend yield of 2.6% whereas its competitors offer only around 1.7%. Aflac is also one of the few dividend aristocrats in the insurance sector, as it has raised its dividends for almost 32 years on the trot. The current annual dividend rate per share is $1.56 per share and the pay-out ratio is at an impressive 25.8%. This means the company has a large window for further dividend increases in the future. Dividend history of the company for the last few years is seen below:

Dividends are one of the major benchmarks in measuring the success of a particular company. However there are lots of factors to watch out for like history of dividends, dividend yield in the light of earnings, pay-out ratio, scope for future improvement and the like. While considering all these factors the above insurance stocks prove to be great dividend payers and provide ultimate value to investors.