Best Fidelity Asset Allocation Mutual Funds 2014

Post on: 16 Март, 2015 No Comment

2014 list of best Fidelity U.S. stocks mutual funds with top ratings. Highest performing, recommended funds for IRA/brokerage account investors in the last 10 years: FFFHX, FFNOX, FIXRX, FGBLX, FDYSX

Best Fidelity Asset Allocation Funds

Fidelity asset allocation funds combine multiple asset classes in a single portfolio, making them a simple and disciplined way to diversify your investments.

Reasons to invest: A portfolio that offers exposure to a mix of different types of assets can help reduce the impact of market volatility, provide a source of income, and offer the potential for capital appreciation.

What to keep in mind:

- Asset class diversification;

- Disciplined, ongoing asset allocation;

- Managed to help meet your needs for income and growth potential.

Fidelity Freedom 2050 Fund (FFFHX)

Objective

Seeks high total return until its target retirement date. Thereafter, the fund’s objective will be to seek high current income and, as a secondary objective, capital appreciation.

Strategy

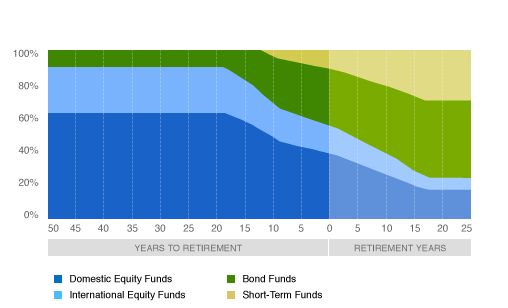

Investing in a combination of underlying Fidelity domestic equity, international equity, bond, and short-term funds using a moderate asset allocation strategy designed for investors expecting to retire around the year 2050. Allocating assets among underlying Fidelity funds according to an asset allocation strategy that becomes increasingly conservative until it reaches approximately 15% in domestic equity funds, 5% in international equity funds, 40% in bond funds, and 40% in short-term funds (approximately 10 to 15 years after the year 2050). Ultimately, the fund will merge with Fidelity Freedom Income Fund.

Performance

The fund has returned 17.96% over the past year, 11.86% over the past three years, and 4.62% over the past five years.

Purchase info: minimum initial investment is $2,500; an expense ratio is 0.81%.

Fidelity Four-in-One Index Fund (FFNOX)

Objective

Seeks high total return.

Strategy

Investing in a combination of four Fidelity stock and bond index funds (underlying Fidelity funds) using an asset allocation strategy designed for investors seeking a broadly diversified, index-based investment.

Performance

The fund has returned 21.42% over the past year, 13.47% over the past three years, 6.60% over the past five years, and 7.50% over the past decade.

Purchase info: minimum initial investment is $2,500; an expense ratio is 0.24%.

Fidelity Income Replacement 2042 Fund (FIXRX)

Objective

The fund seeks total return through a combination of current income and capital growth. The fund’s investment objective is intended to support the Smart Payment Program’s payment strategy.

Strategy

Investing in a combination of underlying Fidelity equity, fixed-income, and short-term funds using an asset allocation strategy designed to achieve a level of total return consistent with a payment strategy to be administered through the fund’s horizon date, December 31, 2042. Allocating assets among underlying Fidelity funds according to an asset allocation strategy that begins with a relatively more aggressive asset allocation and gradually shifts to a relatively more conservative asset allocation over the fund’s time horizon.

The fund has returned 16.57% over the past year, 11.33% over the past three years, and 6.78% over the past five years.

Purchase info: minimum initial investment is $25,000; an expense ratio is 0.68%.

Fidelity Global Balanced Fund (FGBLX)

Objective

Seeks income and capital growth consistent with reasonable risk.

Strategy

Investing in equity and debt securities, including lower-quality debt securities, issued anywhere in the world. Investing at least 25% of total assets in fixed-income senior securities (including debt securities and preferred stock).

Purchase info: minimum initial investment is $2,500; an expense ratio is 1.04%.

Fidelity Global Strategies Fund (FDYSX)

Objective

Seeks to maximize total return.

Strategy

Allocate the funds’ assets between stocks and bonds of all types, as well as non-traditional asset classes such as commodity-related investments, based anywhere in the world by investing in Fidelity funds (underlying Fidelity funds) and unaffiliated exchange traded funds (ETFs), or through direct investments. Utilize a combination of economic research, technical analysis, quantitative analysis and fundamental research to arrive at allocation decisions. Adjust allocations among asset classes to take advantage of short-term market opportunities and strategic, longer-term opportunities.